Turn your digital channels into a growth engine

Build meaningful customer relationships at scale with segment-based apps that give customers personalized services, AI-enabled holistic advice, and the ability to connect instantly with bank employees for complex decisions. Customize and reuse 400+ composable journeys, capabilities, and integrations to fit your unique segments, products, and processes and differentiate from competitors.

Turn onboarding & loan origination into a competitive advantage

Increase conversions with fast, flexible onboarding and origination journeys, across any channel. Whether opening an account or applying for a mortgage, use pre-built flows you can tailor to any segment and product.

Reduce drop-off with guided, intuitive journeys customers can start, pause, and resume anywhere

Accelerate KYC and AML checks with built-in integrations and instant verification

Reach new audiences by embedding journeys into partner websites and points of sale

Support fully digital or hybrid journeys for complex products like mortgages and HELOCs

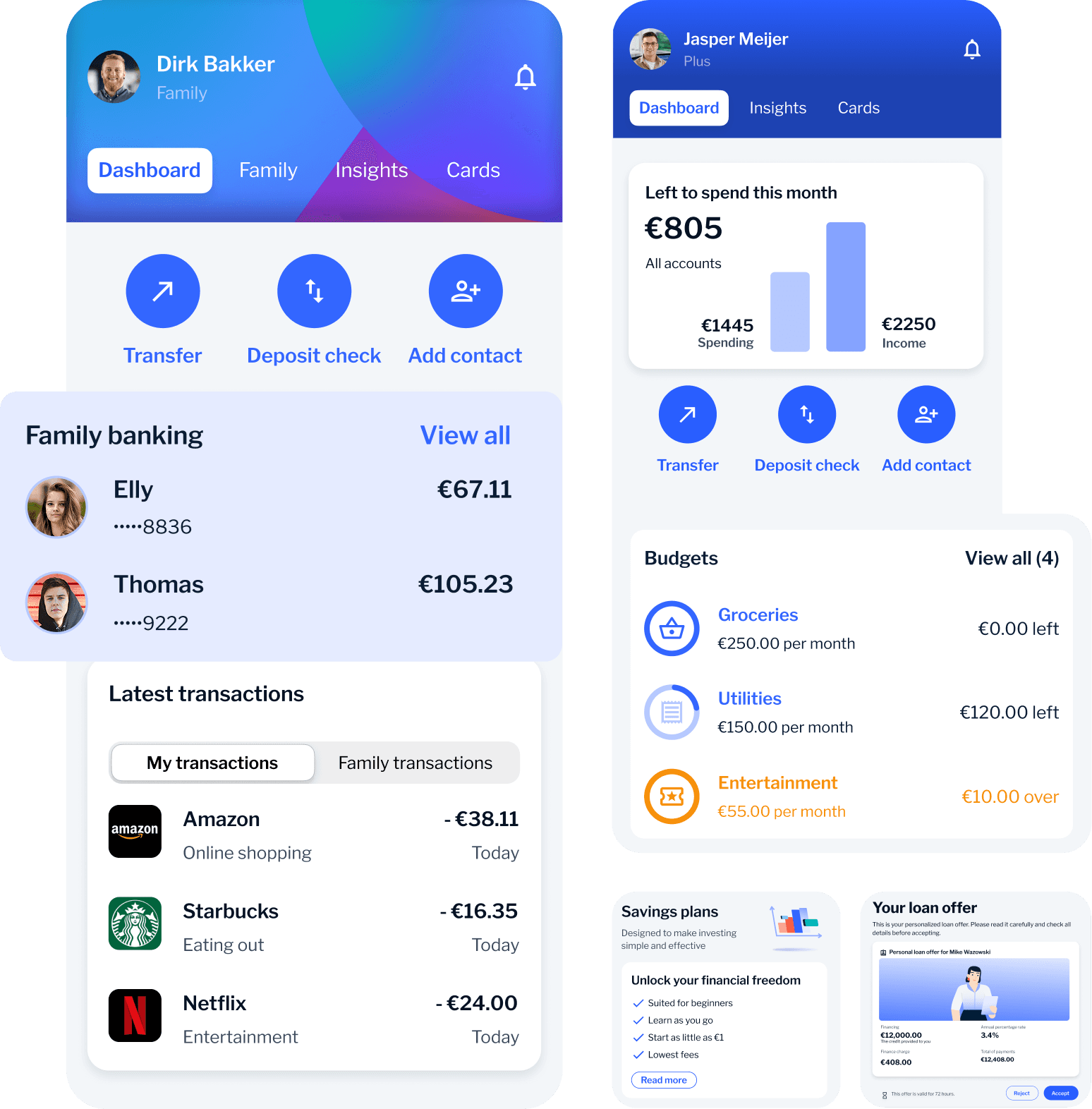

Launch segment-based banking apps designed to engage

Create dynamic, fully-branded experiences that adapt to your customers — whether they log in via mobile, browse online, or connect through open APIs.

Tailor products, bundles, functionality, support options, and design for each unique customer segment — powered by Backbase or your existing segmentation engines and data sources

Boost usage and product holdings with AI-enabled advice, timely nudges, and next-best product recommendations

Expand your services with open banking APIs and fintech integrations

Help customers build their wealth — and your bottom line

Add digital investing services to your banking offerings to unlock non-interest revenue streams. Help clients build their wealth by turning idle deposits into growing portfolios.

Attract new segments with intuitive, goal-based investing for all experience levels

Offer seamless savings, trading, and AI-powered robo-advisory journeys in one platform

Compete head-on with fintechs with intuitive and engaging wealth experiences

Augment digital with the human touch — at scale

Deliver the right mix of digital and human support for every customer segment. Orchestrate seamless channel transitions and equip your teams — branch, contact center and relationship managers — with the tools to make every interaction personal and efficient.

Personalize service by segment offering RM access to affluent clients, and AI-powered chat for everyday needs

Let customers connect on their terms with in-app appointment booking, chat or video calls

Power consistent service with unified workspaces for RMs, branch staff, and service reps

Resolve issues faster with integrated case management and secure document sharing

The first AI-powered platform for banks

The Backbase Suite runs on a unified, AI-driven platform that brings together integrations, data, and customer journeys in one place. It replaces disconnected systems with a modern foundation built for speed, intelligence, and scale.

It’s how you turn fragmented experiences into one smart, connected engine for growth.

What retail banks build with Backbase

From family and daily banking to digital onboarding and relationship management, retail banks use Backbase to deliver tailored solutions that meet the evolving needs of their customers.

Best of suite

Meet your clients’ every need with a unified suite powering all your digital services and channels across all lines of business.

AI-powered platform

Drive growth with every client interaction with AI-powered recommendations and next-best action suggestions on any channel.

Buy and build

Get to market faster with 400+ customizable capabilities and ModelBank implementations you can tailor to your needs.

Proven expertise

100+ leading financial institutions worldwide trust Backbase to power their digital banking services.

Trusted by leading institutions

100+ institutions trust Backbase to modernize their client experience and accelerate growth — with results that speak for themselves.

5

Months to launch a MVP retail banking app

+51%

increase in transactions year-on-year

82%

CSAT

This is the final step in our years-long digital transformation journey. After re-architecting our entire digital ecosystem, [...] we’re confidently delivering a customer-first banking experience. Right now with Backbase, the sky’s the limit on what we can do and offer.

Bala Nibhanupudi

EVP, Chief Technology and Operations Officer at First Bank