Wealth & investments

Backbase

Deliver tailored wealth experiences across mass affluent, affluent, high-net-worth, and ultra-high-net-worth client segments. Build meaningful and long-lasting client relationships while streamlining your bank’s operations. Deliver the right mix of self-service automation and the human touch with robo advisory, self-trading, and hybrid advisory solutions.

Balance personalized investment experiences with digital efficiency

The rise of neobanks, investment apps, and robo-advisory platforms has raised expectations, making speed and convenience priorities across all demographics. High-net-worth and ultra-high-net-worth clients want self-service capabilities but still need personalized guidance. Yet, financial institutions struggle to deliver hybrid advisory models that blend human expertise with digital and AI across client segments. Legacy tech, siloed systems, and outdated infrastructures add complexity, driving up costs and causing inconsistent client experiences.

70%

of households with a net worth over $500,000 (headed by a person under age 45) have a strongly or mostly self-directed investment style

Heading

60%

of financial advisor time is spent on admin tasks instead of servicing customers

Heading

80%

of IT budgets in banks are spent on maintaining legacy systems

Heading

Offer high-quality wealth and investment propositions at speed at scale

Deepen client relationships and attract the next generation of clients by giving every segment the right mix of self-service and assisted investment capabilities. Streamline and personalize the investment journey from discovery to execution.

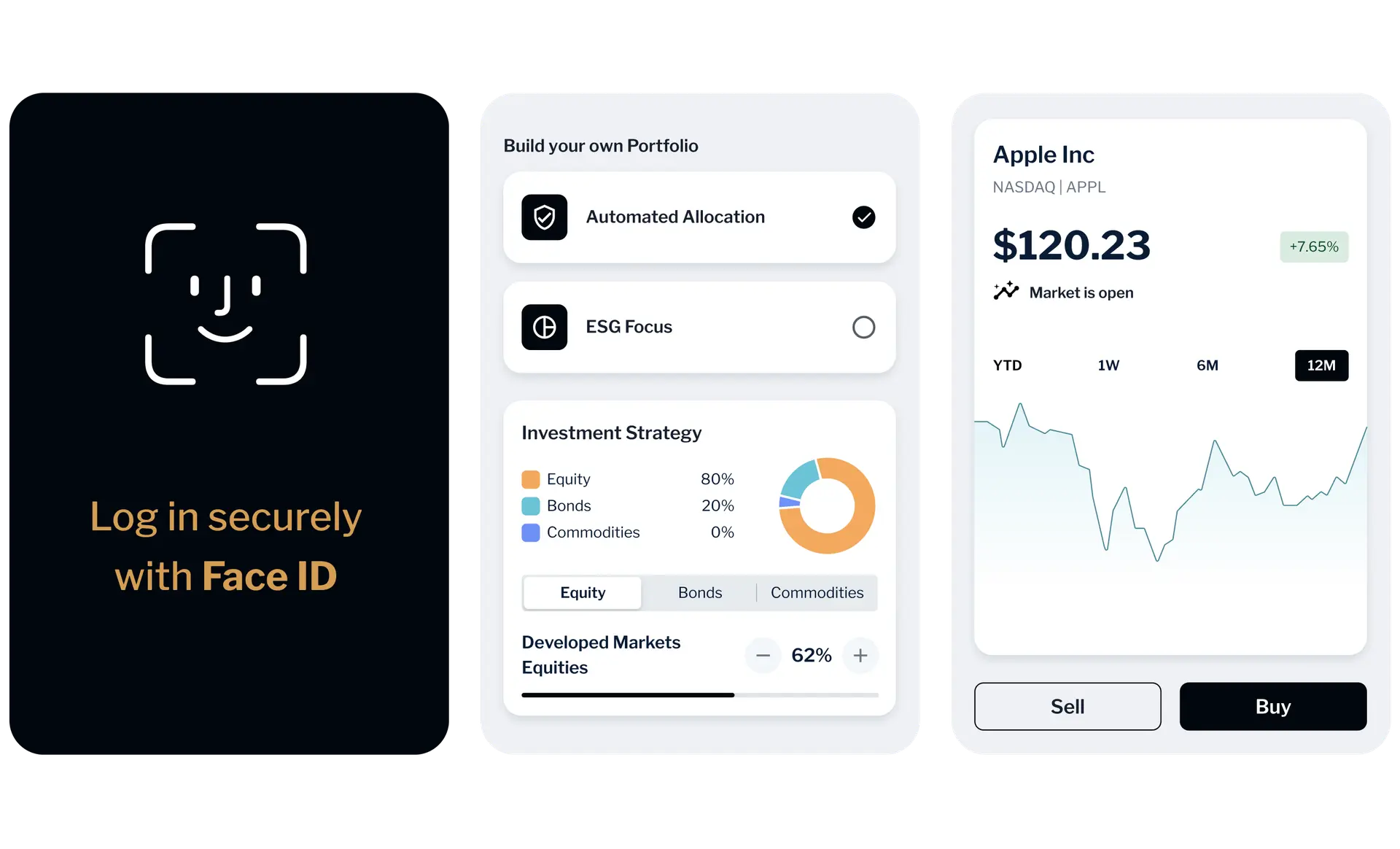

Create tailored, self-directed investing journeys for mass affluent clients

Subline

Add seamless, multi-channel investment journeys to your mobile banking applications that enable customers to create, monitor, and grow their investment portfolios anytime, anywhere, with AI-powered guidance and advice.

Create tailored, self-directed investing journeys for mass affluent clients

Subline

Add seamless, multi-channel investment journeys to your mobile banking applications that enable customers to create, monitor, and grow their investment portfolios anytime, anywhere, with AI-powered guidance and advice.

Retain & grow your existing high-net-worth and ultra-high-net-worth client base

Subline

Offer white-glove wealth services across every channel with hybrid advisory capabilities that give clients control over their wealth, as well as the ability to collaborate with advisors and relationship managers to grow their investment portfolios.

Retain & grow your existing high-net-worth and ultra-high-net-worth client base

Subline

Offer white-glove wealth services across every channel with hybrid advisory capabilities that give clients control over their wealth, as well as the ability to collaborate with advisors and relationship managers to grow their investment portfolios.

Attract the next generation of wealth clients

Subline

Expand your service offerings to capture affluent customers who are building their wealth with premium digital trading capabilities that give them the ability to contact advisors via secure in-app chat or video when making complex portfolio decisions.

Attract the next generation of wealth clients

Subline

Expand your service offerings to capture affluent customers who are building their wealth with premium digital trading capabilities that give them the ability to contact advisors via secure in-app chat or video when making complex portfolio decisions.

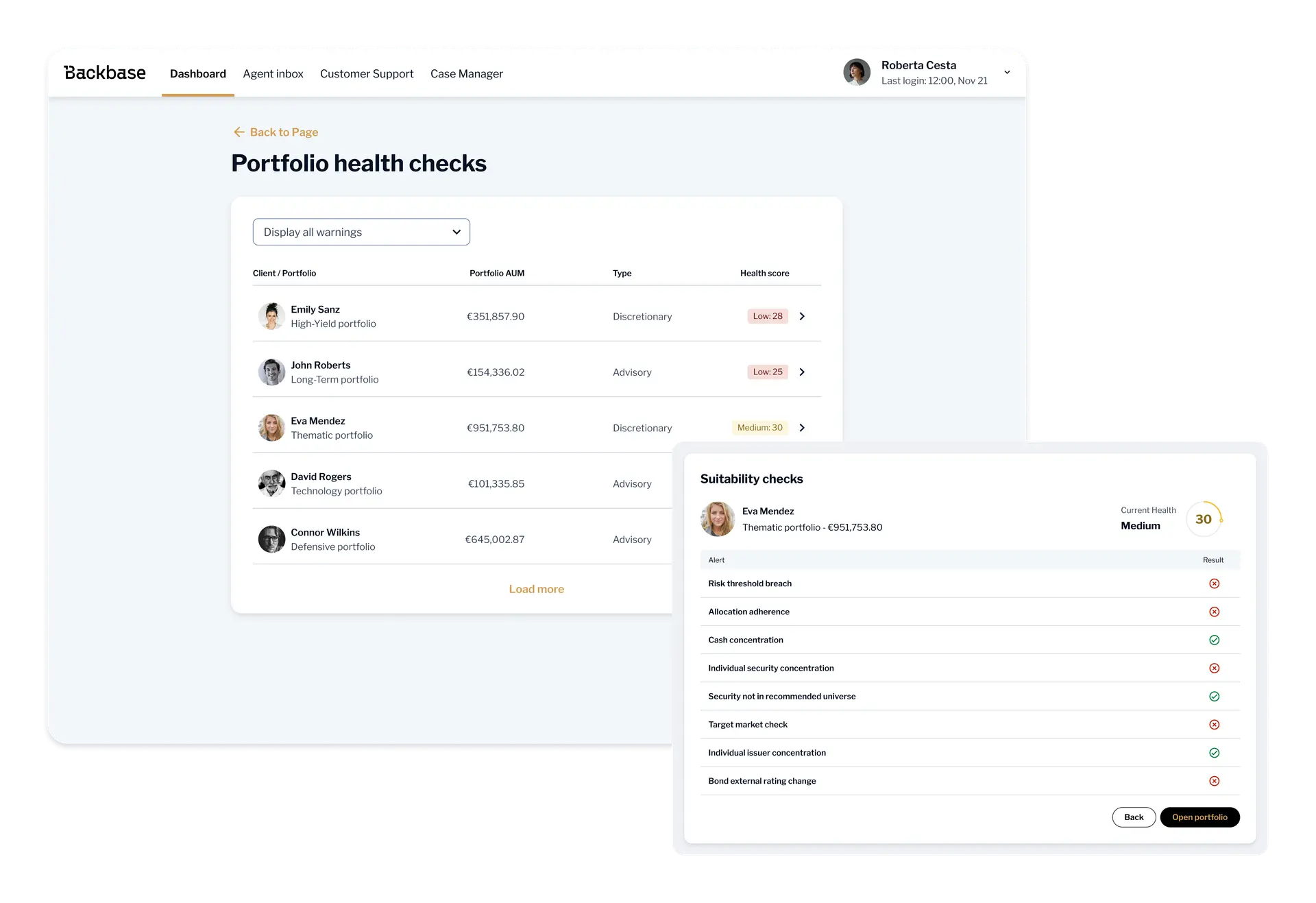

Empower advisors and relationship managers

Subline

Equip advisors, relationship managers, and external asset managers with advanced tools and insights to spend less time on manual tasks and focus on delivering personalized, proactive investment advice.

One platform for all your lines of businesses

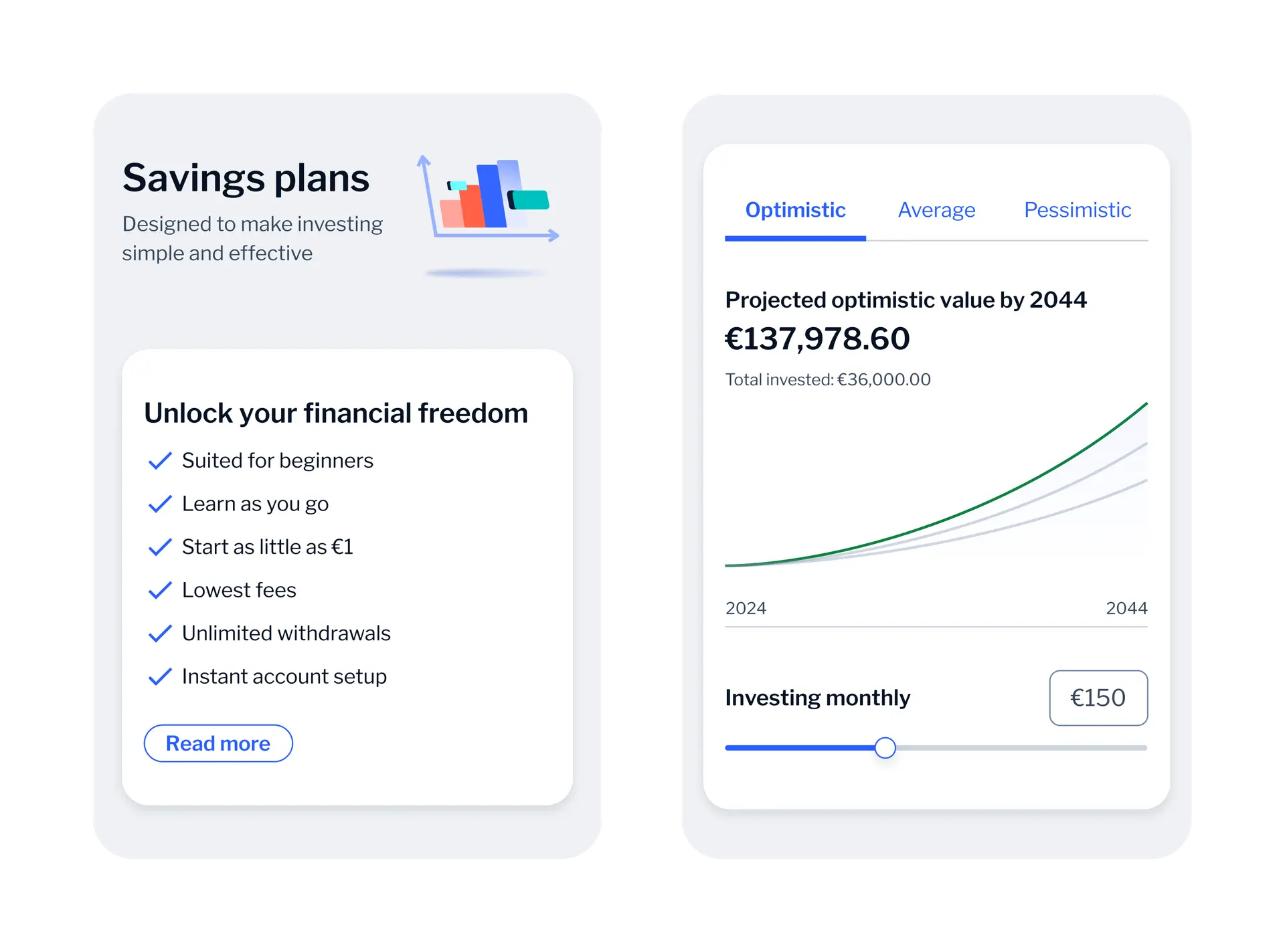

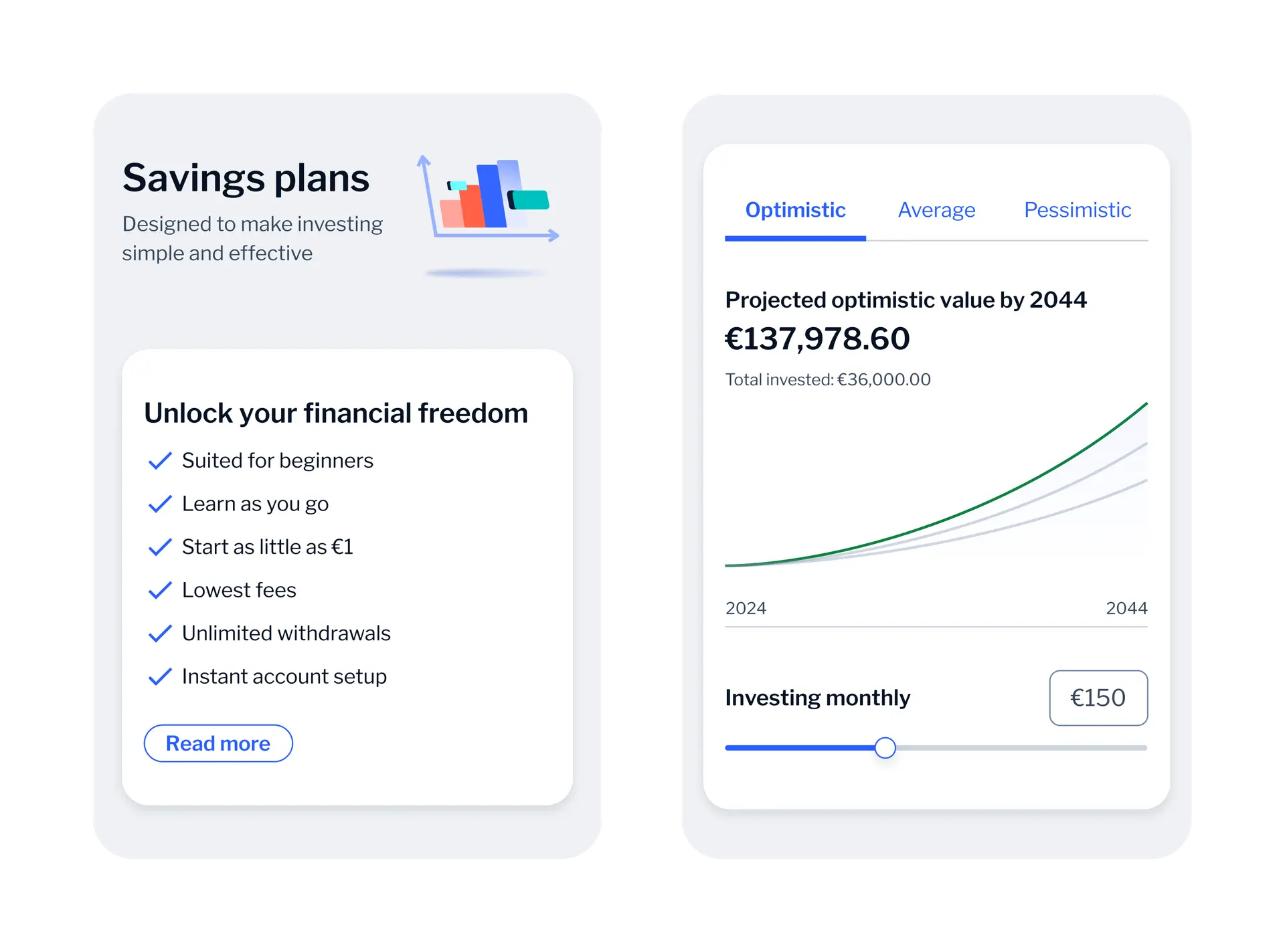

Retail digital investing

Enable retail clients to take full control of their financial journey. From automated, long-term robo-advisory solutions to hands-on trading, clients can tailor their experience based on their preferences. Whether they choose to let their investments run on autopilot with robo mandates or engage in active decision-making, a diverse product range ensures they have the right tools to meet their unique financial goals.

Wealth management

Give clients full transparency and control over their wealth with comprehensive mobile and web applications, offering the right mix of digital and human service. Give high-net-worth and ultra-high-net-worth clients a 360° view of their portfolios with personalized dashboards, quick access to insights, real-time portfolio performance, and more. All this while enabling real-time collaboration with advisors when reviewing investment proposals, discussing investment strategies, and co-creating personalized investment plans.

Private banking

Add advanced wealth management capabilities to your private banking services by enabling clients to analyze their portfolio in real time, adjust asset allocation, and explore curated investment opportunities. Leverage emerging opportunities by incorporating third-party products into your offers, including private equity and alternative asset classes, while giving clients tools to collaborate with relationship managers and external advisors.

How does it work?

Unified architecture

Subline

Our unified architecture eliminates your point solutions and allows you to power channel-agnostic journey orchestration.

Composable banking

Subline

Modular, industrialized platform capabilities that coexist alongside your other technologies, vendors and standards.

Buy plus build

Subline

Use our hybrid operating model for speed, flexibility, and customizability, all with minimized risk and cost.

Plug-and-play integrations

Subline

Our library of API-driven, fintech-powered capabilities gives you the ability to add cutting-edge experiences to your apps, easily and efficiently.

Customer-centricity

Subline

Leverage your customer data to deliver personalized digital banking experiences, at scale.

Employee productivity

Subline

Empower your front-office and development teams to drive faster, more effective customer support.

See it in action

Backbase

Ready to transform your bank? Discover how Backbase empowers you to modernize faster, deliver seamless customer journeys, and drive lasting value.

Backbase