Backbase

Backbase strengthens commitment in the DACH region

Bitkom study “Digital Finance 2020” and credit rating downgrade of German banks show rising importance of digital banking offers

Backbase, the provider of the Engagement Banking Platform, is strengthening its commitment in the DACH region. Backbase has been successfully serving the market for years and has already won numerous customers in the DACH region.

The 2020 results of the annual “Digital Finance” survey by the digital association Bitkom confirm the clear trend towards digital banking. In the meantime, 8 out of 10 German citizens use online banking, including an increasing number of senior citizens. A user-friendly online banking app is already the fourth-most-important selection criterion for a checking account. At the same time, loyalty to the bank continues to fall. In addition, 4 out of 10 online banking users no longer have any contact at all with branch employees. More and more financial institutions are noticing these changes, but have not yet found a solution.

German banks have some of the highest costs and lowest profitability in Europe. This is now reflected in the downgrade of their credit rating by S&P. The pressure to change is high because, in addition to young, digital-first competitors, Big Tech can enter the market at any time.

Jouk Pleiter

CEO and Founder of Backbase

Backbase’s mission is to help financial institutions delight their customers. To achieve this goal, Backbase helps its customers transform their fragmented financial IT. Backbase’s solutions go far beyond the digitization of banks, as the platform focuses on the customer and their engagement.

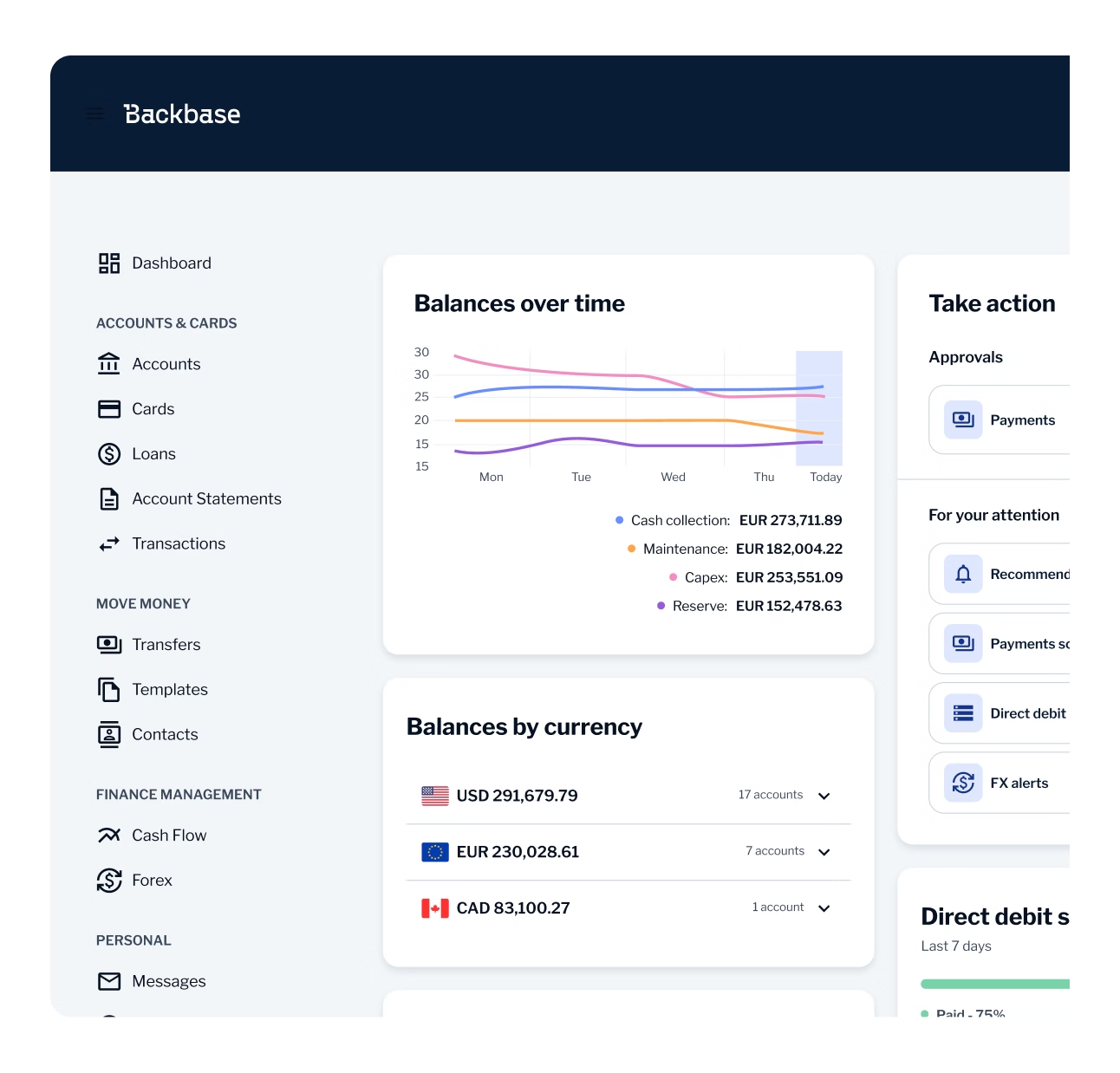

Backbase thus enables financial institutions to connect with their customers and drive their engagement, rather than just interacting with them. Financial institutions achieve this with the Backbase Engagement Banking Platform, which enables Engagement Banking on a single platform across all business lines, from retail to SME and corporate to wealth management. From digital sales to day-to-day digital banking, the entire design of the platform focuses on a seamless and outstanding experience for customers and employees.

The adoption of the platform enables banks to reduce business costs and retain customers for the long term. This translates into:

- up to 60% faster time to market

- 10x improved customer retention

Simply engaging with customers digitally is easy, but delighting them and building customer loyalty is more demanding. Those who understand this difference benefit tremendously, as the market is about to enter the era of engagement banking. In this new era, solutions like the Backbase Engagement Banking Platform provide financial institutions with comprehensive capabilities to improve all relevant customer journeys for their customers and internal employees – faster and more scalable than ever before. Banks and credit unions are able to stay in touch with their customers across all digital channels thanks to the Engagement Banking Platform. They can optimize all interactions across all business units and product lines. And if new customer and member demands create the need for change, the changes can be implemented very quickly on Backbase’s scalable, open Engagement Banking Platform.

Backbase already has a large partner network in the DACH region. The partners and Backbase work closely together to help their joint customers transform fragmented financial IT. Backbase partners include Capco and Network Effects, for example.

Many financial institutions have outdated back-end systems and monolithic front-end infrastructure that prevent best-in-class banking experiences for customers and employees. Backbase is countering Engagement Banking’s view that changes to legacy systems are enough. At the core of Engagement Banking is customer satisfaction and a focus on the banking experience. Engagement Banking is emotional and personalized. Engagement Banking reconnects bankers with their customers. If financial institutions put their faith in Engagement Banking, they become a bank that people love. We want to help financial institutions in the DACH region evolve their existing business formula.

Jouk Pleiter

CEO and Founder of Backbase

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.