Product activation & expansion

Backbase

Turn new customers into active users — and active users into high-value relationships. Deliver AI-powered insights and next-best actions across customer and employee applications to drive activation, boost usage, and increase product holdings.

Are you leaving opportunities for growth on the table?

Financial institutions invest heavily in onboarding and acquisition, but sustaining engagement and driving cross- and upsell beyond day one remains a challenge. Limited staff capacity, coupled with fragmented technology and data, makes it difficult to support and capitalize on every activation, upsell, or retention moment — leaving valuable opportunities on the table.

72%

of customers say personalization influences their choice of bank

Heading

70%

of digitally acquired customers don’t activate their accounts

Heading

90 days

nearly half of all new accounts do not survive beyond the first three months

Heading

Drive growth at every stage of your customer lifecycle

Leverage the power of AI to activate, retain and expand customer relationships — at scale

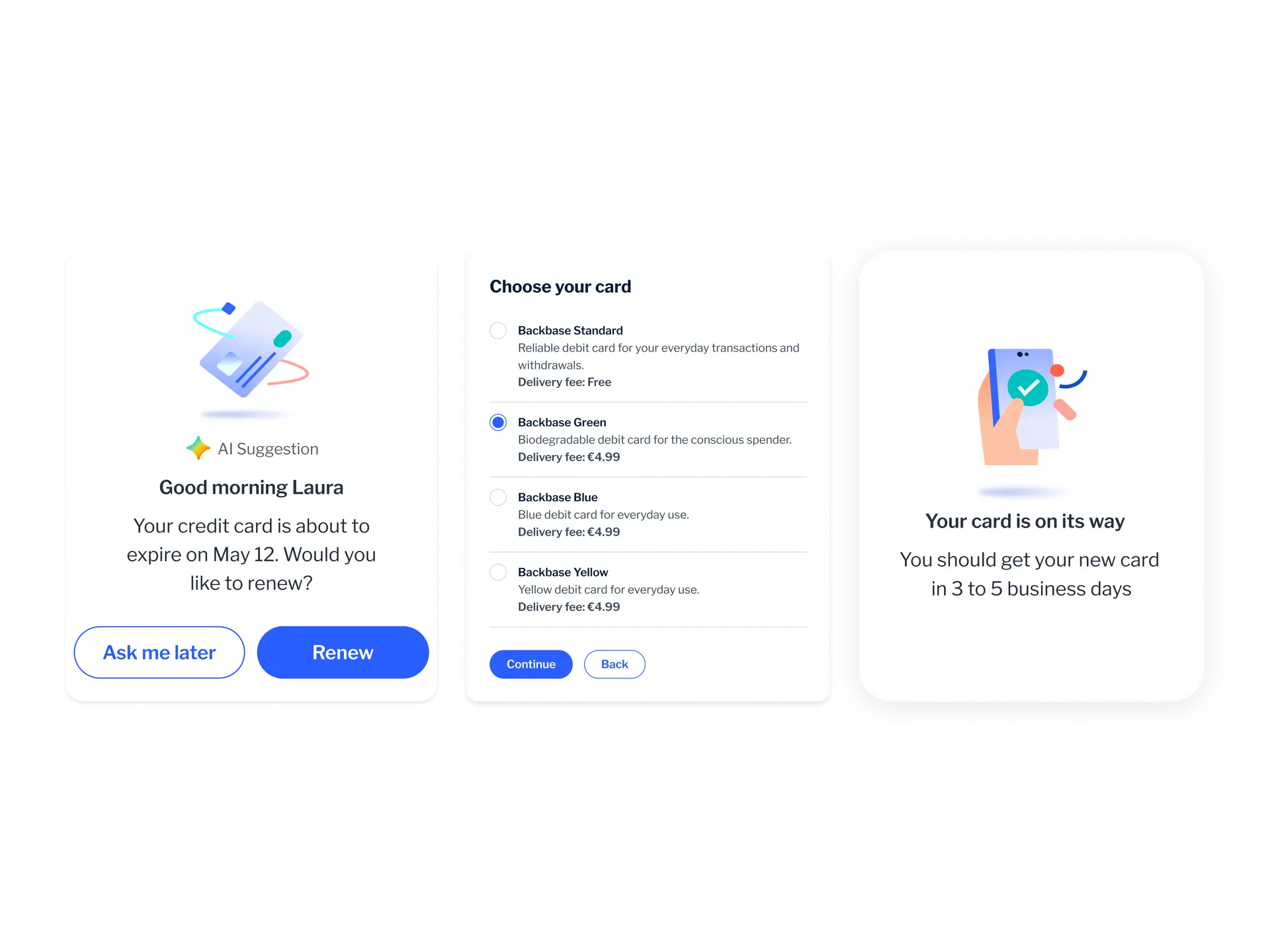

Drive product activation

Subline

Proactively guide new and existing customers to explore and use the products that best match their needs. Launch personalized, time-bound campaigns — like 90-day activation plans — powered by AI and tailored by behavior, segment, and lifecycle stage.

Boost ongoing usage and engagement

Subline

Use AI-powered nudges to encourage customers to regularly engage with your bank’s products and services — like making payments, managing cash flow, or tracking investments. Deliver personalized prompts across digital and employee channels to keep clients active and engaged.

Boost ongoing usage and engagement

Subline

Use AI-powered nudges to encourage customers to regularly engage with your bank’s products and services — like making payments, managing cash flow, or tracking investments. Deliver personalized prompts across digital and employee channels to keep clients active and engaged.

Drive intelligent cross- and upsell

Subline

Build tailored onboarding experiences using a modular library of journeys, workflows and banking capabilities. Customize by product, channel, or segment and reuse what works to scale faster.

Measure impact and optimize in real time

Subline

Track activation rates, product usage, and campaign performance with real-time dashboards. Spot drop-off points, identify gaps in journeys, and adjust in-flight campaigns to increase ROI. Get continuous insights into customer behavior so you can refine strategies on the fly, reduce attrition, and keep customers engaged for the long haul.

Measure impact and optimize in real time

Subline

Track activation rates, product usage, and campaign performance with real-time dashboards. Spot drop-off points, identify gaps in journeys, and adjust in-flight campaigns to increase ROI. Get continuous insights into customer behavior so you can refine strategies on the fly, reduce attrition, and keep customers engaged for the long haul.

Designed to drive growth across all lines of business

Retail banking

Guide new customers through key milestones — like activating a virtual card, setting up bill pay, or making their first digital payment — in their first 30 days. Boost app adoption and feature usage with targeted in-app prompts, and real-time recommendations based on spending habits and financial behavior.

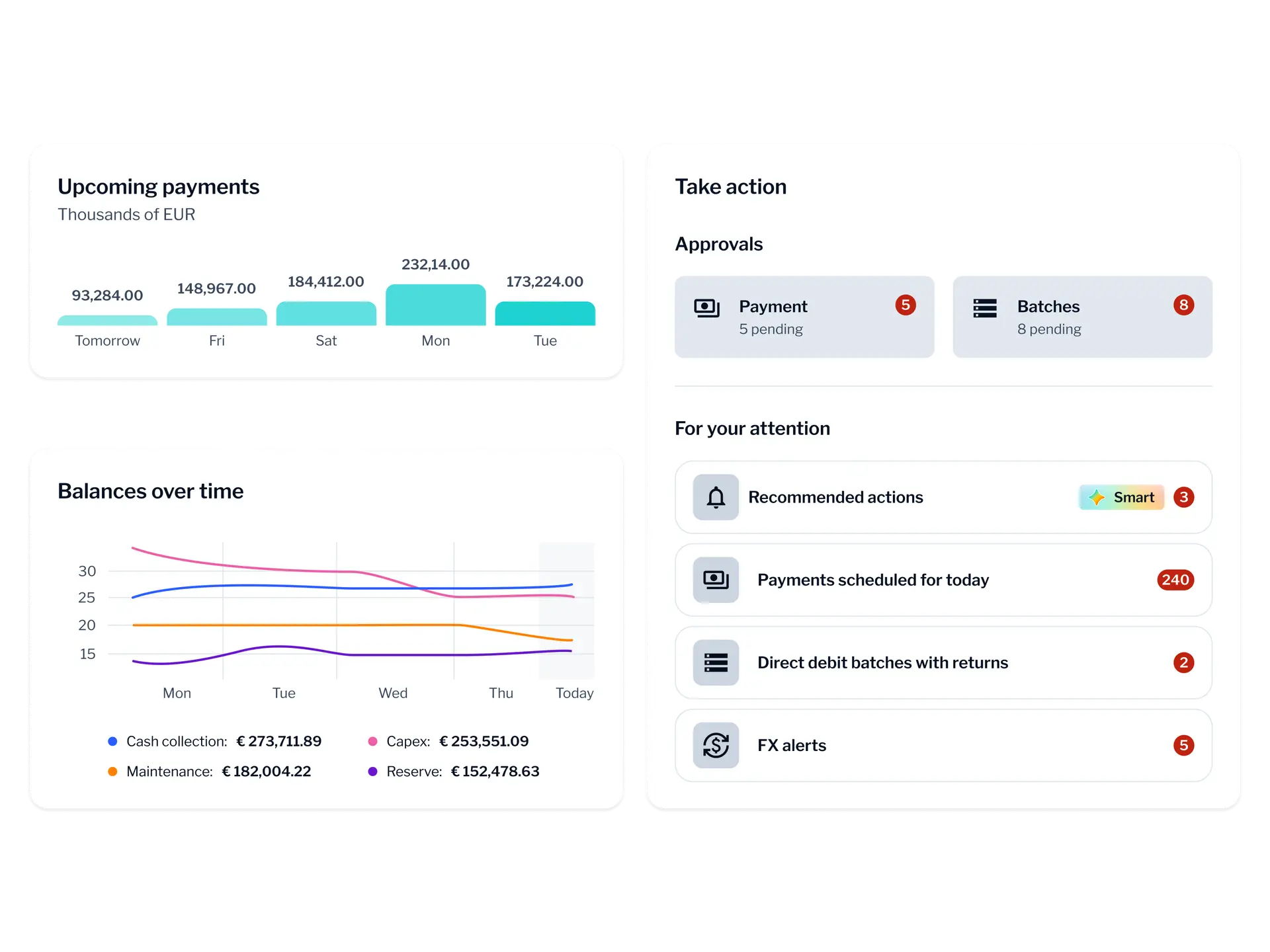

Small business banking

Support small business clients setting up their account, linking invoicing tools, or making their first supplier payment. Recommend relevant products and services based on transaction data and business growth signals — like suggesting a working capital loan in response to seasonal cash flow gaps. Equip RMs with AI-powered insights to spot relevant cross-sell opportunities and deliver proactive advice at scale.

Commercial banking

Drive cross- and upsell of high-margin services by leveraging AI to predict which clients are ready for fee-based offerings like treasury management and payments. Surface contextual prompts — like recommending cash management tools to a business with an active commercial loan. Equip RMs with AI-powered signals to identify cross-sell opportunities, flag clients at risk, and take next best actions easily.

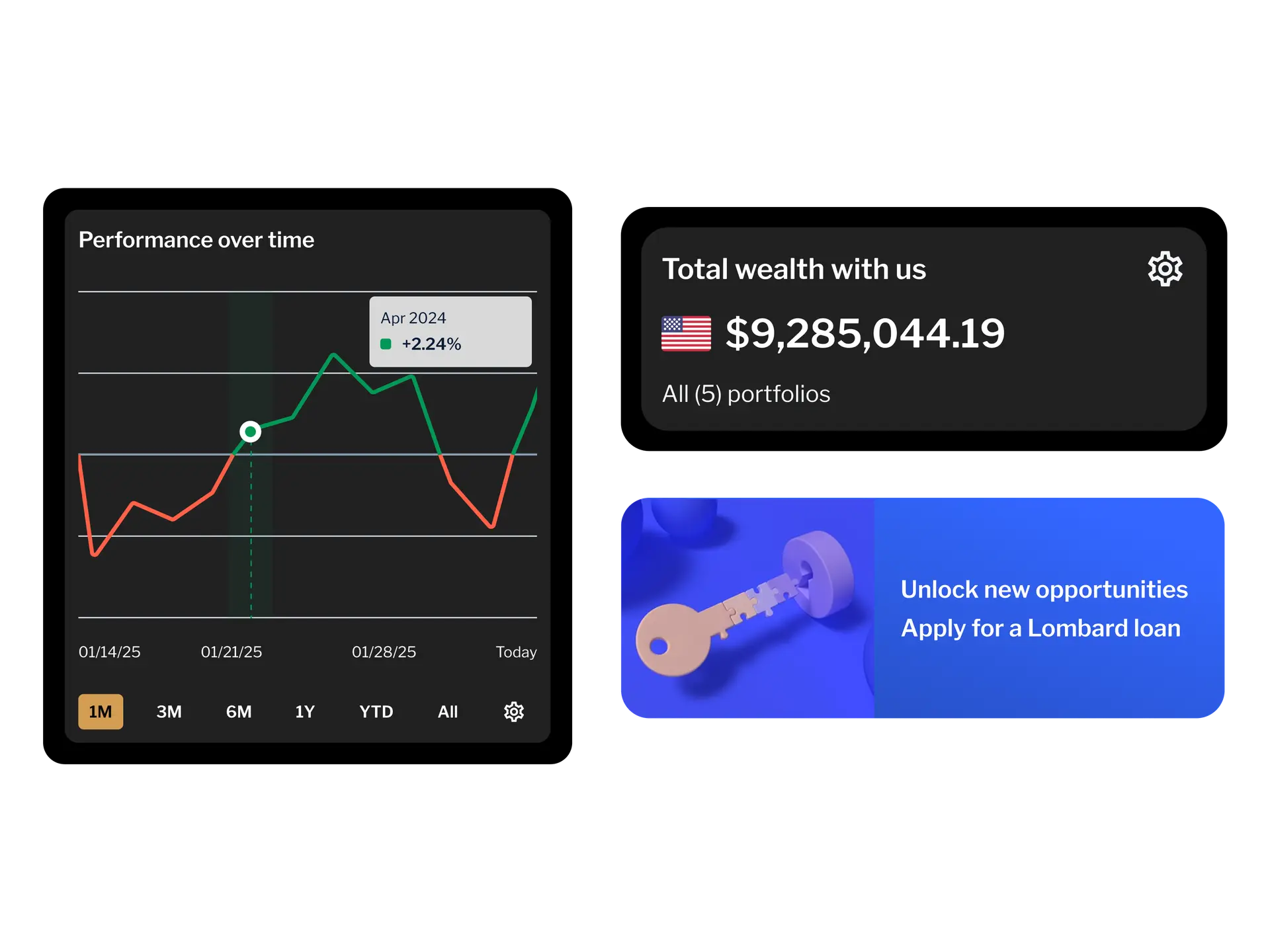

Private banking

Equip relationship managers with AI-powered insights to anticipate needs and deliver tailored advice. Flag clients at risk of disengagement and trigger proposal journeys, such as a curated portfolio review after a period of inactivity. With timely prompts across RM dashboards and digital channels, you can deepen trust, grow share of wallet, and deliver white-glove service across all channels.

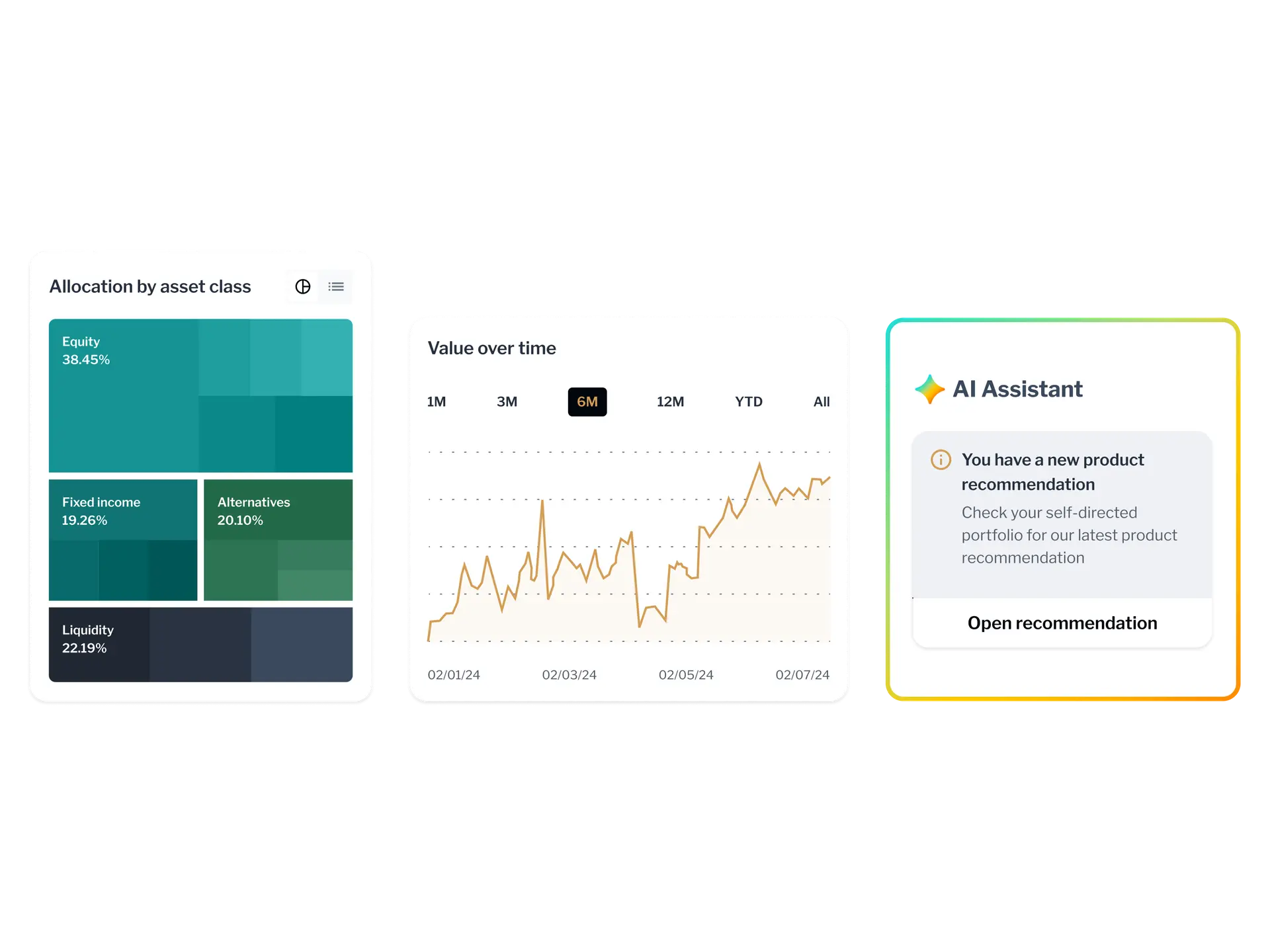

Wealth management

Guide and engage investors at every stage of their journey. Deliver personalized insights through mobile and web channels, nudging clients to explore new investment opportunities, initiate portfolio reviews or act on wealth planning milestones. Empower advisors with tools to help them generate tailored proposals faster, next-best action prompts, and real-time portfolio health indicators.

How does it work?

One platform

Subline

Our unified architecture eliminates your point solutions and allows you to power channel-agnostic journey orchestration.

Composable banking

Subline

Modular, industrialized platform capabilities that coexist alongside your other technologies, vendors and standards.

Buy plus build

Subline

Use our hybrid operating model for speed, flexibility, and customizability, all with minimized risk and cost.

Plug-and-play integrations

Subline

Our library of API-driven, fintech-powered capabilities gives you the ability to add cutting-edge experiences to your apps, easily and efficiently.

Customer-centricity

Subline

Leverage your customer data to deliver personalized digital banking experiences, at scale.

Employee productivity

Subline

Empower your front-office and development teams to drive faster, more effective customer support.

See it in action

Backbase

Ready to transform your bank? Discover how Backbase empowers you to modernize faster, deliver seamless customer journeys, and drive lasting value.

Backbase