Backbase

Backbase and Codat partner to help small businesses manage their cash-flow

The partnership enables Financial Service Providers to make life easier for their small business customers by integrating.

Backbase, the omni-channel Digital Banking platform, has partnered with Codat, the SME financial data exchange provider, to provide FI’s with easy connectivity to the world’s leading accounting platforms. As a result, Backbase commercial banking clients can deliver a faster, more convenient experience to SMEs by tightly integrating bank products with the financial applications SMEs use to run their business.

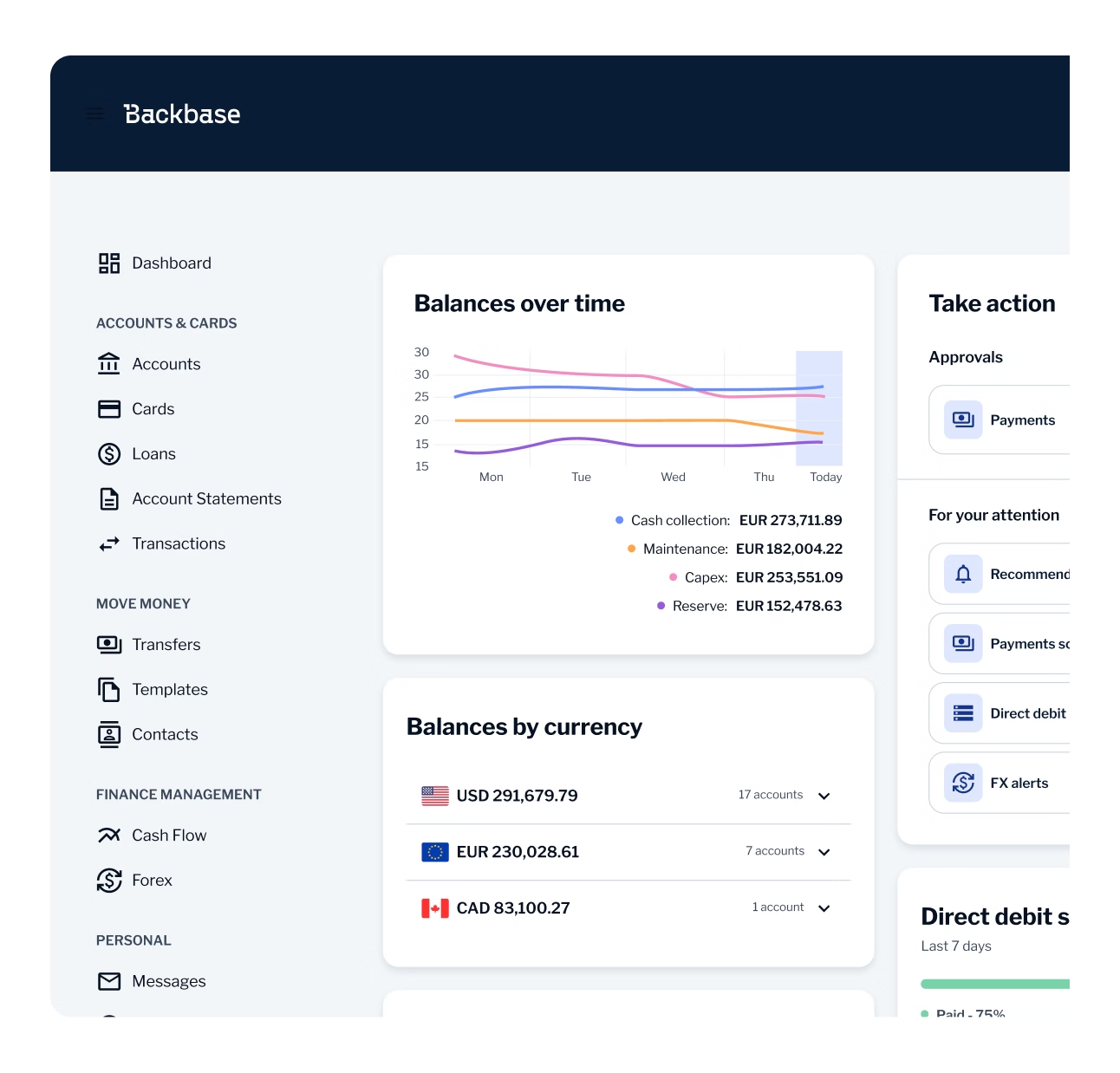

Backbase via Codat, facilitates the free movement of SME financial data through a single API to enable banks and credit unions to import their SME clients’ accounting data into their online banking dashboard.The integrated solution equips financial institutions with the essential components to offer superior SME experience such as;

- vast market coverage and fast connection to the world’s major accounting platforms such as Quickbooks, Xero, Sage;

- quick loan application to manage positive cash flows;

- personalized product and services recommendations;

- alerts on cash flow issues or risks.

Banks benefit from the additional transparency and insights into their SME clients’ accounting data which allows them to improve the quality and speed of their financial services.

Ultimately both Codat and Backbase are committed to helping banks make life easier for their small business customers and making their banking experience interoperable does exactly that. We are only seeing the beginning of what small businesses can achieve by integrating the financial systems they use to run their business.

Pete Lord

CEO of Codat

The Backbase end-to-end solution positively impacts financial institutions, facing competition from challenger fintechs. By enabling SMEs to see all of their ledger data within their online banking dashboard and plan their cash flow more effectively means banks will increase their product stickiness and become an integral part in SME business growth. Clients of the partnership can get up and running in days as the solution is faster, simpler and less expensive than in-house built. Another key benefit is that each connection will be monitored, so that banks focus on their customers, not on ongoing maintenance.

The partnership between Backbase and Codat enables banks around the globe to give their customers real time insight into their current financial status. An extensive and easy to understand view of past and future Cash Flow is key for making the right business decisions. We believe this is an important step in helping our current and future customers, to become the bank that people love.

Pim Koorn

Product Director Business Banking at Backbase

About Codat

Codat makes data integration seamless for the small business economy.

They are the pipes that connect small business data, whether that’s a lender pulling information from a company’s cloud accounting package, or a payment terminal immediately pushing sales information into company accounts.

Codat is building an eco-system of connected datasets that means small businesses are finally seeing the benefit of real innovation, with better products and services.

Through their single API, financial service providers can easily access consented. contributed data from their small business customers.

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.