Backbase

For the third time in 2021, Backbase named “Best in Class” among digital banking platform vendors

“Backbase offers a highly customizable solution that anticipates consumer banking expectations"-Javelin 2021 Digital Banking Platform Scorecard

Engagement Banking Platform category leader Backbase announced today that it was named “Best in Class” in the 2021 Digital Banking Platform Scorecard from Javelin Strategy & Research, the third leader recognition this year.

Javelin’s Digital Banking Platform Vendor Scorecard evaluates 11 vendor solutions. The assessment is made against three criteria: functionality; experience and engagement; and development and delivery. The Backbase Engagement Banking Platform (EBP) “topped the scorecard with the best combination of functionality, customer experience and development and delivery support.

“Smaller financial institutions require a platform that is mature across all three categories of the Scorecard,” explains Emmett Higdon, Director of Digital Banking at Javelin Strategy & Research and author of the report. “To remain competitive, functional parity alone is not enough. FIs need a platform that integrates customer data with marketing and messaging tools to target and engage the next generation of digital consumers.”

Backbase stood out in the following areas:

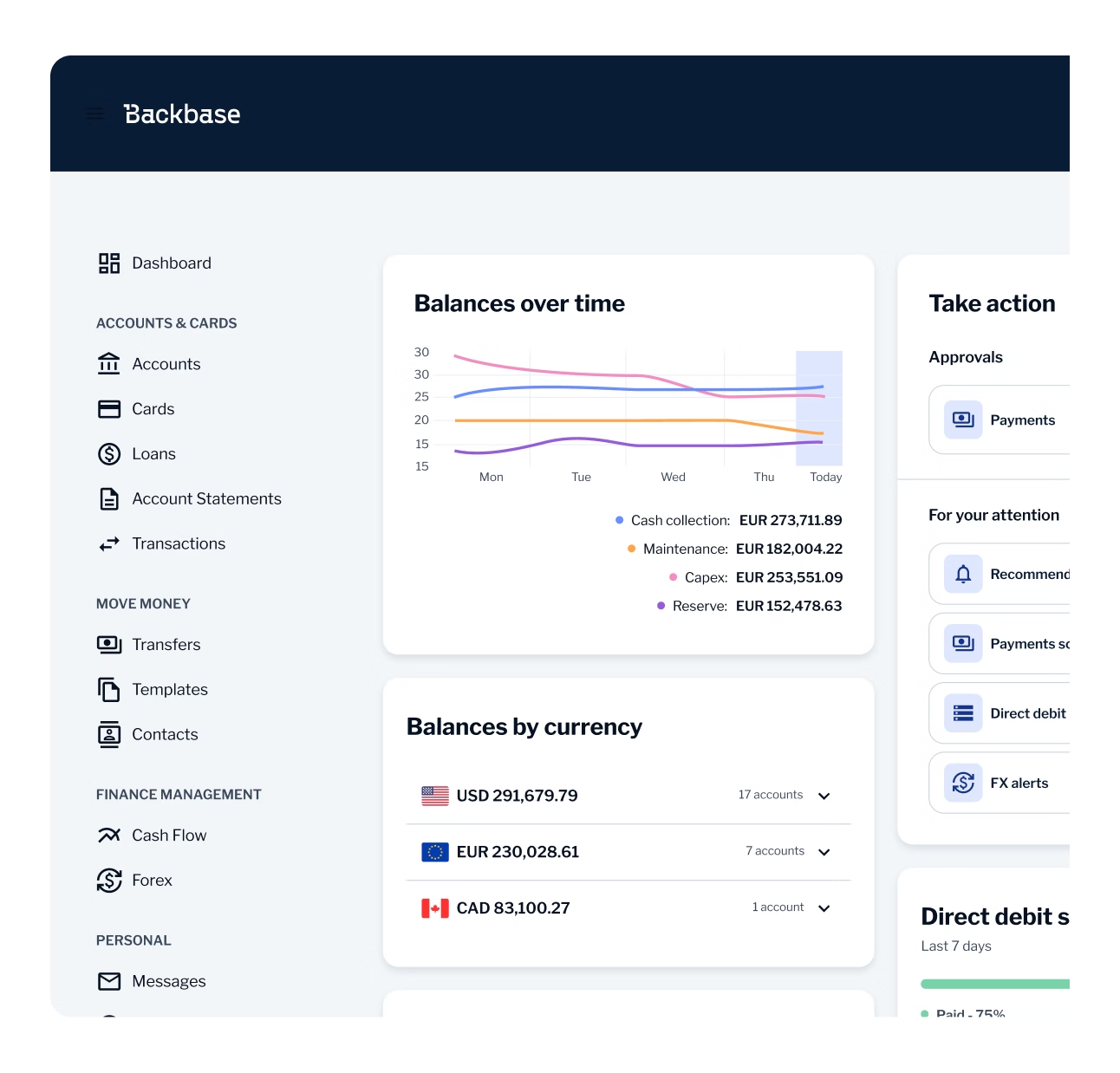

1. Functionality: Backbase was revealed as the functionality leader with the most complete solution available, with additional functionality readily available with key partners. Plus, a strong Account Origination and Onboarding solution.

2. Development and Delivery: Backbase’s customer experience design and full online and mobile banking customization is provided out of the box, making it easy for banks to differentiate themselves.

3. Experience and engagement: Backbase provides functionality that moves banks beyond the basics, including native chat support, family banking account support, and aggregated account data available in multiple locations for advanced reporting, categorization and more.

According to Javelin, small and mid-sized financial institutions are frustrated with commoditized experiences and struggle to set themselves apart from look-alike rivals. With that in mind, Javelin shared that a strength of Backbase is that it’s not merely a “plug and play” solution, but rather “anticipates the overwhelming majority of retail banking consumer needs, providing pre-configured flows that can be mixed, matched and combined to deliver a highly customized digital banking solution.”

“The degree of difficulty in launching a digital experience stitched together piece by piece should not be underestimated. And it is because of Backbase’s position that banks can both buy and build, enabling them to move quickly with a highly customized solution that prioritizes strong customer experiences,” added Higdon.

What really makes our solution so highly prized and standout from the rest is our impressive commitment to R&D and customer service — we want all of our clients to have a quick and seamless implementation. We’re pleased to be recognized as Best in Class for the third time by Javelin, as it further demonstrates that we’re focusing our efforts in the right places. It’s also a testament to the dedication and teamwork of Backbase and our tireless efforts to achieve our mission: helping banks to re-architect around the customer and embrace the paradigm shift to a platform model.

Vincent Bezemer

role Senior Vice President

Want to find out more?

If you have any questions about Backbase, please contact us:

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.