The Intelligence Fabric is here

Backbase

Unlocking the full potential of Agentic AI for transformative productivity gains

Our newest release empowers your bank to harness the power of AI and unified data, driving substantial productivity gains across your most vital customer service, sales, and operational workflows.

AI-driven customer engagement orchestration

With the Intelligence Fabric, your bank can seamlessly create AI Agents that augment and orchestrate every customer journey. These agents work hand-in-hand with your existing workflows, integrations, and real-time data. By unifying enterprise-wide data, tools, and processes on the Engagement Banking Platform, they interpret contextual information to deliver personalized, timely responses — empowering you to elevate customer engagement at every touchpoint.

~33%

potential boost in operational efficiency and productivity can be realized when adopting AI

Heading

+600

basis points (BPS) in revenue can be achieved by pairing AI with customer-facing banking staff

Heading

53%

of banks are not fully prepared to adapt to the accelerating rate of AI

Heading

What can you build with the Backbase Intelligence Fabric?

Redefine how your bank drives growth with intelligent systems that enhance efficiency, elevate risk management, and orchestrate contextual, personalized customer experiences — all at scale.

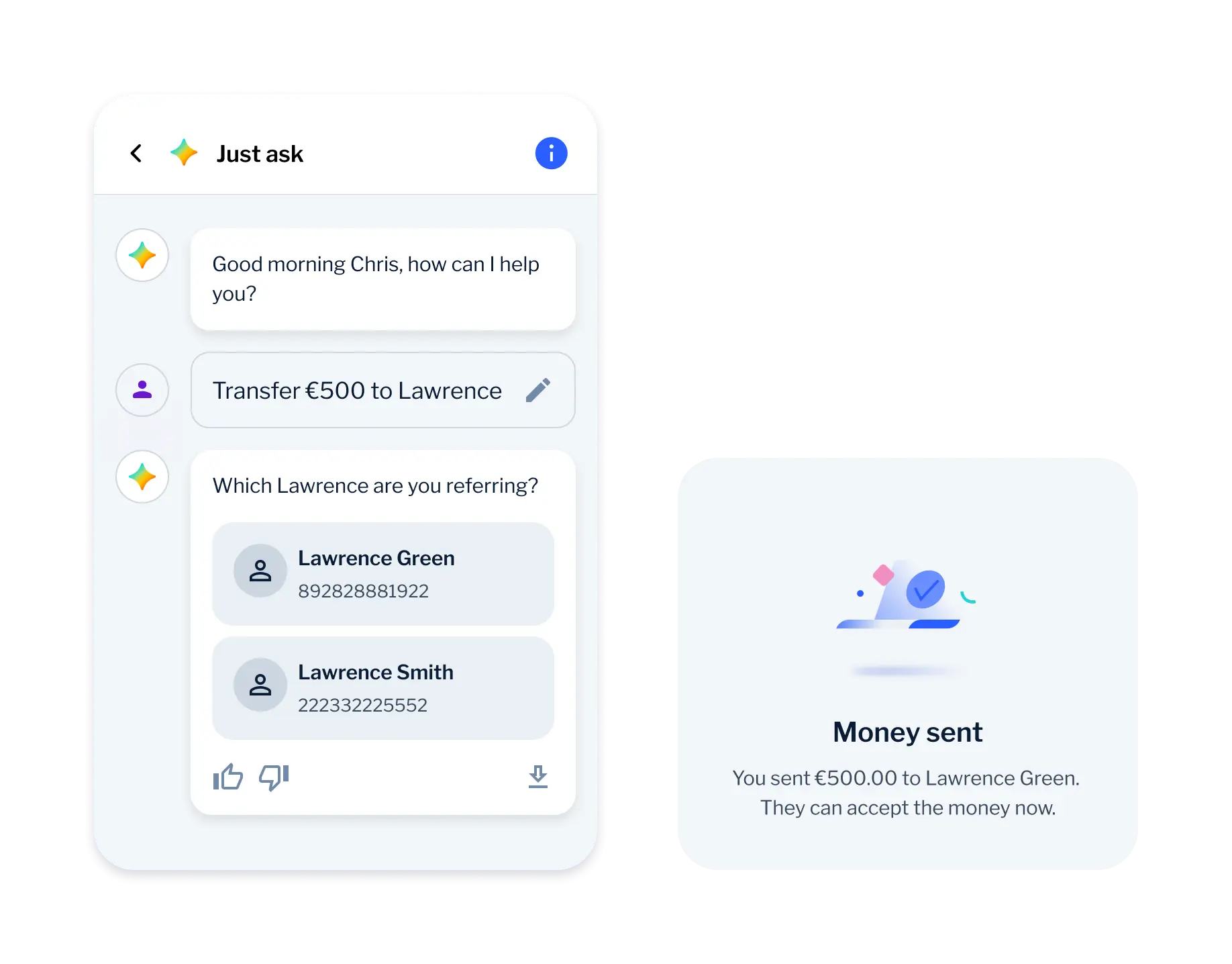

Conversational banking

Allow your customers to leverage large language models (LLMs) to handle daily banking tasks, including accessing accounts, making payments, checking transaction histories, and managing cards across digital channels.

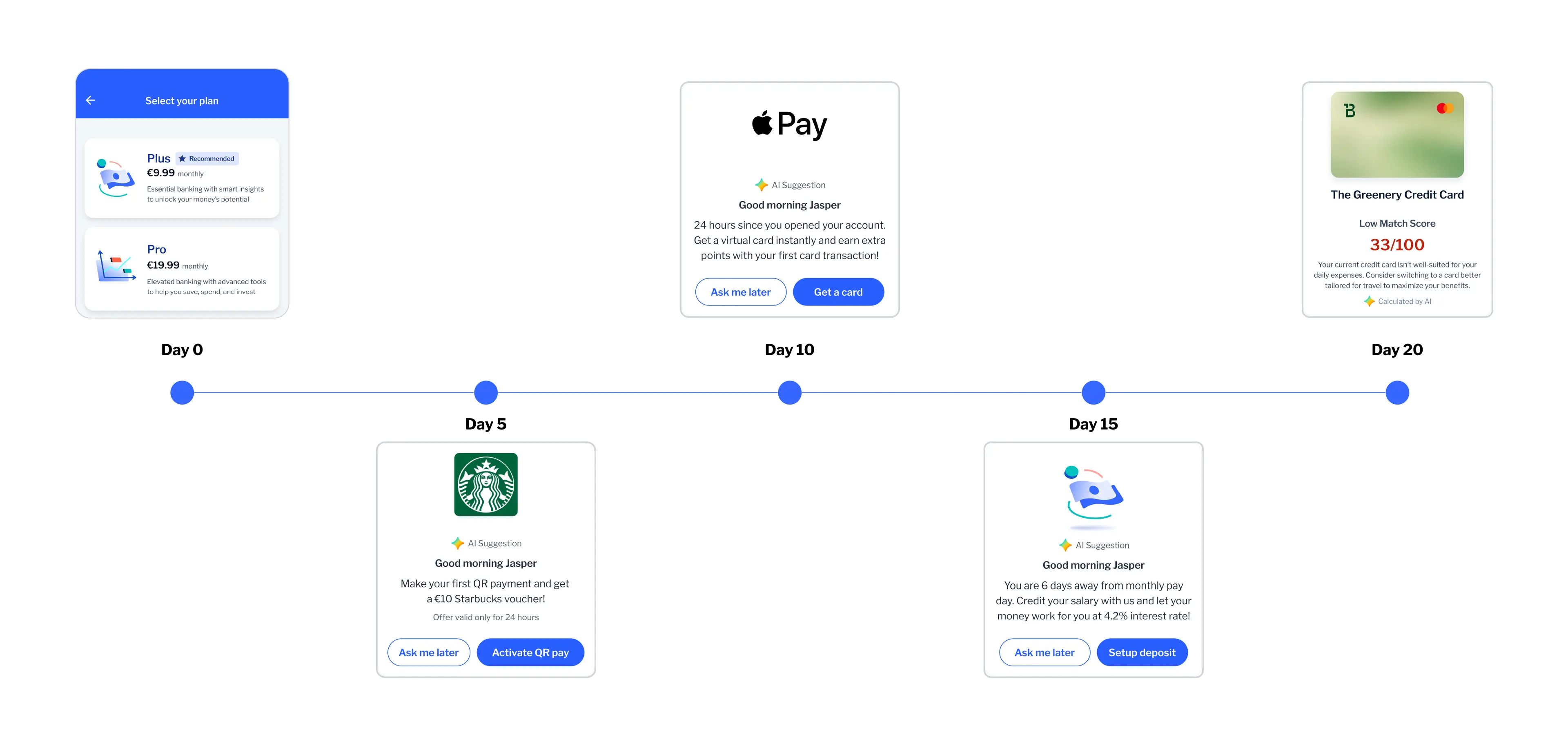

Customer Lifetime Orchestration

Create AI-driven product activation and up-sell campaigns across a timeline that will enable your bank to increase product holding per new-to-bank and existing customer. Predictive nudges provide contextual guidance to customers, promoting relevant new products such as credit cards, loans, savings, investments, and insurance, all based on behavior and financial history.

Advanced financial insights

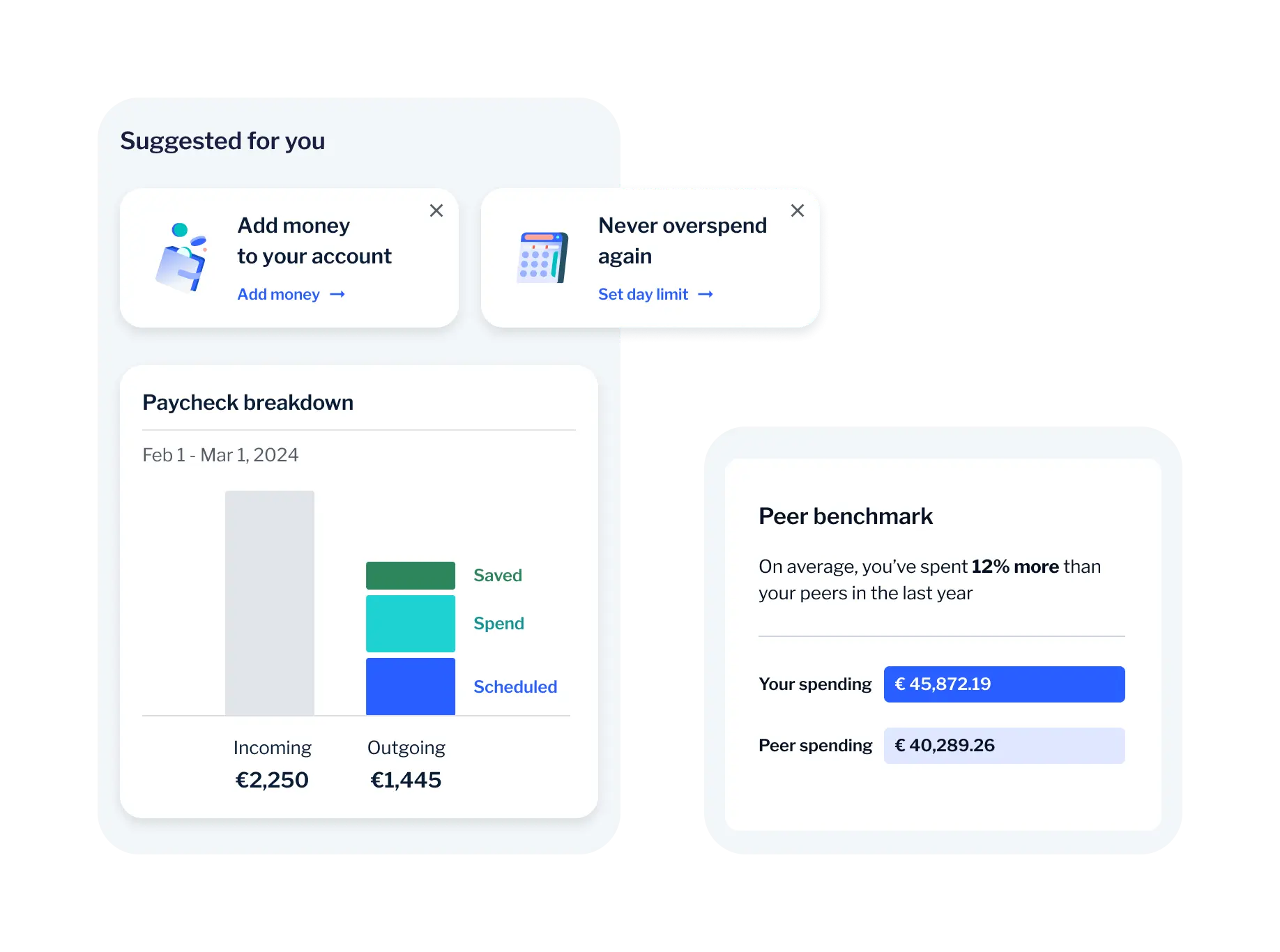

Analyze customer data and behavior to provide actionable insights, like early warning indicators and peer benchmarking for retail customers, cash-flow forecasting for small and medium businesses (SMBs), and customer health and viability information for relationship managers.

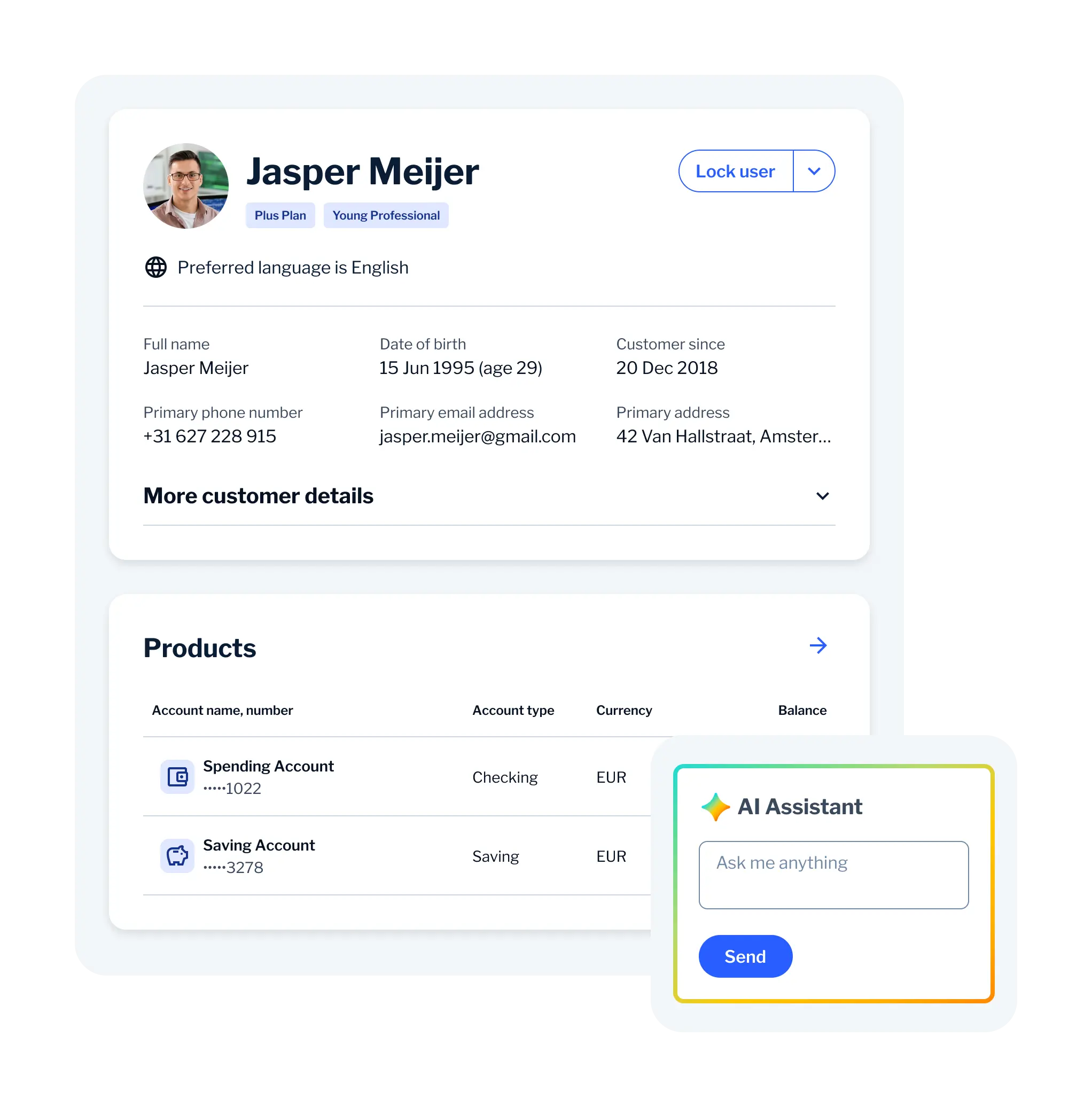

AI-augmented customer support

Deploy cutting-edge generative AI models to power customer-facing chatbots that provide safe, accurate, instant responses, drastically reducing support ticket volume. Meanwhile, your support teams will be able to leverage these AI capabilities to analyze customer sentiment, summarize issues, and suggest reply options, equipping them with the insights they need to create personalized, effective responses and enhance the overall service experience.