Loan origination

Backbase

Drive higher conversions and reduce cost per loan application with AI-powered loan origination. Give applicants a more convenient experience while accelerating approvals and increasing product holdings across retail, small business, and commercial lending.

Are your loan origination processes holding you back?

Applicants expect a frictionless, fast, and personalized experience from application to approval. However, legacy systems, siloed workflows, and disconnected channels make loan decisioning highly manual, slowing down the process while increasing cost per loan, leading to abandoned applications.

1 in 2

loan applications require rework due to errors or incomplete information

Heading

>42%

of borrowers report satisfaction with the loan process, with traditional banks trailing non-bank lenders by up to 30%

Heading

≈80%

of loan origination processes are not fully digitized

Heading

Modernize your end-to-end loan origination processes

Streamline and personalize the entire lending process from application to approval

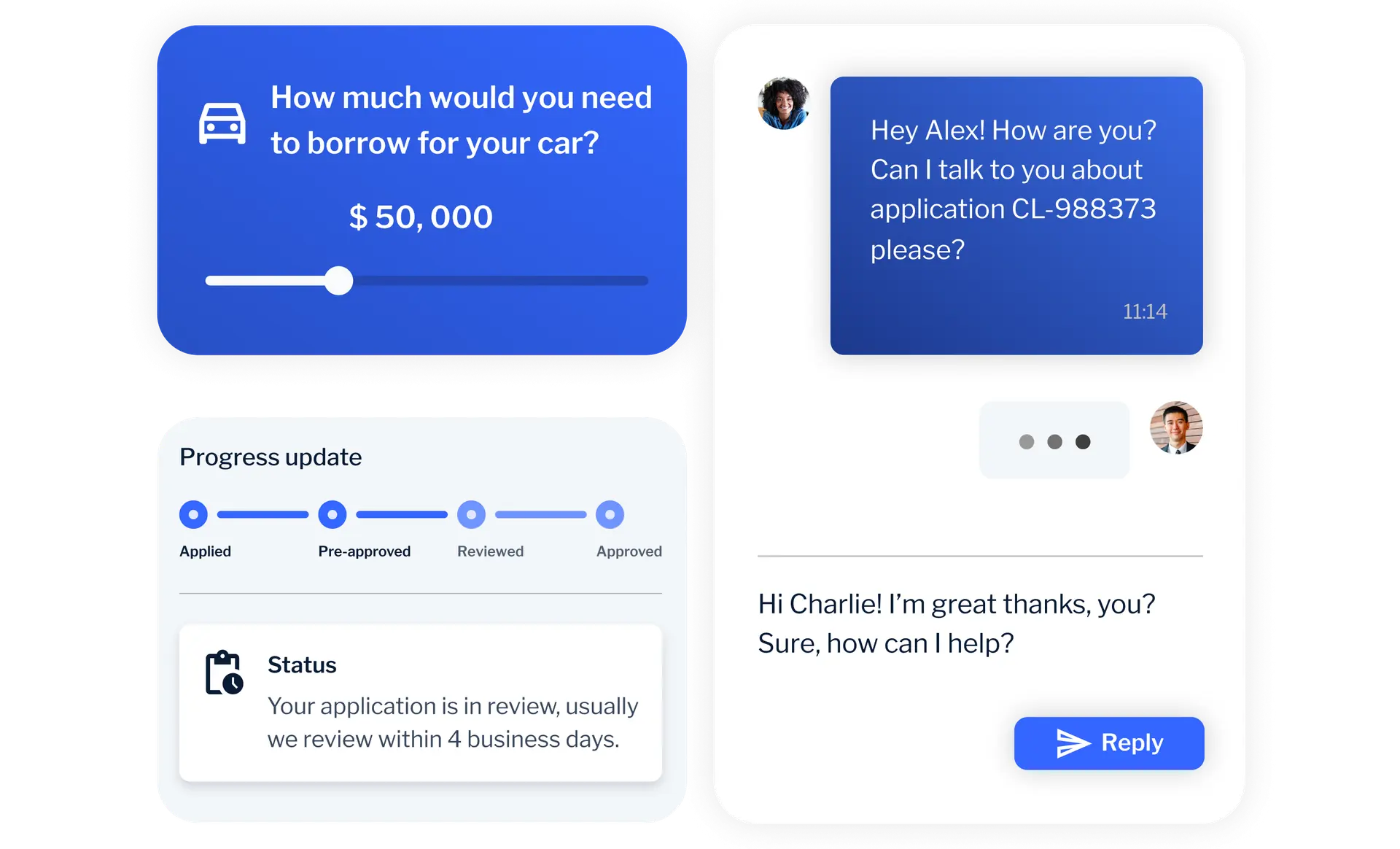

Frictionless loan applications

Subline

Streamline loan origination across channels and touchpoints. Minimize abandonment rates by allowing applicants to start, stop, and resume their applications without losing information or having to repeat steps, ensuring a smooth, continuous experience.

Compose dynamic origination journeys

Subline

Leverage a comprehensive library of pre-built capabilities, customizable templates, and flexible workflows. Integrate seamlessly with back-office systems to automate decision-making, approval processes, and customer interactions.

Tailor experiences for every applicant

Subline

Create personalized loan experiences with the freedom to design, configure, and scale at your pace. Easily reuse capabilities across various loan products and channels, reducing time to market and lowering operational costs.

Boost conversion and cross-sell opportunities

Subline

Adopt a unified approach across retail, small business, and commercial loan offerings to deliver consistent, efficient origination processes and leverage cross-sell opportunities, increasing product holdings.

Consistent, unified loan origination across all customer segments

Retail loan origination

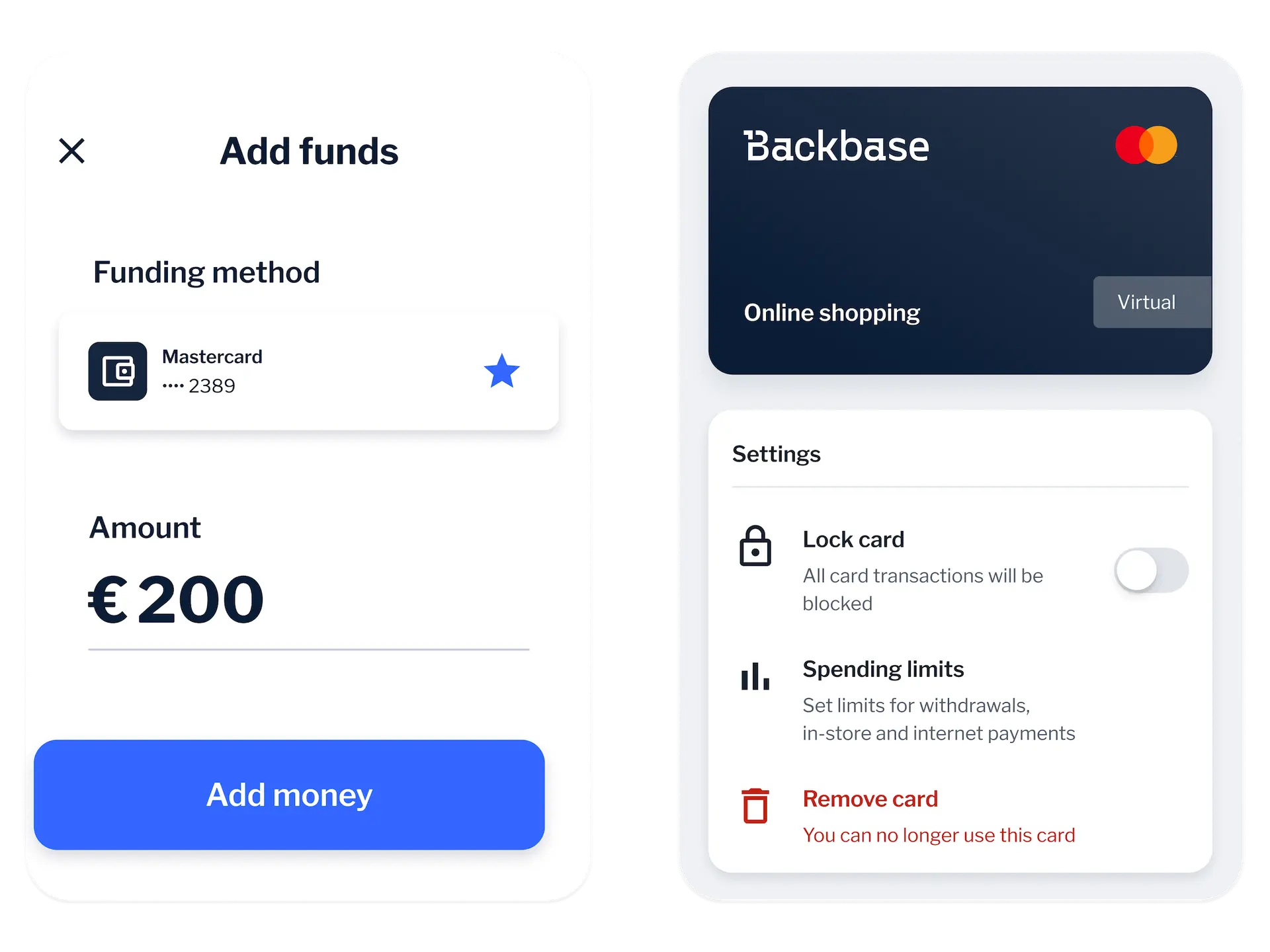

Empower retail customers with digital-first origination across personal and auto loans, credit cards, mortgages and embedded finance. From instant, fully online approvals to real-time asynchronous collaboration with bank employees, reduce friction on complex products and increase application completion rates. Furthermore, leverage pre-filled forms, multi-product offers, and automated decisioning including pre-qualification to lower origination costs and increase pull-through rates.

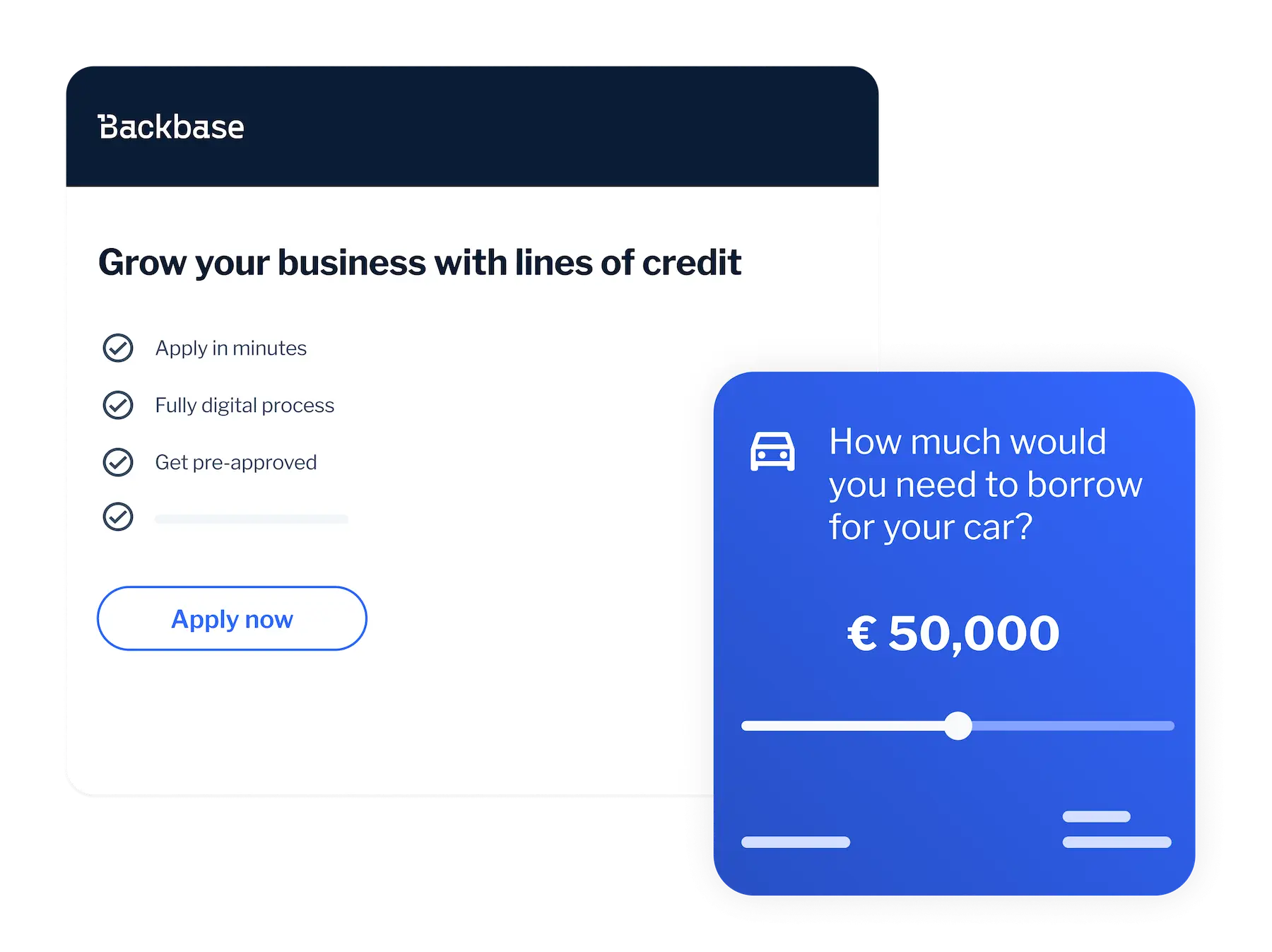

Small business loan origination

Offer a fully digital origination experience for small business owners to access unsecured loans, lines of credit, invoice financing, credit cards, and more. Automate pre-qualification and credit approvals based on configurable rules and streamline workflows like financial document analysis, regulatory compliance checks, and credit scoring for reduced origination costs.

Commercial loan origination

Streamline and digitize commercial loan origination processes. From term loans to working capital, asset finance, or commercial real-estate, easily automate complex workflows like credit analysis, document collection, and compliance checks. Enable seamless collaboration between clients, relationship managers, credit teams and underwriters, from application to funding, for faster decisions and a better client experience.

How does it work?

One platform

Subline

Our unified architecture eliminates your point solutions and allows you to power channel-agnostic journey orchestration.

Composable banking

Subline

Modular, industrialized platform capabilities that coexist alongside your other technologies, vendors and standards.

Buy plus build

Subline

Use our hybrid operating model for speed, flexibility, and customizability, all with minimized risk and cost.

Plug-and-play integrations

Subline

Our library of API-driven, fintech-powered capabilities gives you the ability to add cutting-edge experiences to your apps, easily and efficiently.

Customer-centricity

Subline

Leverage your customer data to deliver personalized digital banking experiences, at scale.

Employee productivity

Subline

Empower your front-office and development teams to drive faster, more effective customer support.

See it in action

Backbase

Ready to transform your bank? Discover how Backbase empowers you to modernize faster, deliver seamless customer journeys, and drive lasting value.

Backbase