Business process orchestration

Backbase

One platform to orchestrate both your customer interactions and the underlying business processes.

Unlock business agility

Backbase gives you the architectural blueprint and enterprise-grade capabilities to build and orchestrate simple to highly complex customer interactions and business processes, including decisioning, document storage, and case management.

Process & workflow automation

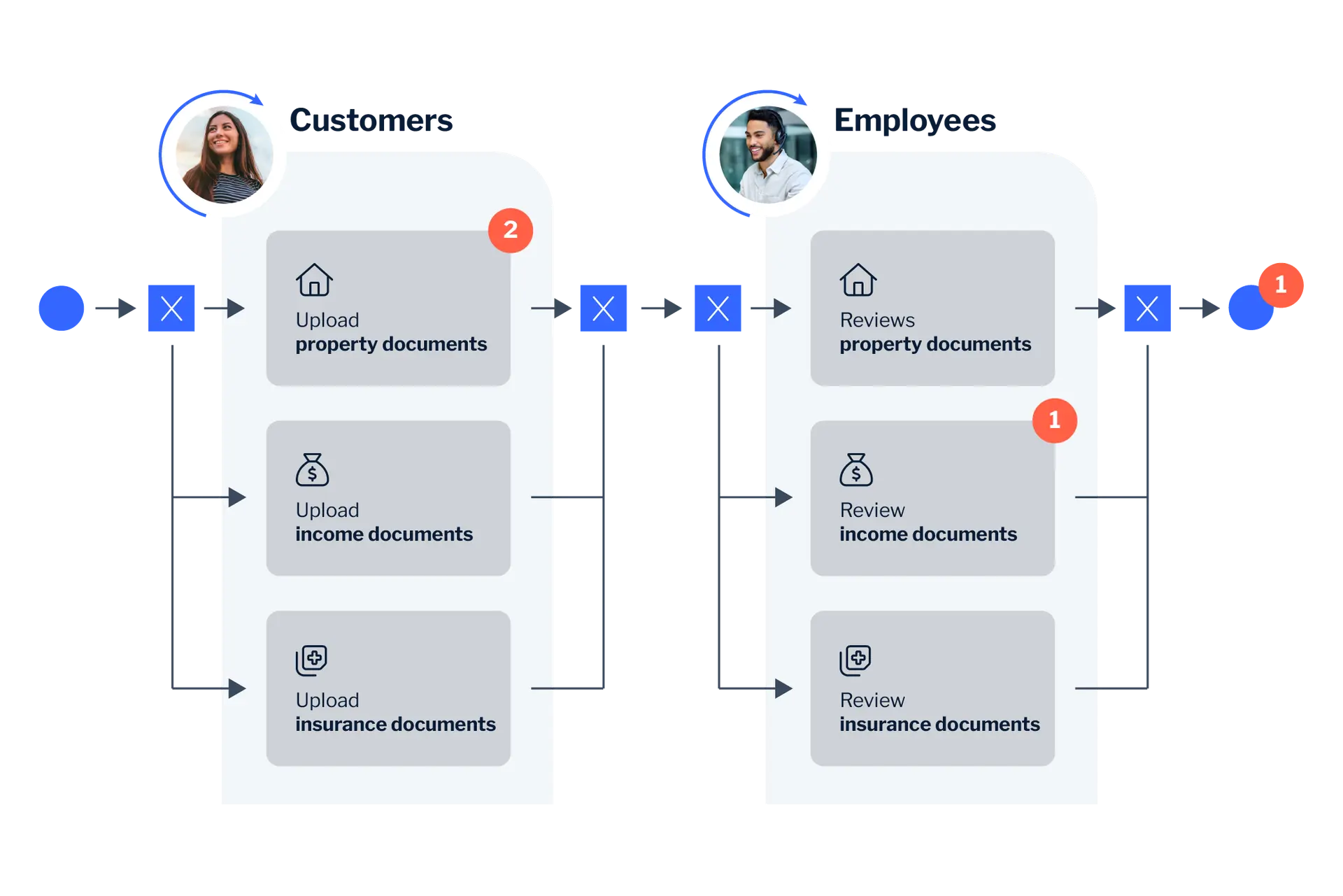

From straight-through processing (STP) to full automation, our Process Engine allows you to completely transform any process into a full-fledged digital alternative. Orchestrate complex workflows between your customers and bank employees on a single unified platform.

AI-powered decisioning

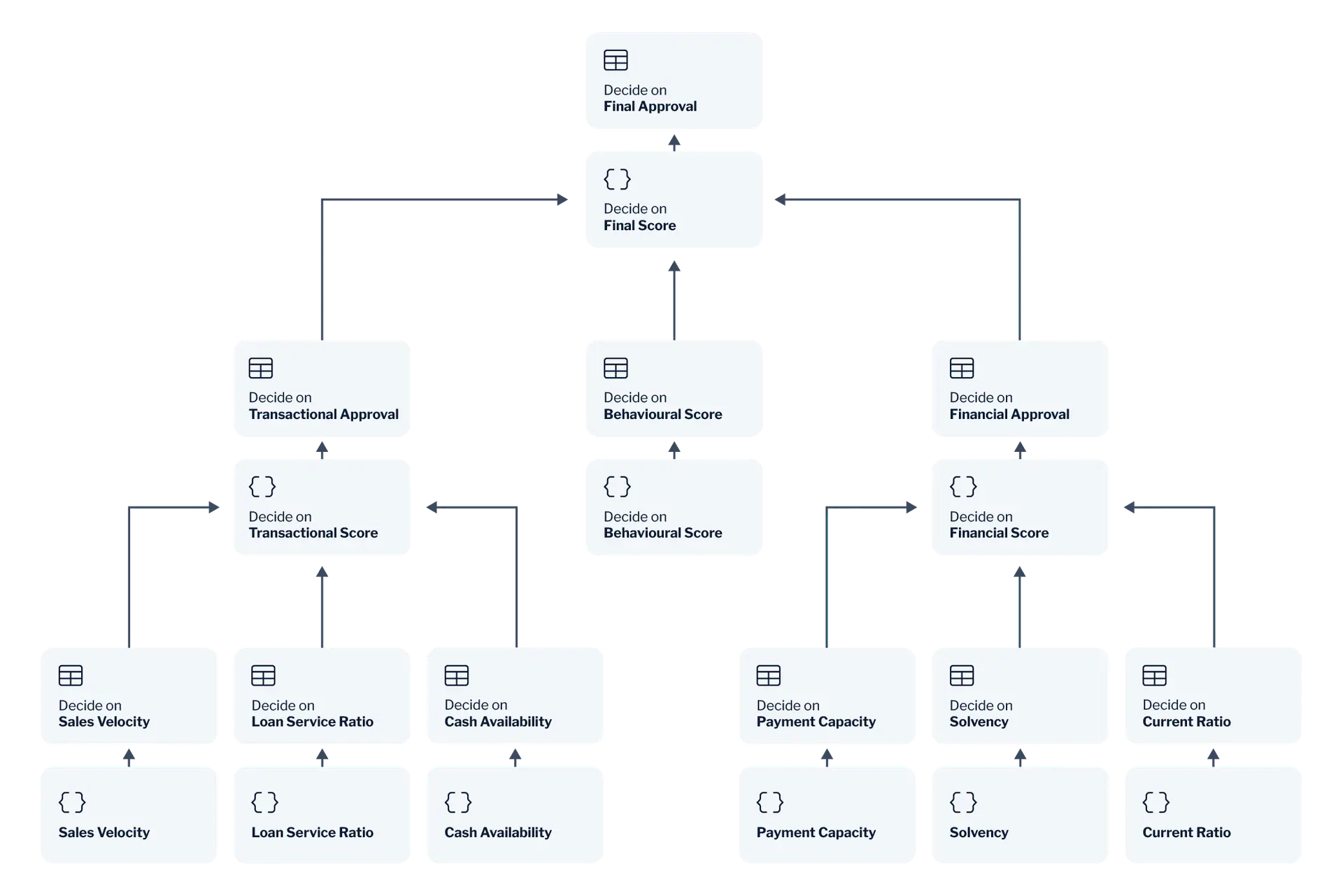

Automate smart and efficient decision-making processes across all your banking workflows while leveraging the native AI capabilities of the Backbase platform. Create your own decision models with ease and speed, based on the well-established Decision Model and Notation (DMN) standard for decision modeling.

Orchestrate harmonized journeys

Stop stitching together point solutions, a wasteful process that usually leads to broken processes and fragmented journeys. Our business process orchestration can digitize even the most complex banking processes, facilitating both the customer-facing interactions as well as the employee-facing case management capabilities.

Unified data at your fingertips

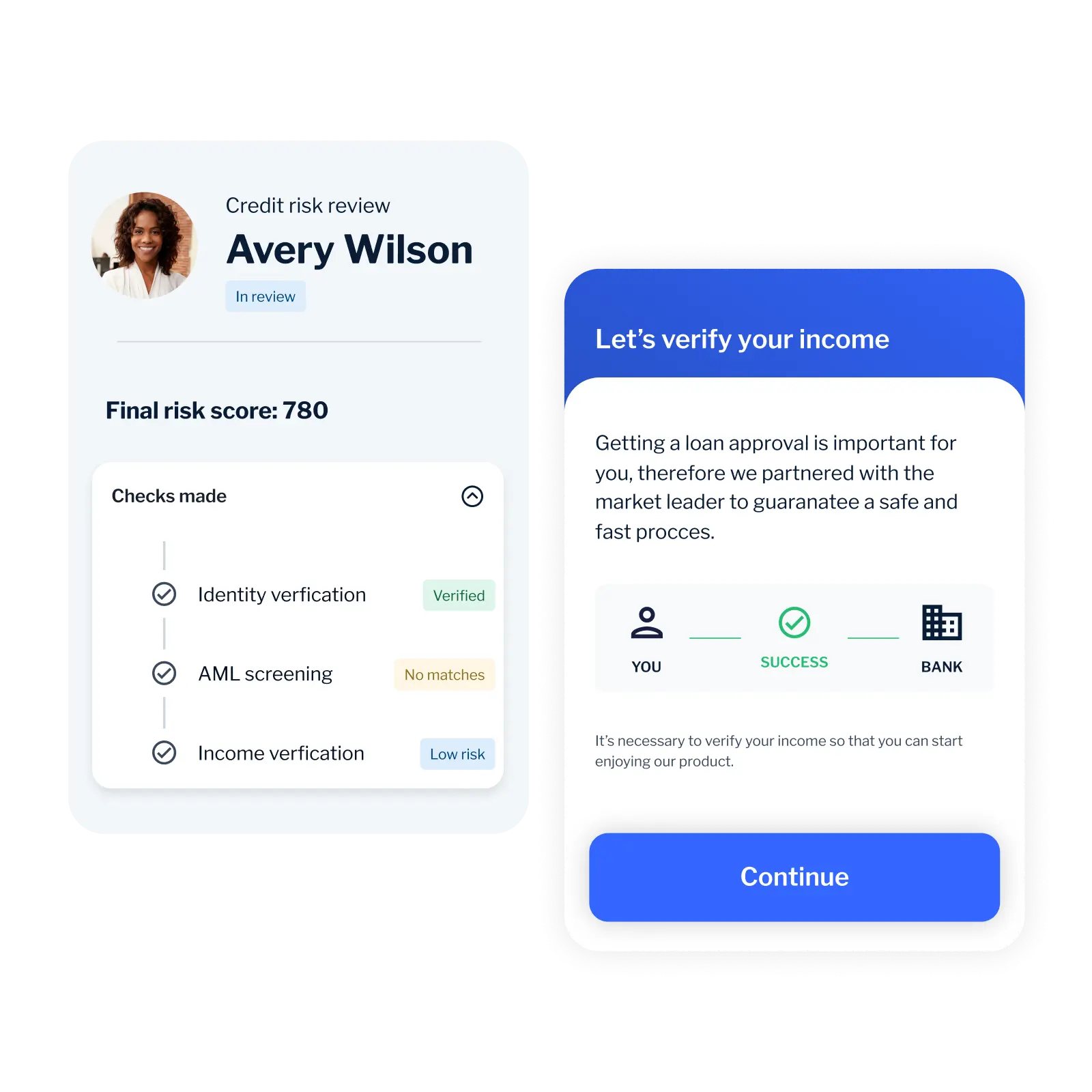

Juggling different steps, systems, documents, and teams results in long processing times and a high risk of errors. Our capabilities unlock agility, transparency, and control by merging all available customer data and documents into a single data store and bringing customers and employees together on the same platform.

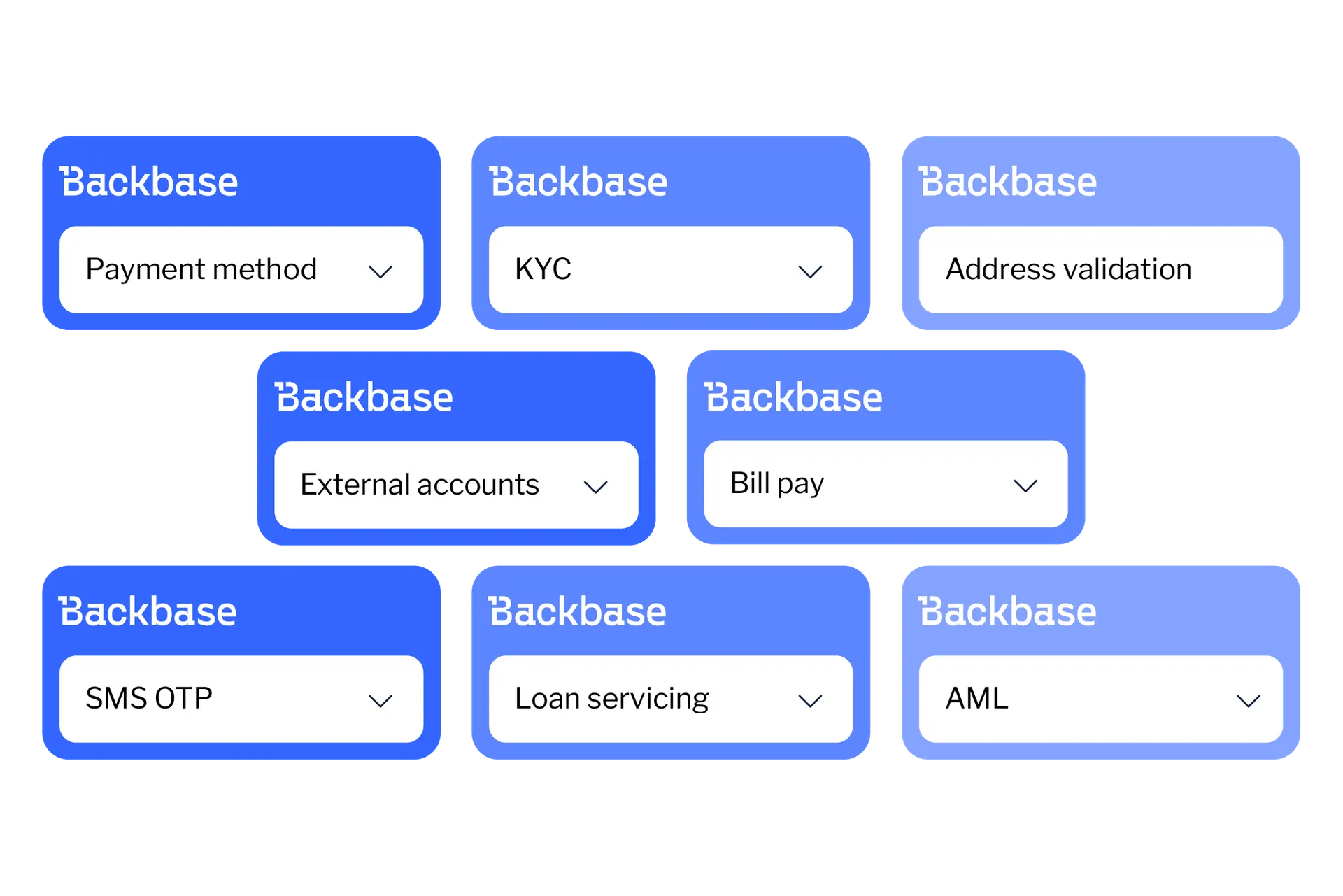

Pre-integrated fintechs so you can go fast

Our solution comes with pre-integrations to best-in-class fintech partners, without the hassle of integrating with multiple vendors. From digital income verification to identity and data verification solutions, you'll get access to a vibrant ecosystem of top-notch solutions, all within the safety of the Backbase AI-powered Banking Platform.

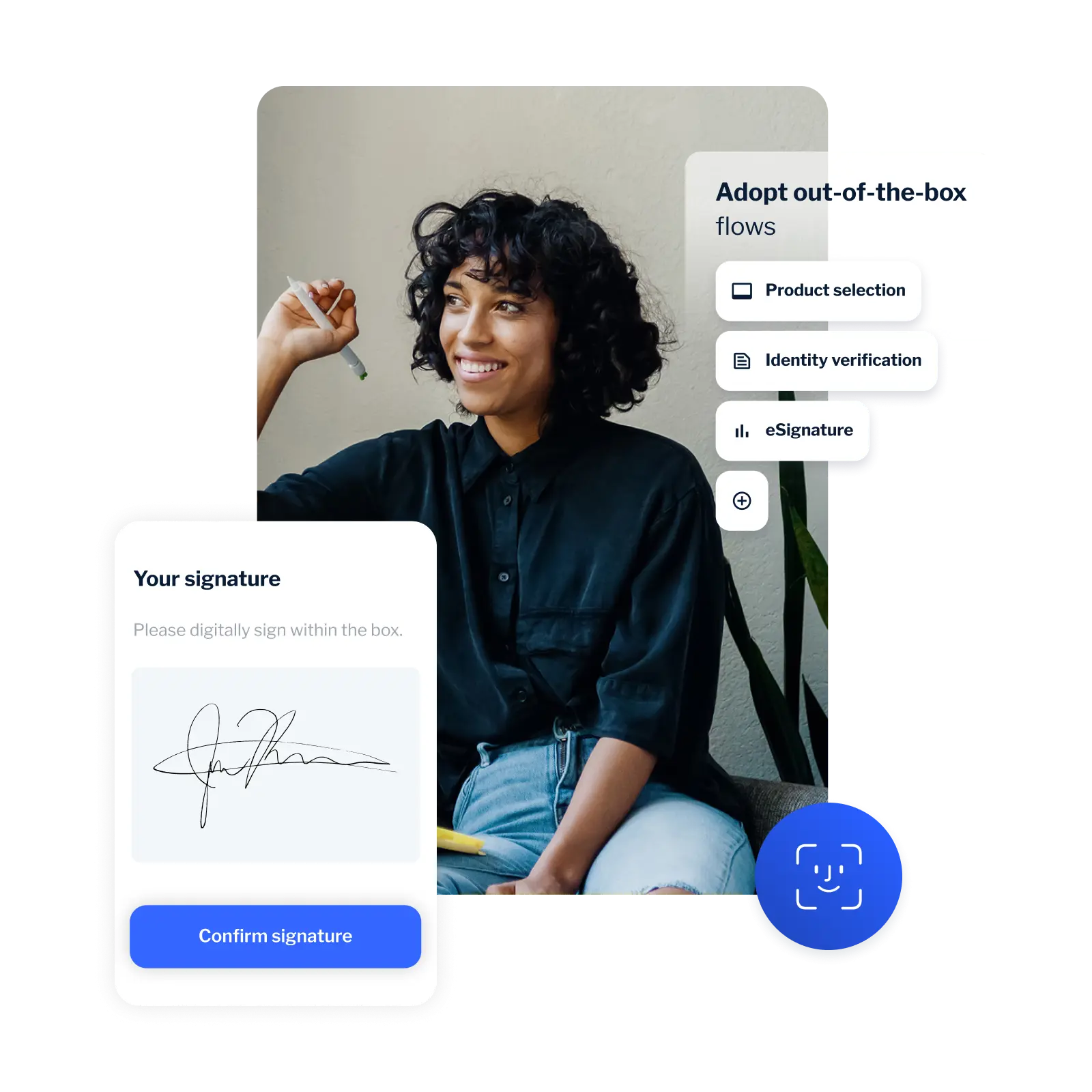

Out-of-the-box journeys to accelerate time-to-market

Every bank wants to be different, but that doesn’t mean you need to build everything from scratch. Adopt out-of-the-box onboarding, servicing, lending, and investing flows and configure them for your specific banking use-case — without any extra coding.

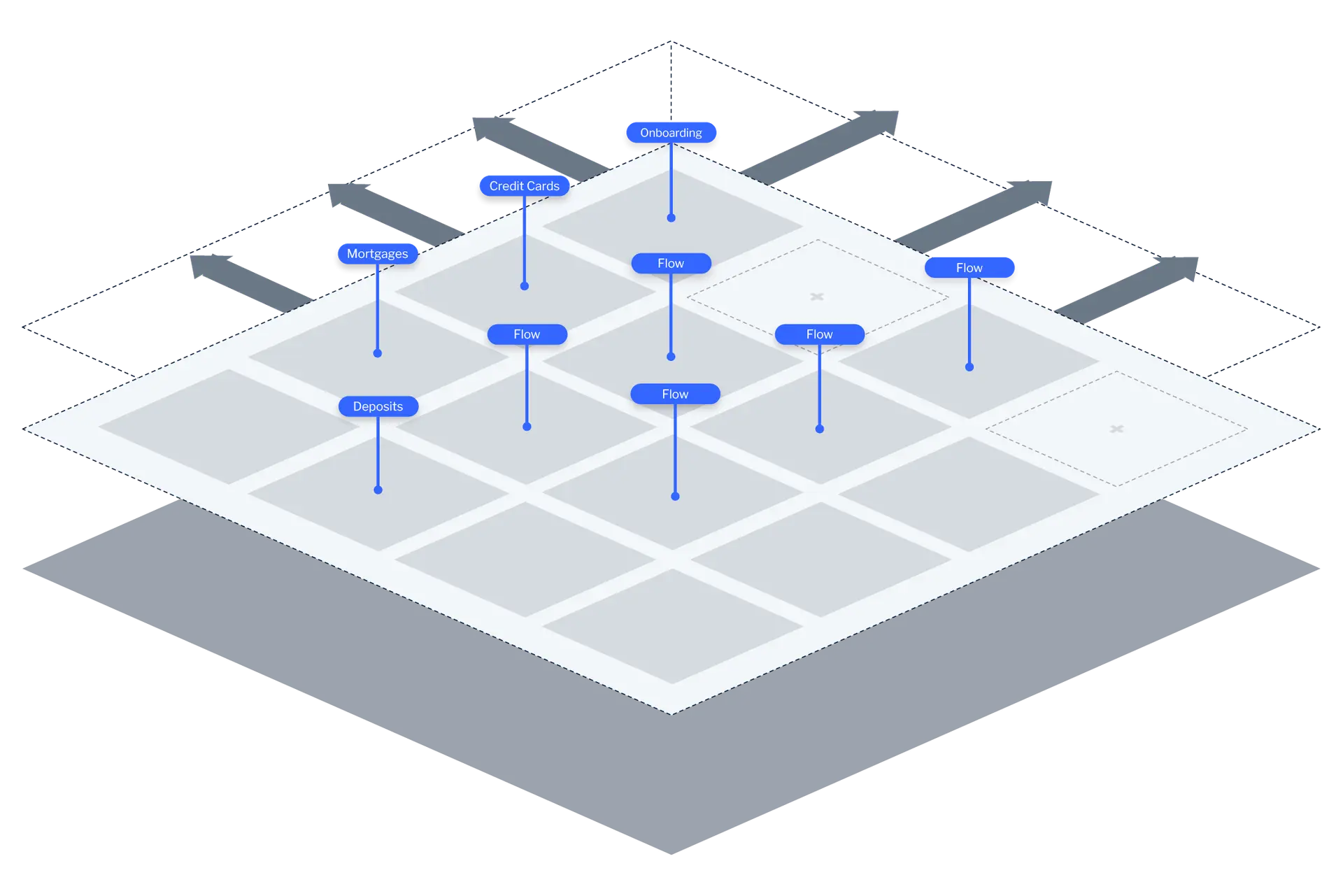

Microservices architecture that scales

No more traffic spikes that keep you up at night. Traditional workflow solutions use monolithic architectures, where a single instance of the process engine orchestrates all the different banking processes. Our process orchestration capabilities are 100% microservice-based — with separate deployable units that you can scale, test, and maintain individually.

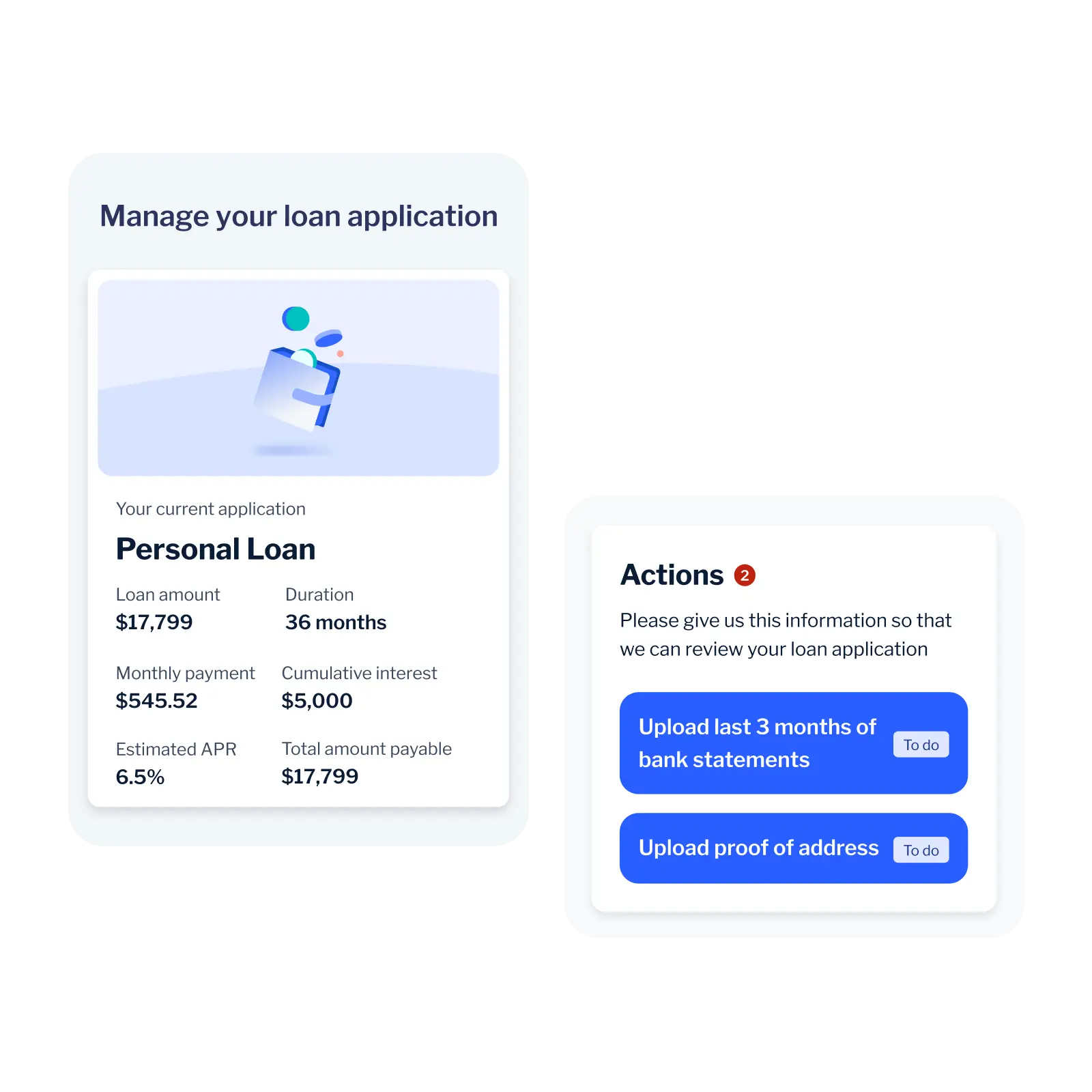

Applications Center

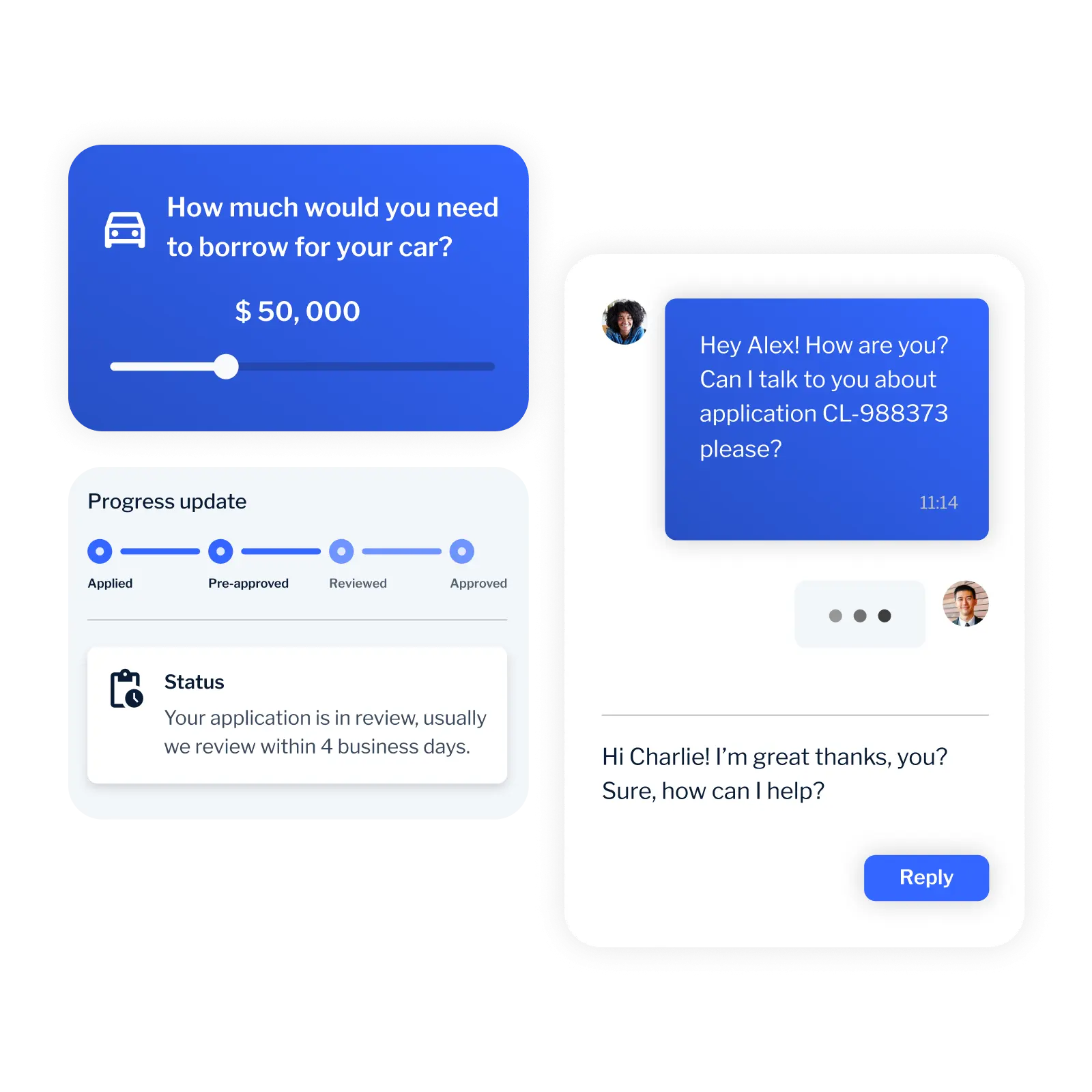

Digitally engage your customers — while providing full transparency and security. Our secure platform enables them to view, manage, and expedite loan applications — all within a single seamless, efficient experience. Increase your conversion rates while giving customers the power to track loan applications, manage transaction disputes, upload documents, e-sign-contracts, and even complete KYC checks.

Capabilities

Process Engine

Subline

Orchestrate complex workflows between customers and the involved bank departments. Design and execute end-to-end business workflows within a journey, including manual steps. Rather than using a proprietary language and technology, the Backbase platform adopts the Business Process Modeling Notation (BPMN) 2.0 standard and is based on the open-source Camunda platform. That way, you can always find the right talent to work with it. Your business analysts can use a visual modeling studio to create new business processes or make changes to existing/out-of-the-box processes provided by Backbase.

Process Engine

Subline

Orchestrate complex workflows between customers and the involved bank departments. Design and execute end-to-end business workflows within a journey, including manual steps. Rather than using a proprietary language and technology, the Backbase platform adopts the Business Process Modeling Notation (BPMN) 2.0 standard and is based on the open-source Camunda platform. That way, you can always find the right talent to work with it. Your business analysts can use a visual modeling studio to create new business processes or make changes to existing/out-of-the-box processes provided by Backbase.

Decision Engine

Subline

Automate decision making across your banking workflows. Invoked from the Interaction Engine and the Process Engine, decisions are reused not only across flows (i.e. your end-to-end main processes), but also between sub-processes and interactions. Backbase adopts the Decision Model and Notation (DMN) standard for decision modeling, a well-established standard within the industry. This makes it relatively easy to find people that can work with Backbase to craft your decision models.Orchestrate all of the interactions between your bank and customers, on any channel, for any engagement pattern. Templates can be used and enriched with customer data to personalize the experience. These capabilities include ready-to-use communications services such as SMS, email, push notifications, in-app messages, or even full-blown real-time communication capabilities (chat/video).

Decision Engine

Subline

Automate decision making across your banking workflows. Invoked from the Interaction Engine and the Process Engine, decisions are reused not only across flows (i.e. your end-to-end main processes), but also between sub-processes and interactions. Backbase adopts the Decision Model and Notation (DMN) standard for decision modeling, a well-established standard within the industry. This makes it relatively easy to find people that can work with Backbase to craft your decision models.Orchestrate all of the interactions between your bank and customers, on any channel, for any engagement pattern. Templates can be used and enriched with customer data to personalize the experience. These capabilities include ready-to-use communications services such as SMS, email, push notifications, in-app messages, or even full-blown real-time communication capabilities (chat/video).

Interaction Engine

Subline

Facilitate the customer-facing parts of your onboarding, lending, and investing UX flows and ensure the right questions, steps, and experiences are rendered on any digital customer touchpoint. An interaction is the collection of steps a customer needs to go through in order to complete their application. An interaction step can vary in size from a multi-page form to a single-form field. The engine ensures a seamless user experience and handles unstructured user behavior much better than a process engine could on its own.

Interaction Engine

Subline

Facilitate the customer-facing parts of your onboarding, lending, and investing UX flows and ensure the right questions, steps, and experiences are rendered on any digital customer touchpoint. An interaction is the collection of steps a customer needs to go through in order to complete their application. An interaction step can vary in size from a multi-page form to a single-form field. The engine ensures a seamless user experience and handles unstructured user behavior much better than a process engine could on its own.

Case management

Subline

The Case Data Store is a domain-agnostic model that provides a single source of truth for the case data across the end-to-end banking process. Data is collected and enriched through the interaction engine. At the same time, integrations are orchestrated by the process engine, collecting data from third-party providers and downstream systems. It’s fully versioned, stored, and managed within the platform, accessible to employees through the Case Manager. Case Manager is an application that allows bank employees to manage tasks related to user onboarding and other product applications. The Milestone-Tracking Capability service provides out-of-the-box functionality that allows customers and employees to easily see and track the progress of an application.Deliver personalized content on any channel, using any of the available engagement patterns (e.g. in-app notification/nudge, live chat, SMS, etc). Any capability or combination thereof can trigger personalized content delivery: account activity data, balance mutations, transactions, payments, user behavior, etc.

Case management

Subline

The Case Data Store is a domain-agnostic model that provides a single source of truth for the case data across the end-to-end banking process. Data is collected and enriched through the interaction engine. At the same time, integrations are orchestrated by the process engine, collecting data from third-party providers and downstream systems. It’s fully versioned, stored, and managed within the platform, accessible to employees through the Case Manager. Case Manager is an application that allows bank employees to manage tasks related to user onboarding and other product applications. The Milestone-Tracking Capability service provides out-of-the-box functionality that allows customers and employees to easily see and track the progress of an application.Deliver personalized content on any channel, using any of the available engagement patterns (e.g. in-app notification/nudge, live chat, SMS, etc). Any capability or combination thereof can trigger personalized content delivery: account activity data, balance mutations, transactions, payments, user behavior, etc.

Document management

Subline

Enable intelligent document orchestration throughout any workflow, catering for storage, searching, versioning, communication, and access control. Documents can be either uploaded by a customer or employee, automatically generated in the Backbase platform, or received from an external solution. The Document Store service supports private repositories that are only available for service-to-service communication inside the platform. The Authentication and Access Control handle access control for Document Store so only authorized users have access to case documents.

Document management

Subline

Enable intelligent document orchestration throughout any workflow, catering for storage, searching, versioning, communication, and access control. Documents can be either uploaded by a customer or employee, automatically generated in the Backbase platform, or received from an external solution. The Document Store service supports private repositories that are only available for service-to-service communication inside the platform. The Authentication and Access Control handle access control for Document Store so only authorized users have access to case documents.

Application CenterAI - Upsell

Subline

Enable secure access for your prospects and customers, allowing them to digitally collaborate with the bank, complete pending tasks on their side, and keep track of the progress of their case or application. A pre-built Document Request Journey allows the bank to create document requests, either manually through the Case Manager or driven automatically by the Process Engine. A task is generated in the Application Center, where the customer or prospect can securely exchange documents with the bank.

Application CenterAI - Upsell

Subline

Enable secure access for your prospects and customers, allowing them to digitally collaborate with the bank, complete pending tasks on their side, and keep track of the progress of their case or application. A pre-built Document Request Journey allows the bank to create document requests, either manually through the Case Manager or driven automatically by the Process Engine. A task is generated in the Application Center, where the customer or prospect can securely exchange documents with the bank.

See it in action

Backbase

Empower your teams with orchestrated, end-to-end workflows. Discover how our business process orchestration can streamline your customer interactions and business processes.

Backbase