Backbase

Engagement Banking Cloud launches to future-proof banking operating model

Backbase Engagement Banking Cloud industrializes the entire banking technology stack from the engagement layer through to cloud infrastructure

Backbase announced the launch of the Engagement Banking Cloud (EBC), which brings together the category-leading Backbase Engagement Banking Platform and the underlying technology layers that industrialize the banking operating model of the future. The EBC provides banks and credit unions with ready-to-go connectivity, fintech partners, data capabilities and cloud infrastructure.

The EBC unburdens financial institutions by industrializing the critical capabilities downstream of the Engagement Banking Platform, including the Microsoft Cloud and Backbase’s strategic technology partners. Banks can improve their total cost of ownership, cutting software and hardware costs to create a healthier CAPEX. Financial institutions can build operational efficiency and scale with confidence when adopting the EBC. Adopting the EBC positions banks and credit unions to focus on differentiating their digital products and services.

The EBC frees banks to move into the platform era without having to reinvent the wheel and instead, adopting a best-of-breed banking technology stack. It ensures these ambitious financial institutions can focus their investments on differentiation, rather than building the foundations. The EBC gives these institutions an industrialized operating model to accelerate upon.

The Engagement Banking Cloud

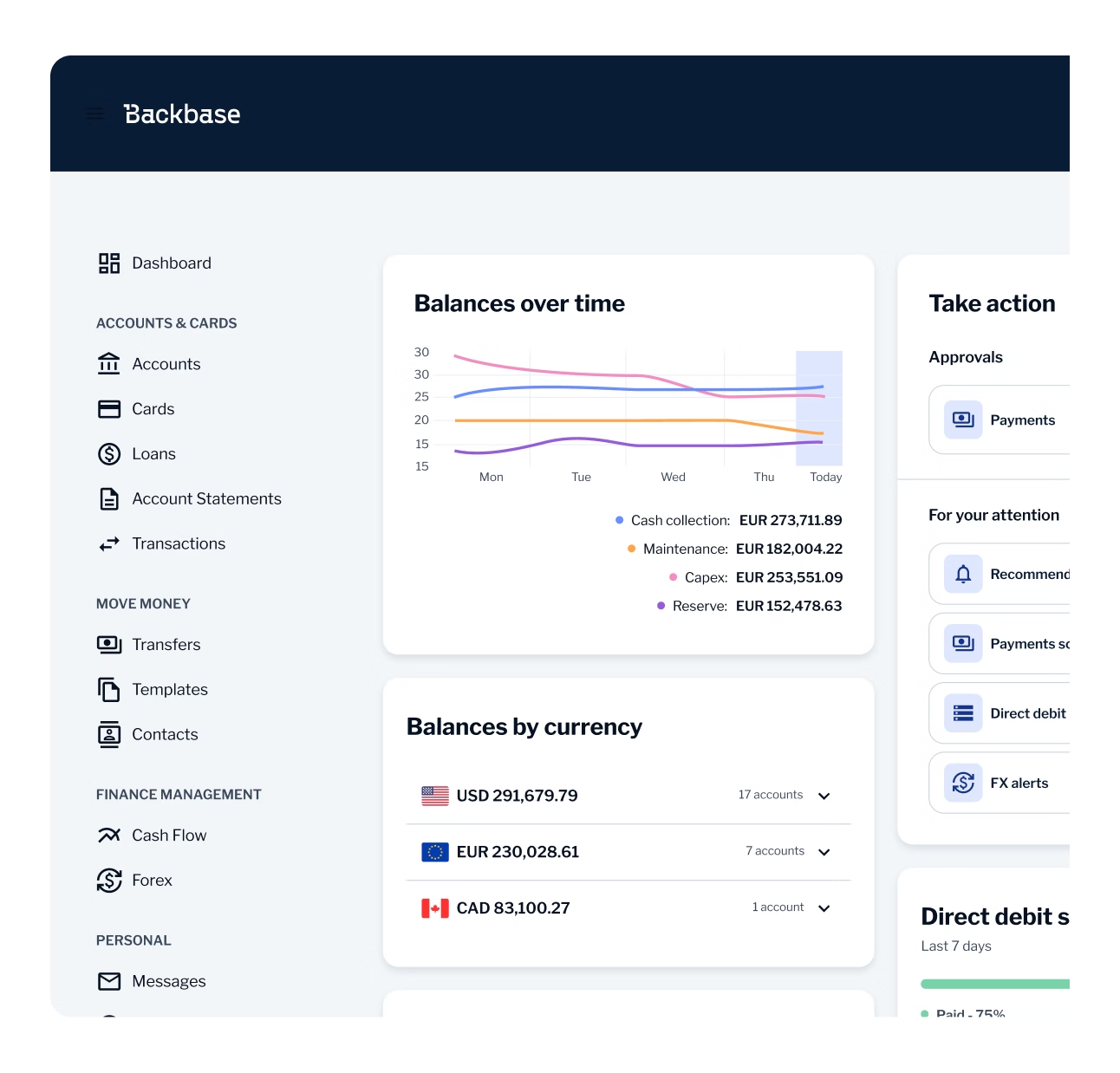

- Engagement Banking Platform: one platform, all lines of business, supporting the full customer lifecycle with seamless customer journeys

- Connectivity-as-a-service: 10+ of the most common core banking systems, industry-leading CRMs (e.g. Microsoft Dynamics and others) and business applications are all pre-integrated

- Fintech-as-a-service: pre-integrated specialist fintech capabilities, available on demand through one billing party, as well as dozens of open-source accelerators

- Data-as-a-service: Leveraging Microsoft’s powerful data capabilities to aggregate and harmonize all data from your organization and ecosystem within the engagement domain

- Cloud-as-a-service: Microsoft Cloud’s scalable, secure, trusted infrastructure with operations managed by Backbase

“The Engagement Banking Cloud finally lets banks and credit unions stop reinventing the wheel and focus their investments on delivering customer value,” Jouk Pleiter, Founder and CEO of Backbase, said on-stage at ENGAGE 2022 in Amsterdam. “With the Engagement Banking Platform now mature, we set ourselves the ambitious target to industrialize solutions to the remaining challenges our customers faced. This massively de-risks digital transformation for banks and credit unions of all sizes.”

This would not be possible without a strong ecosystem of specialist capabilities. Microsoft’s Infrastructure, Cloud, Business Applications and Data offerings provide foundational capabilities. Leading modern core providers such as Mambu and ThoughtMachine, offer pre-integrated, cloud-native core banking services. Beyond that, curated fintech specialists cover a wide range of services from account aggregation to anti-money laundering and more, including two new additions last quarter, credit score management and virtual card tokenization.

“The EBC brings together the larger ecosystem, harnessing all that power into an industrialized cloud,” Roland Booijen, General Manager for Ecosystems at Backbase added. “Our Ecosystems team unburdens financial institutions with curated, pre-integrated, maintained capabilities, allowing banks and credit unions to devote their attention on what matters most - their customers and members.”

Want to find out more?

If you have any questions, please contact us:

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.