Rethink client service for a digital-first world

Deliver high-quality, hybrid services and experiences that meet the full spectrum of HNW and Ultra HNW clients’ needs. From intuitive self-service tools for everyday banking and investments to unified workspaces for high-touch, tailored advice, enable clients and relationship managers to collaboratively manage, grow, and optimize client assets.

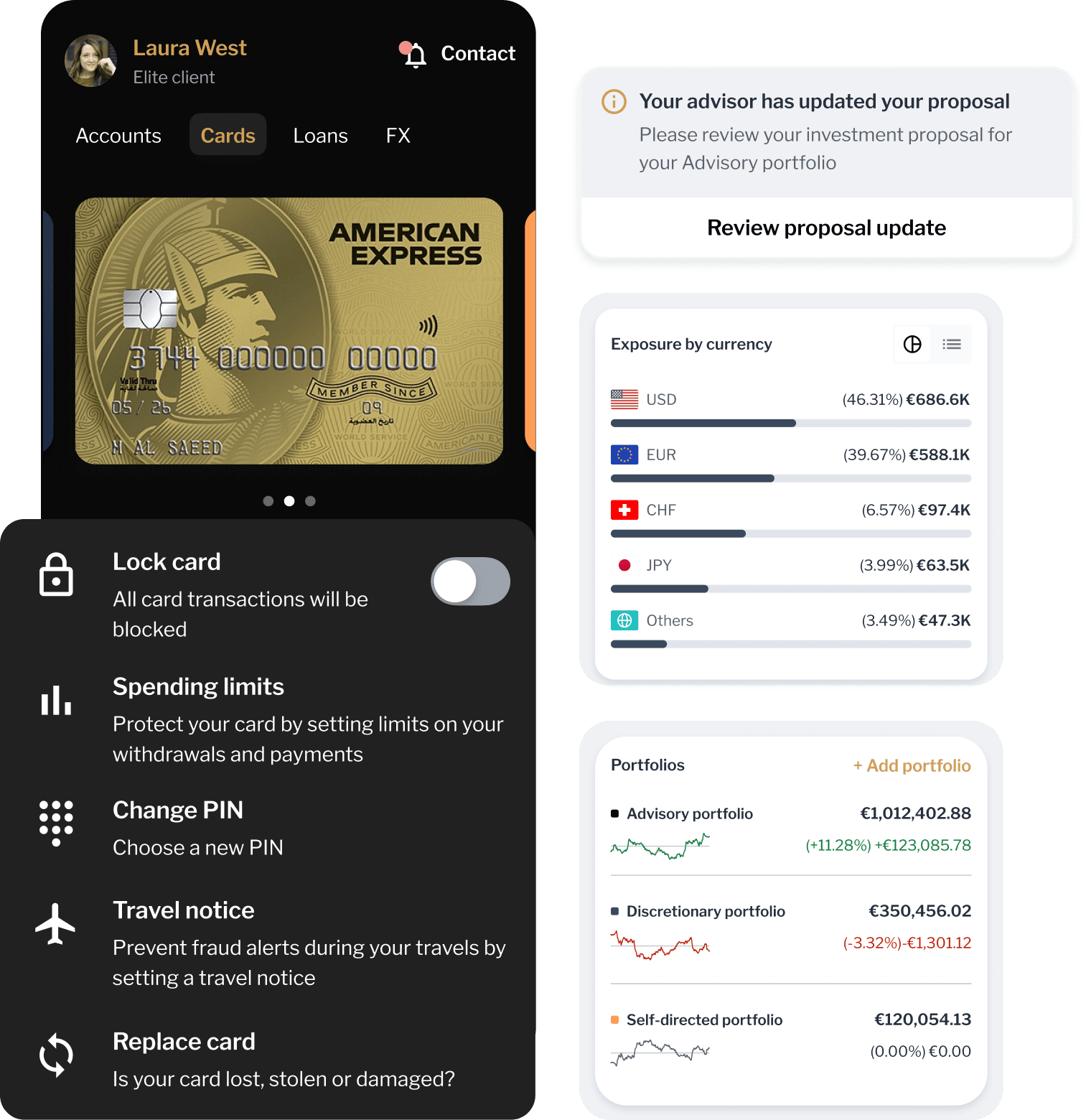

Differentiate with personalized, white glove digital experiences

Offer clients full transparency and control with award-winning mobile and web apps that reflect your brand and tone of voice. Give clients a holistic view of their wealth, real-time insights, and tools to manage complex family relationships and collaborate with RMs.

Empower relationship managers to deliver exceptional service

Free your relationship managers from manual tasks with workspaces that streamline daily execution and provide a full view of client assets, preferences, and past interactions. Surface AI-driven recommendations and connect to real-time insights across internal systems and third-party data sources.

Offer holistic wealth management propositions

Support a full spectrum of investment approaches, allowing clients and RMs to open, manage, and collaborate on portfolios through a single, intuitive experience. Facilitate portfolio creation and tracking across all mandates with AI-driven insights, timely proposals, and personalized product discovery.

The first AI-powered platform for banks

The Backbase Suite runs on a unified, AI-driven platform that brings together integrations, data, and customer journeys in one place. It replaces disconnected systems with a modern foundation built for speed, intelligence, and scale.

It’s how you turn fragmented experiences into one smart, connected engine for growth.

What private banks build with Backbase

From day-to-day banking to long-term wealth planning, private banks use Backbase to design modern, high-impact services and experiences across every stage of the client lifecycle.

Best of suite

Meet your clients’ every need with a unified suite powering all your digital services and channels across all lines of business.

AI-powered platform

Drive growth with every client interaction with AI-powered recommendations and next-best action suggestions on any channel.

Buy and build

Get to market faster with 400+ customizable capabilities and ModelBank implementations you can tailor to your needs.

Proven expertise

100+ leading financial institutions worldwide trust Backbase to power their digital banking services.

Trusted by leading institutions

100+ institutions trust Backbase to modernize their client experience and accelerate growth — with results that speak for themselves.

50

NPS score

£18billion

in payments via digital channels in one year

29k+

portfolios live on digital channels

22k+

private banking users