Digital banking

Deliver frictionless, personalized banking at scale

Unlock your bank’s growth potential by harnessing the power of a composable banking architecture. Leverage out-of-the-box capabilities or customize to meet customer needs. Deliver seamless, tailored experiences across all your digital channels to boost loyalty, drive cross-sell, and optimize efficiency — all while meeting the unique demands of every segment.

Struggling to deliver frictionless banking experience to your customers?

Customers across all walks of life expect a frictionless, tailored banking experience at every touchpoint. And yet, many banks face challenges with fragmented systems, outdated technologies, and siloed processes, making it difficult to meet evolving customer demands while driving efficiency and growth.

42%

of customers find it hard to distinguish between banks

58%

of customers say their bank offers poor product advice

≈70%

of digitally acquired customers don’t activate their accounts

Harness the power of a unified platform

Rapid deployment

Unlimited flexibility

Effortless integrations

Core-agnostic flexibility

Future-proof scalability

Always innovating

One platform for all your lines of businesses

Unlock seamless, personalized experiences across all customer segments

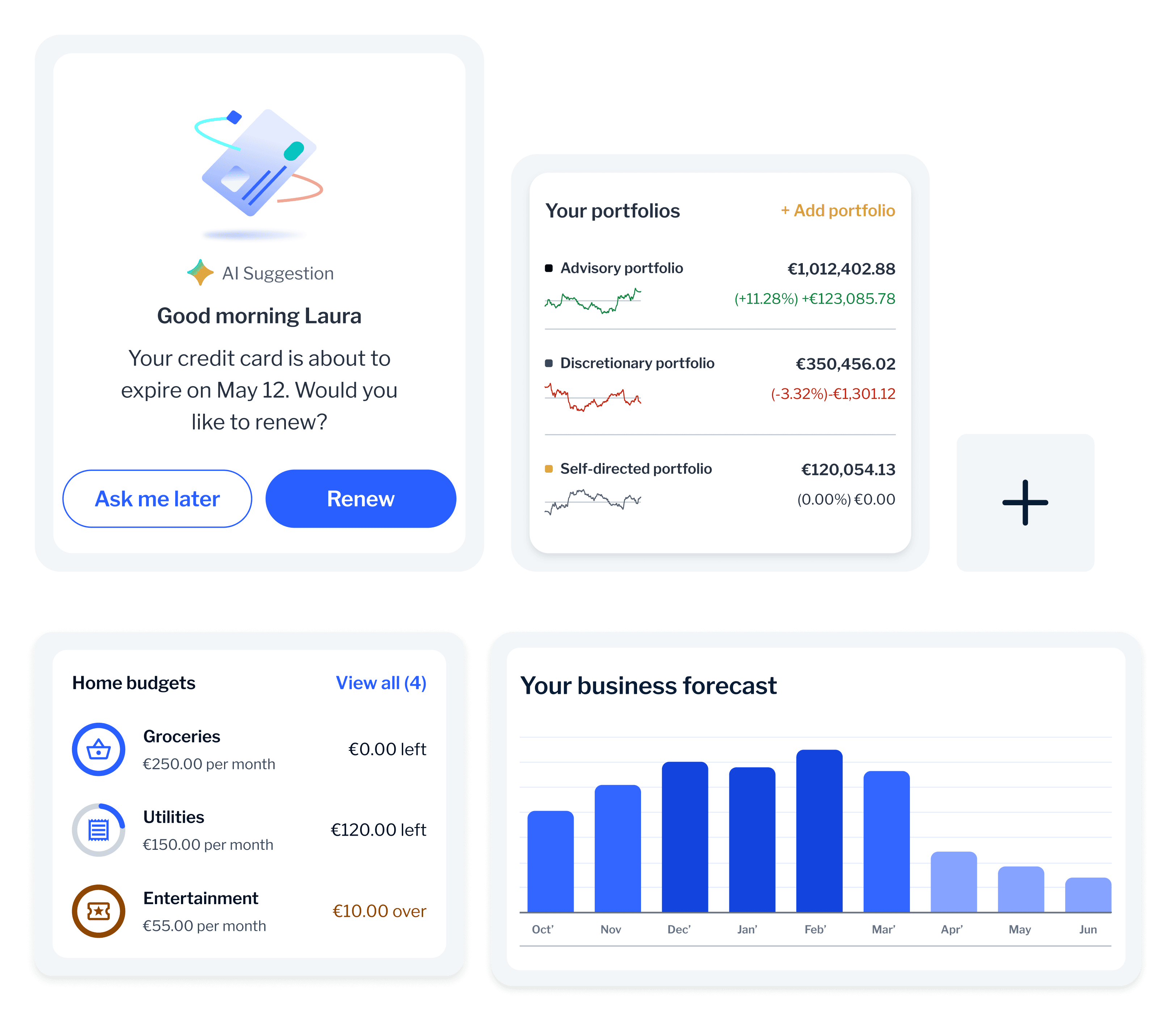

Retail banking

Deliver adaptive, segment-based applications that drive customer loyalty with AI-enabled advice and intuitive self-service options.

Small business banking

Become the one-stop-shop for small businesses with easy to use financial tools, seamless transactions, and personalized support to fuel their growth.

Private banking

Cater to your high-net-worth clients’ every need with white-glove private banking services across all touchpoints.

Wealth management

Deepen customer relationships with affluent, high-net-worth and ultra-high-net-worth clients while streamlining operations to scale effectively.