Onboarding

Backbase

Boost revenue and lower acquisition costs with automated, omnichannel onboarding journeys. AI helps you optimize every step, from streamlined applications and instant verification to personalized product selection. This means higher conversion, better product uptake, and a smoother experience from day one.

Are your onboarding experiences costing you business?

When onboarding feels disjointed or takes too long, your costs skyrocket and customers go somewhere else. Fragmented systems and manual workflows make it hard to deliver the smooth, efficient experience today’s customers expect. And when complex products and services require human support, disconnected tools create even more delays, frustration, and lost opportunities.

14x

higher acquisition costs for non-automated processes, compared to digital-first ones

Heading

70%

of customers abandon the onboarding process after 20 minutes

Heading

90 days

nearly half of all new accounts do not survive beyond the first three months

Heading

Deliver outstanding onboarding journeys

Make onboarding fast, flexible and personalized

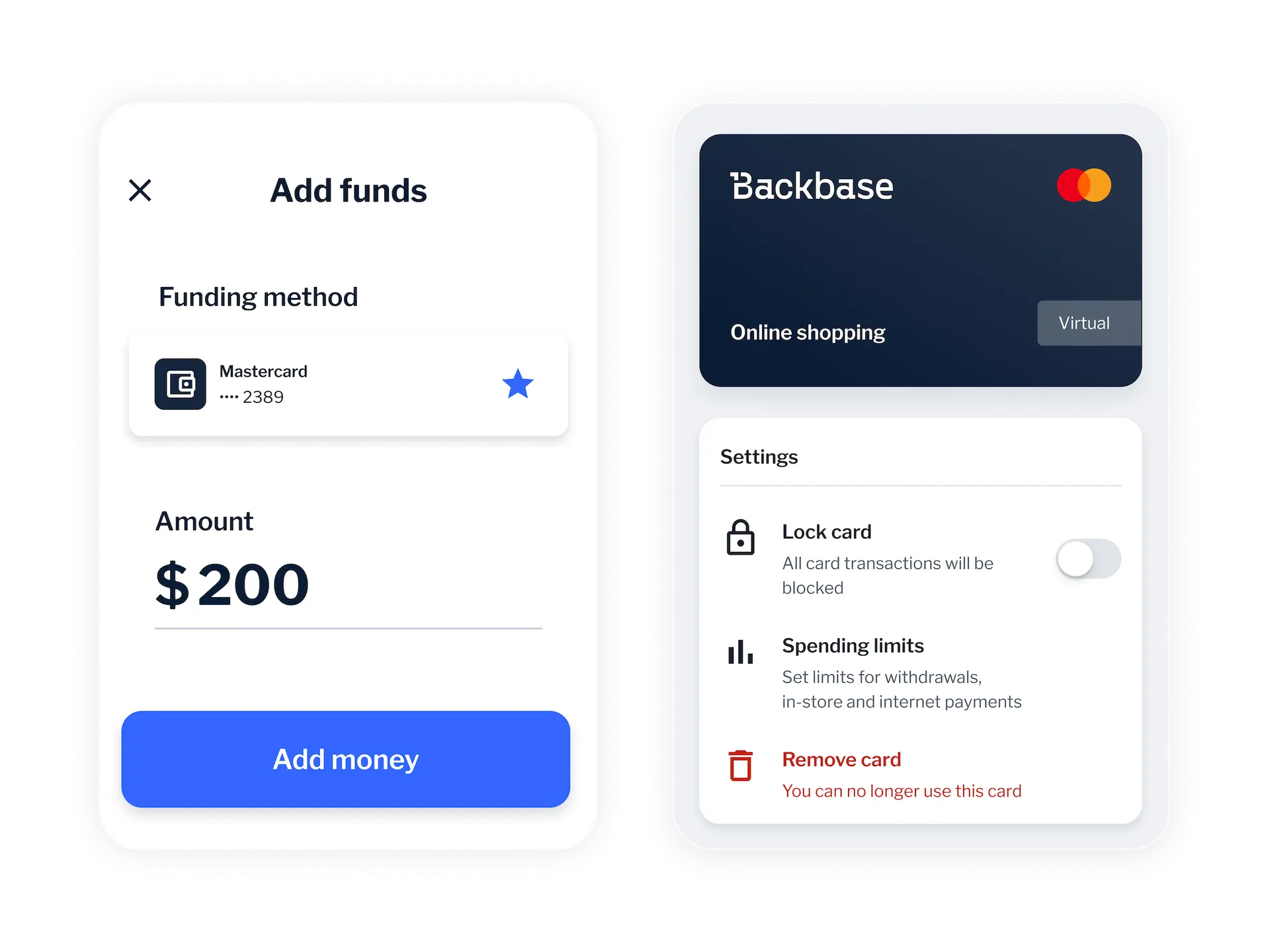

Onboard in minutes

Subline

Accelerate digital and omnichannel onboarding with AI-driven flows that remove friction at every step. Pre-fill data, streamline tasks, and let customers start, stop, and resume anytime — on any channel, any device.

Collaborate seamlessly

Subline

Give clients and employees a shared digital workspace that keeps onboarding moving. AI surfaces next-best actions, clears roadblocks, and provides full visibility into tasks, status, and progress so everyone stays aligned and in sync.

Design once, adapt everywhere

Subline

Build tailored onboarding experiences using a modular library of journeys, workflows and banking capabilities. Customize by product, channel, or segment and reuse what works to scale faster.

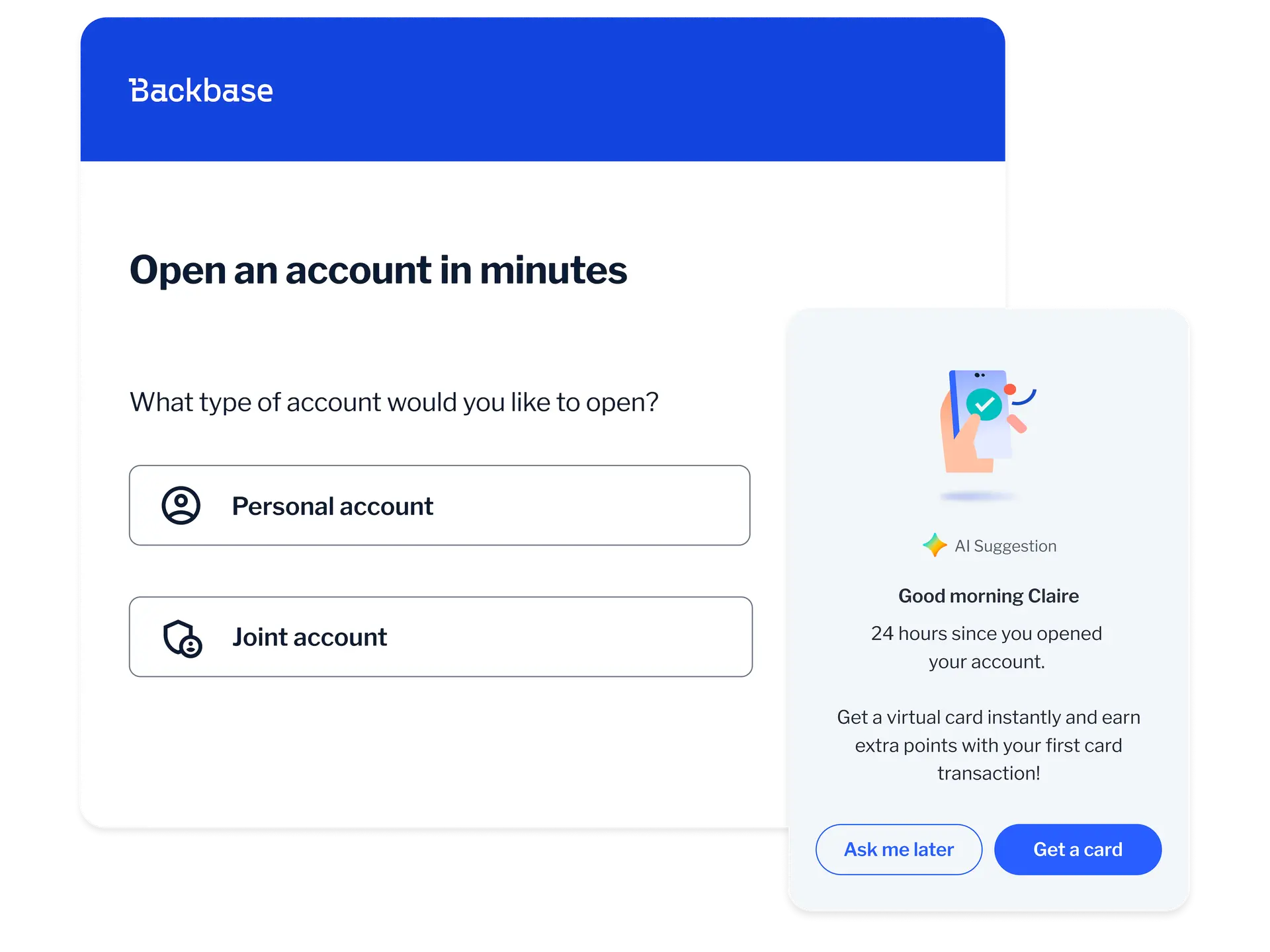

Boost product adoption from day one

Subline

Use real-time data and AI to recommend the right mix of products and services during onboarding. Deliver personalized offers that increase adoption, deepen engagement, and set the stage for long-term loyalty.

Deliver consistent, unified onboarding across all customer segments

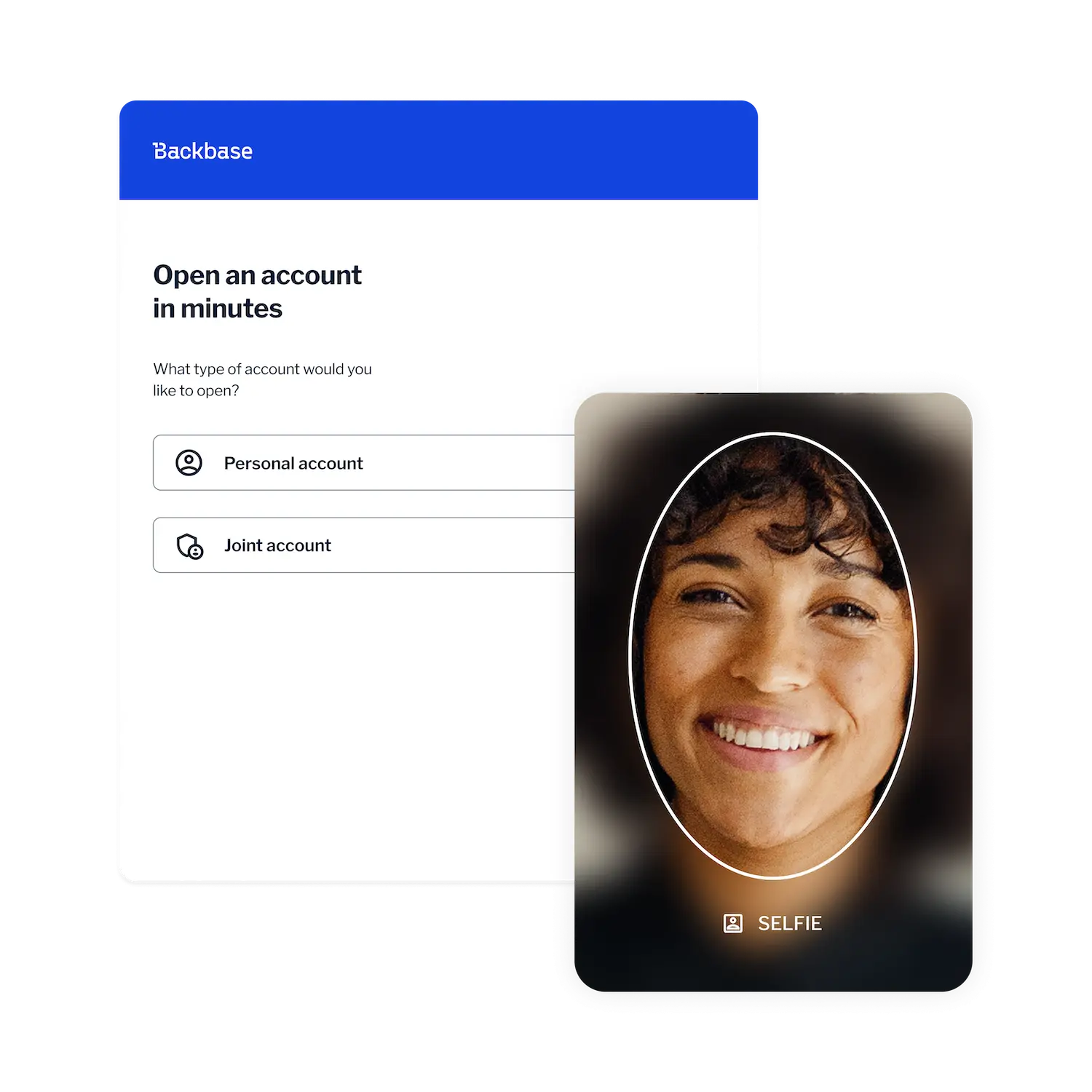

Retail onboarding

Help customers open accounts in minutes with AI-powered digital onboarding that removes friction and makes identity verification, funding accounts, and selecting add-on products fast and easy.

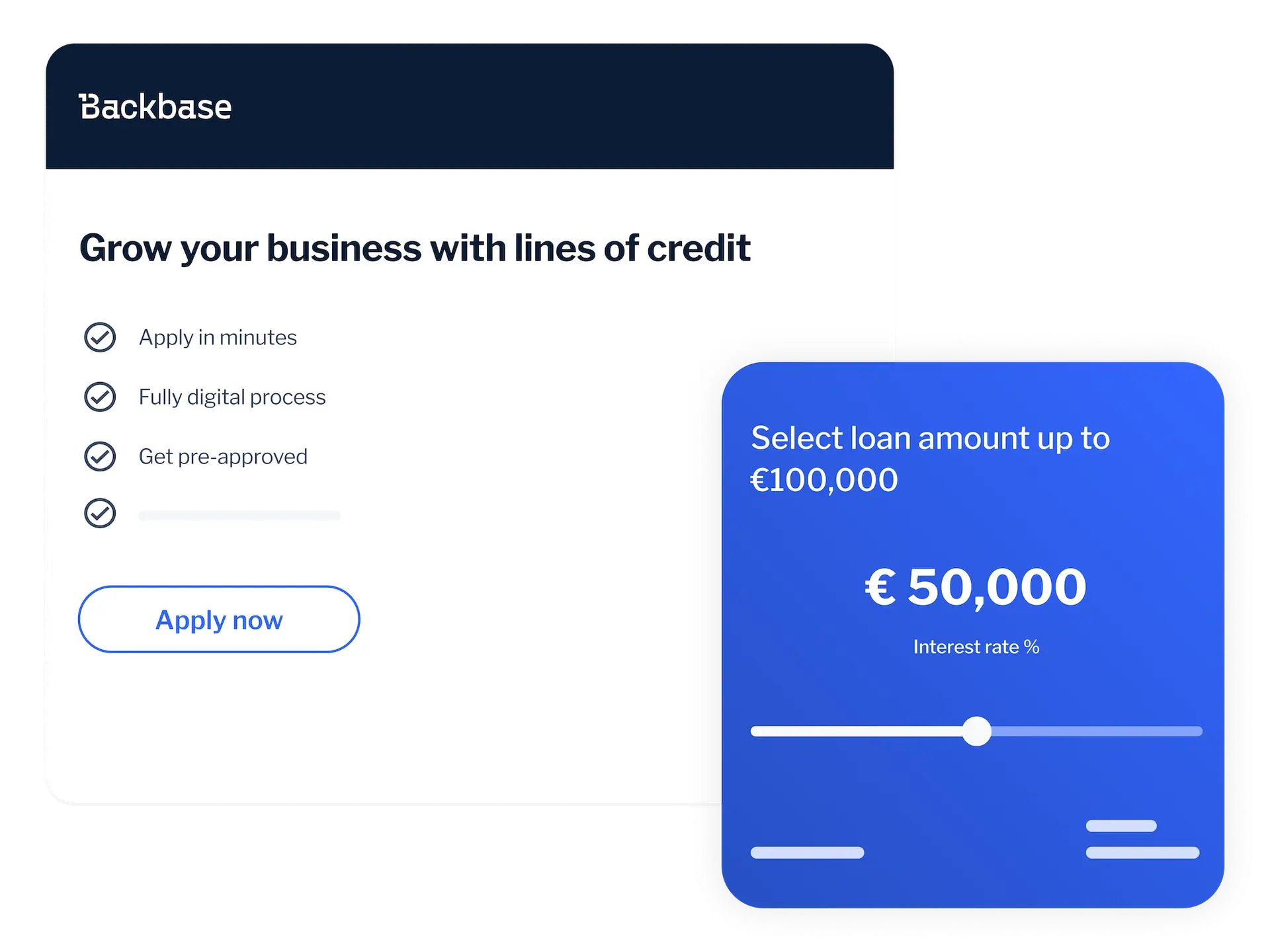

Small business onboarding

Make it easy for business owners to get started with current accounts, credit cards, loans and beyond banking services by using AI to automate and simplify eligibility checks and document collection.

Commercial onboarding

Speed up onboarding for complex products and services like loans, treasury, and commercial payments. Use shared workspaces to streamline collaboration between clients, RMs, and internal teams. Leverage AI to surface next steps and recommend additional services based on needs and behavior.

Private banking onboarding

Transform your bank with a unified Banking Suite — where data, journeys, and intelligent operations come together as one.

Unify your digital sales and servicing to drive growth across every channel, every client, and every line of business.

Wealth management onboarding

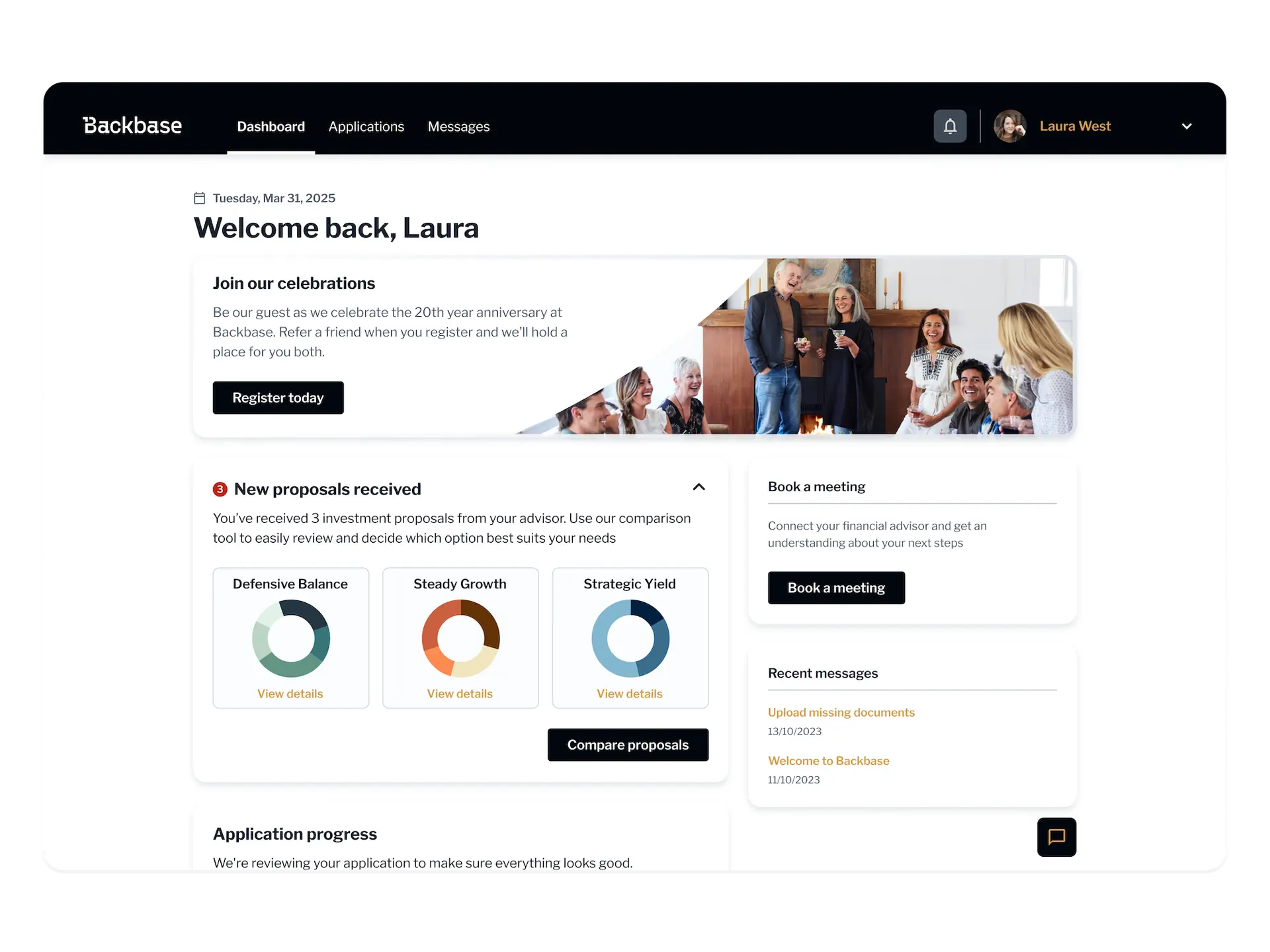

Simplify onboarding across all client segments—from mass affluent to ultra high net-worth—with guided digital and hybrid journeys. Cover everything from KYC and suitability profiling to account setup, and give advisors shared workspaces to collaborate in real time and tailor portfolios to client goals.

How does it work?

One platform

Subline

Our unified architecture eliminates your point solutions and allows you to power channel-agnostic journey orchestration.

Composable banking

Subline

Modular, industrialized platform capabilities that coexist alongside your other technologies, vendors and standards.

Buy plus build

Subline

Use our hybrid operating model for speed, flexibility, and customizability, all with minimized risk and cost.

Plug-and-play integrations

Subline

Our library of API-driven, fintech-powered capabilities gives you the ability to add cutting-edge experiences to your apps, easily and efficiently.

Customer-centricity

Subline

Leverage your customer data to deliver personalized digital banking experiences, at scale.

Employee productivity

Subline

Empower your front-office and development teams to drive faster, more effective customer support.

See it in action

Backbase

Ready to transform your bank? Discover how Backbase empowers you to modernize faster, deliver seamless customer journeys, and drive lasting value.

Backbase