Customer due diligence

Backbase

Turn a regulatory necessity into a strategic advantage. Backbase helps you embed intelligent, AI-powered KYC, KYB and AML journeys across the entire customer lifecycle—accelerating onboarding, minimizing fraud, and ensuring continuous compliance at scale.

Staying compliant shouldn't slow you down

Banks sit on vast amounts of data, yet still rely on manual KYC and AML processes that are slow, costly, and error-prone. With Backbase, you can operationalize AI to automate due diligence across onboarding and risk workflows. By combining real-time data with predictive and generative AI, you reduce fraud, accelerate compliance, and improve decisions - without adding complexity.

$26bn

in global fines due to KYC/AML non-compliance in the past decade

Heading

52%

of institutions take 2+ months to complete a single KYC review

Heading

Up to 3000$

Spent by banks for every KYC review

Heading

Automate due diligence with AI

Navigate risk and compliance landscapes with our AI-driven identity and fraud prevention solutions, ensuring accuracy and agility in every decision Implement real-time data orchestration with AI-powered decisioning to help you streamline KYC/AML processes while preventing fraud and reducing costs.

Always-on KYC

Subline

Move from periodic reviews to continuous, AI-driven monitoring and customer risk scoring.

Frictionless identity verification

Subline

Implement out-of-the-box integrations with leading fintechs to validate documents, detect anomalies, and automate ID checks instantly.

Real-time decisioning

Subline

Reduce false positives and accelerate time-to-yes using machine learning-based decision engines.

Built-in compliance controls

Subline

Ensure every decision is traceable, explainable, and audit-ready. Apply policy rules, monitor model behavior, and maintain full regulatory oversight - by design.

Smarter journeys. Stronger defenses. Happier customers.

Backbase combines AI, orchestration, and secure data foundations to transform customer due diligence from onboarding to ongoing monitoring. Whether it’s screening, verification, or re-KYC — we automate the complex and elevate the experience.

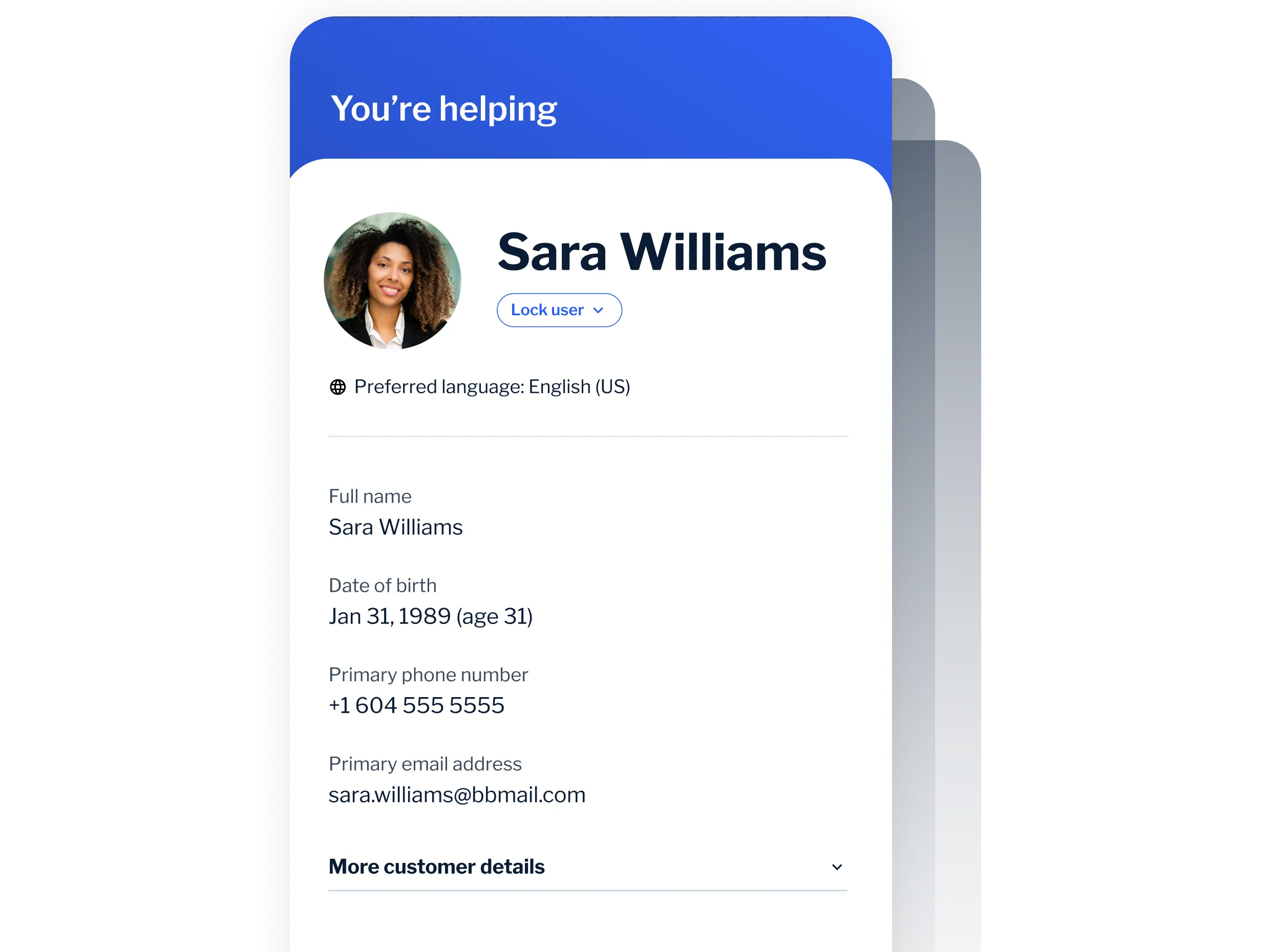

Continuous due diligence across the lifecycle

Integrate behavioral, transactional, and third-party data to create full customer risk profiles. Backbase combines AI, orchestration and secure data foundations to continuously update KYC status, flag anomalies, and prioritize alerts — helping compliance teams focus on what matters most.

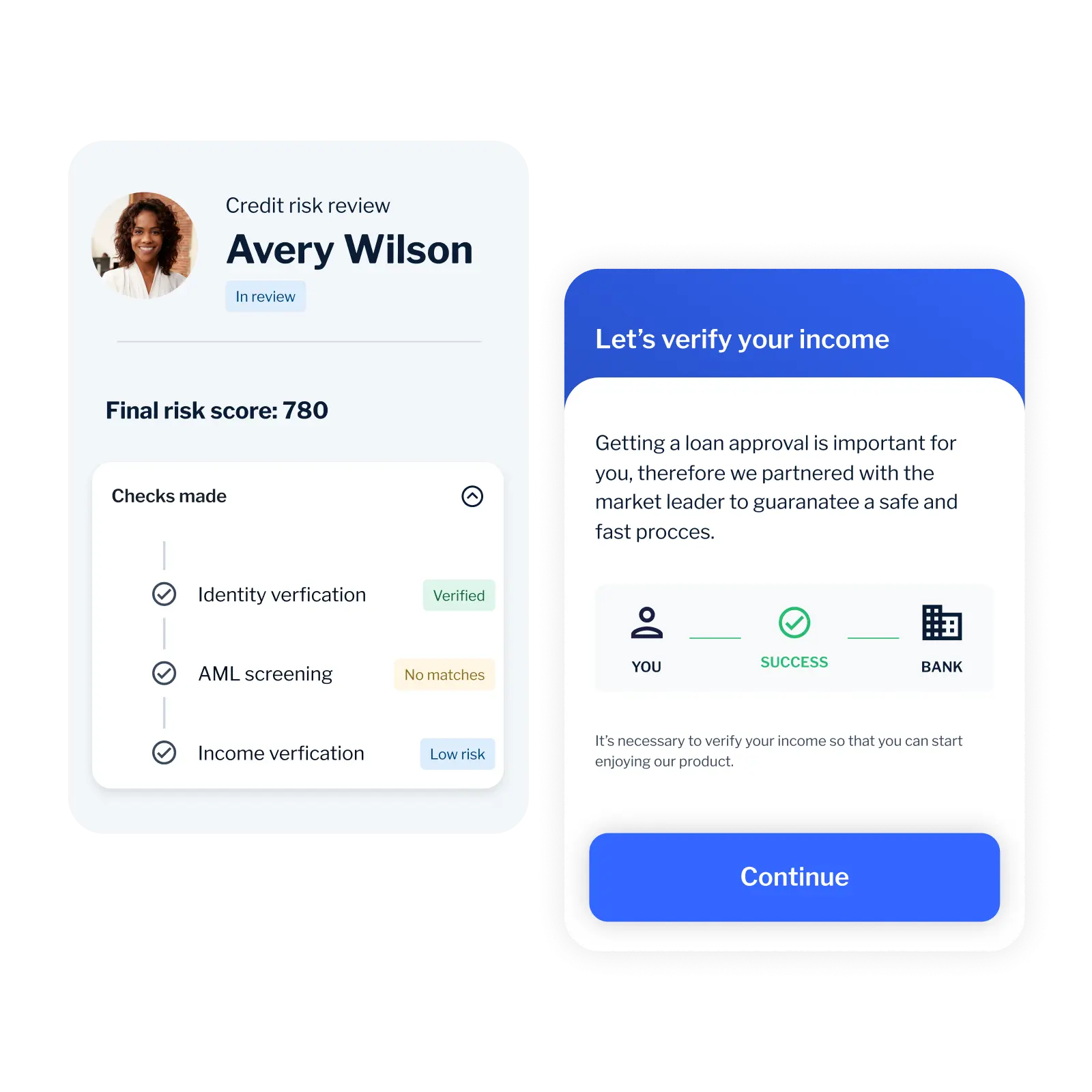

Streamline your operations and empower informed decision-making

Automate core due diligence tasks - like identity checks, risk scoring, and document validation - to reduce manual workloads and speed up reviews. With AI-powered decisioning and real-time data orchestration, your teams can act faster, escalate fewer cases, and focus on the exceptions that matter most.

Trust and transparency by design

Maintain robust compliance posture with Microsoft Purview-powered data anonymization, built-in PII protections, and fully configurable screening rules and workflows.

AI-powered risk & compliance

Move from reactive responses to proactive defense. Leverage AI to detect threats in real-time, assess risk more accurately, and automate decisions across KYC, AML, and fraud prevention workflows, while meeting all necessary regulations.

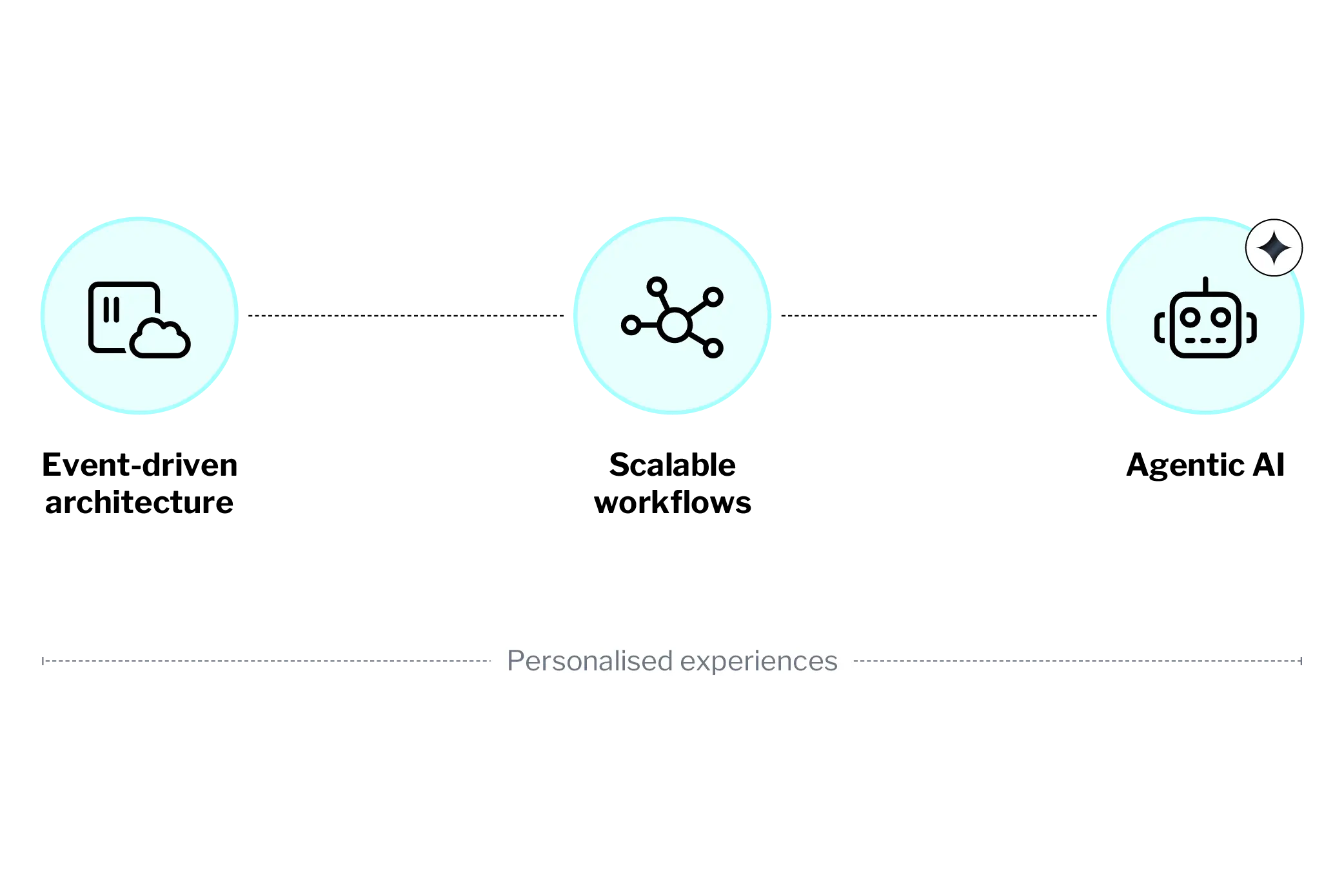

Powered by next generation technology

Orchestrate real-time compliance journeys using an event-driven architecture. Launch easy, scalable workflows, automate complex KYC and AML tasks, and react instantly to customer behavior. Agentic AI powers decisioning and personalization — so your team works faster and your compliance stays one step ahead.

How does it work?

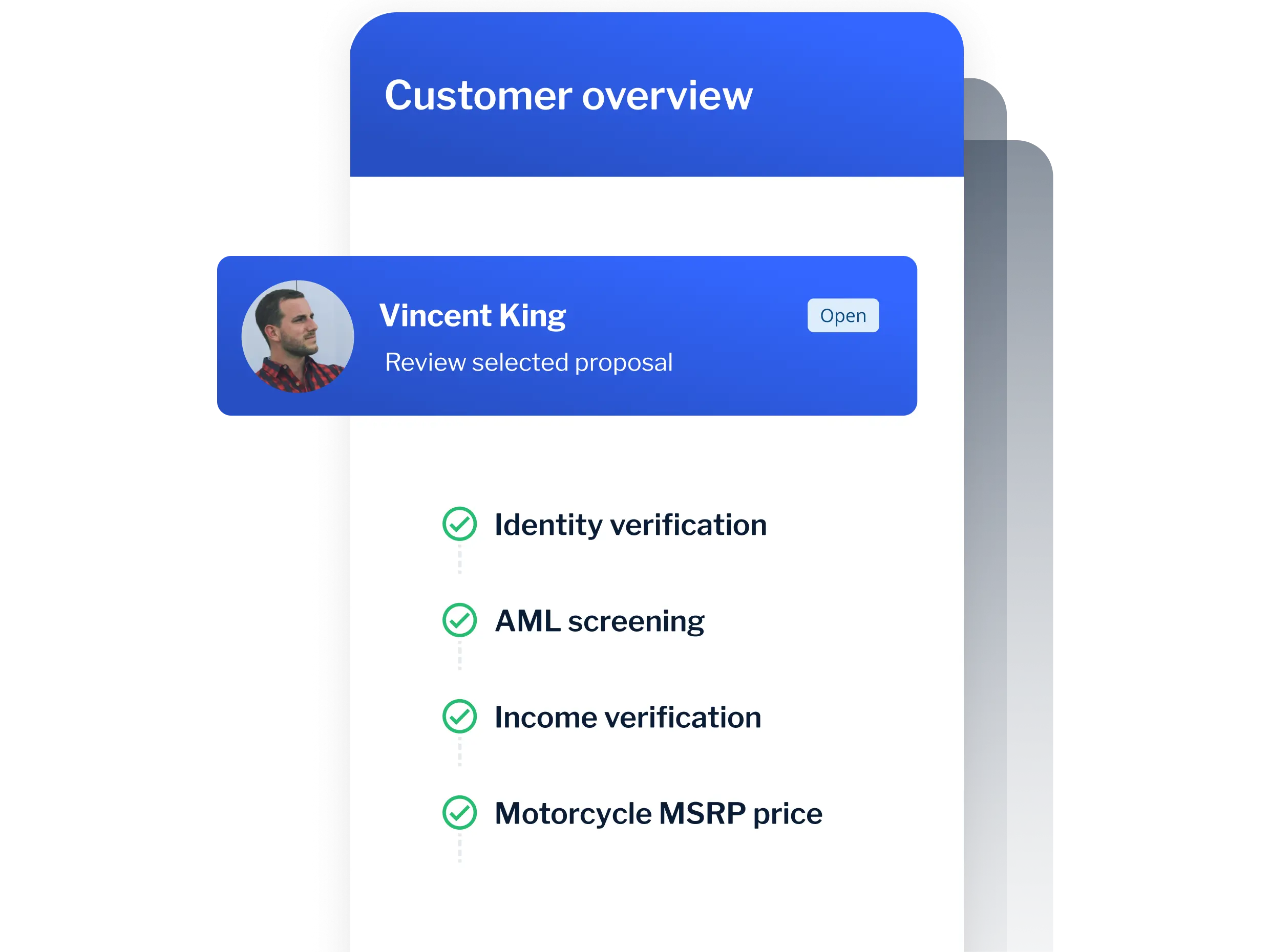

Customer onboarding with AML/KYC

Subline

Streamline new account opening while running real-time fraud, ID&V, and AML checks.

Continuous KYC & AML monitoring

Subline

Ensure your bank adapts to ever-evolving risk indicators.

Enhanced due diligence

Subline

Leverage AI to expose adverse media, summarize risk factors, and support case decisioning.

Investigations & reporting

Subline

Centralize compliance cases, alerts, and decision logs — ensuring audit-readiness at all times.

AI-driven precision in fraud risk and AML compliance

Backbase

Discover how Backbase can help your bank accelerate KYC/AML compliance while elevating customer experience and lowering your cost to operate.

Backbase