Leading Southeast Asian bank revolutionizes digital business banking with Backbase

Backbase

In a country where digital adoption is rapidly increasing, a leading Southeast Asian bank embarked on a mission to modernize its banking services for small business and corporate clients. With a focus on delivering personalized, seamless banking experiences, the bank set out to build new digital capabilities that would help them better serve business customers while driving operational efficiencies.

This transformation, powered by Backbase’s Engagement Banking Platform, allowed the bank to overhaul its traditional operations and introduce innovative omnichannel digital services. These changes positioned the bank as a leader in Southeast Asia's digital banking landscape.

Key results

+ 40%

- improvement in process efficiency

Heading

+ 246%

growth in digital banking usage

Heading

+ 42K

- users for business banking

Heading

Overcoming fragmented systems

Despite the region’s growing digital capabilities, the bank faced significant challenges in its digital transformation. Fragmented systems, siloed digital channels, inconsistent user experiences across business lines, and significant technical debt, made innovation difficult, expensive and slow.

One of the most significant barriers to progress was the use of over 12 distinct design systems across the organization, causing delays in time to market and making it difficult to standardize and innovate efficiently.

A unified omnichannel platform for business banking

To address the specific challenges of its business banking operations, the bank partnered with Backbase to unify its digital and physical channels for business customers. This transformation focused on delivering a seamless omnichannel experience tailored to the unique needs of SMEs and corporate clients, who rely on efficient cash management, loan services, and payment solutions.

The new platform leveraged reusable APIs and customer journeys, allowing the bank to streamline operations and scale services more effectively.

For example, solutions like instant and scheduled transfers, business loan payments, and advanced cash management features were developed for business banking and easily extended across other business units. This approach significantly accelerated time to market for new features and resulted in a 40% improvement in process efficiency, allowing the bank to serve its business customers much more cost-effectively.

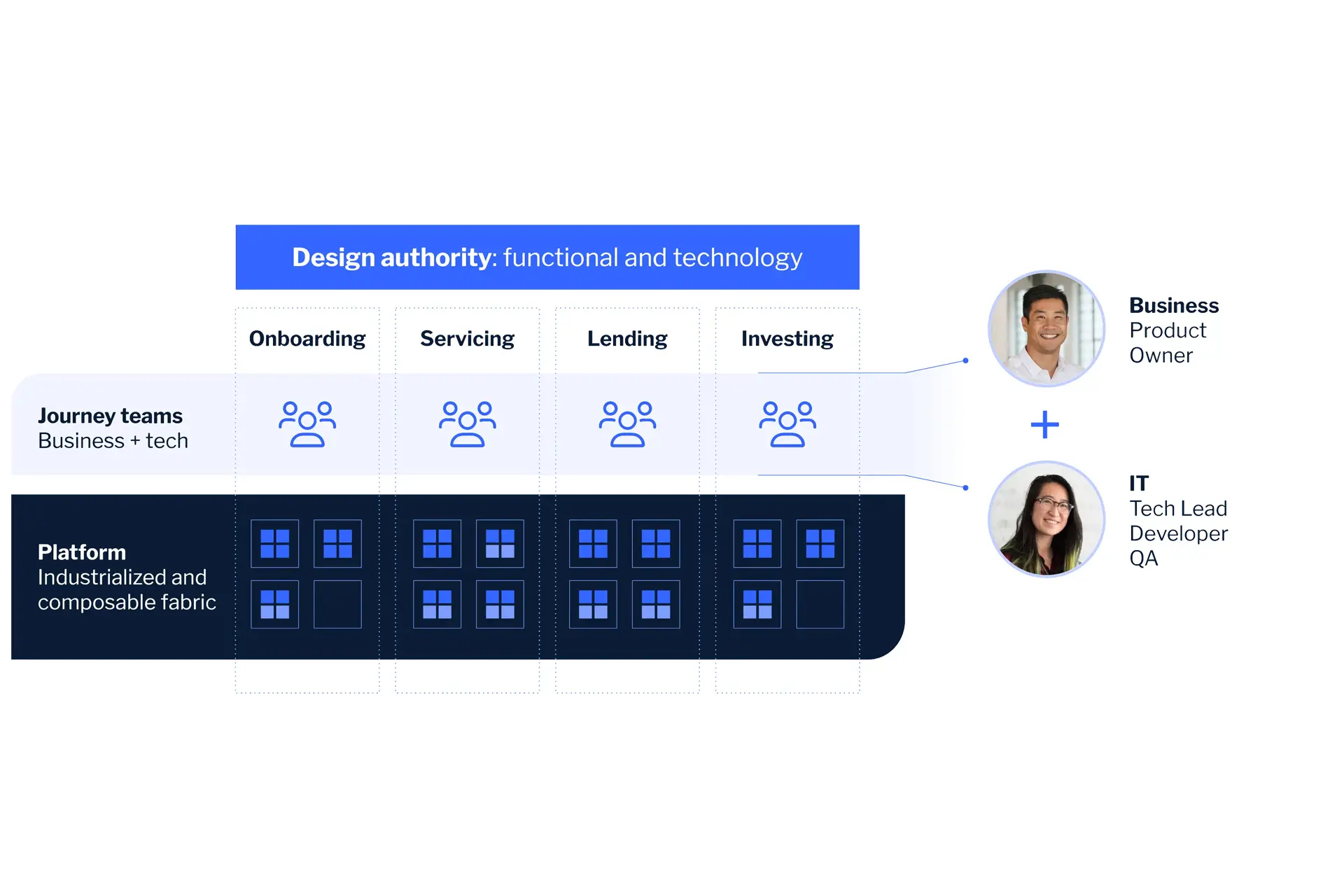

The Digital Factory: unifying Business and IT

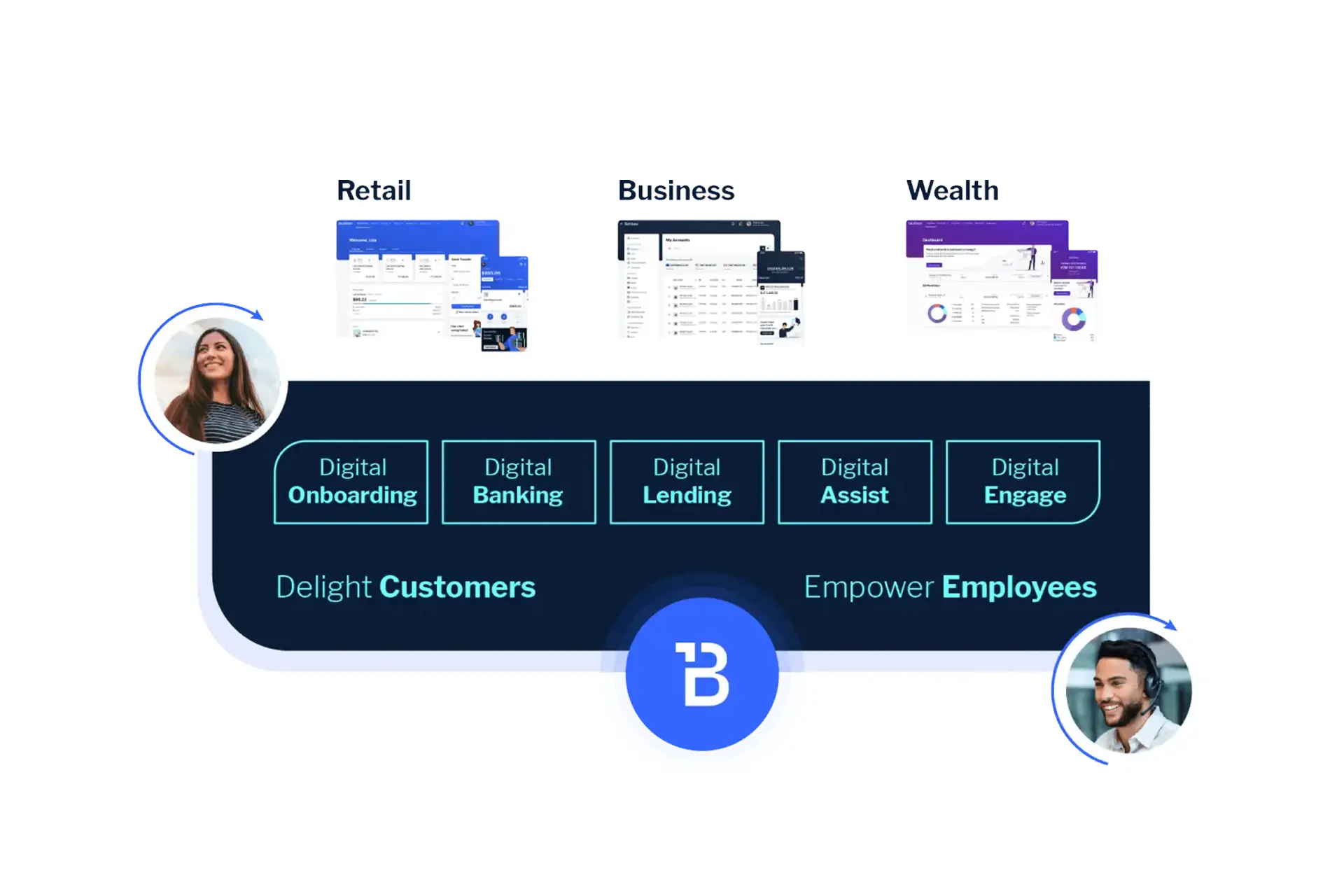

The transformation wasn’t limited to business banking or even to technology. The bank introduced a Digital Factory model—a collaboration between business and IT teams designed to streamline the development of key customer journeys across every line of business, from retail, to business banking and wealth.

Powered by Backbase’s composable platform, these blended teams re-architected vital customer functions such as onboarding, loan origination, and servicing, achieving 100% reusability on platform components. This joint effort helped the bank break down internal silos, speed up development, and ensure more personalized and consistent experiences for customers.

By adopting this unified approach, the bank was able to launch 40 new business banking customer journeys in 2023, including merchant onboarding, dynamic QR codes, and loan limit displays—all contributing to an improved customer experience for business owners.

Accelerated growth and engagement

Customer engagement skyrocketed, with 78% of domestic transactions now conducted online and 87% of customers actively using digital channels. Additionally, lending and trade finance services saw exponential growth, with bank guarantees and short-term loans growing by 100-300% monthly.

The bank’s app became a customer favorite, achieving a 4.9/5 rating on Google Play and 4.8/5 on the Apple App Store, thanks to its user-friendly interface and advanced features like customizable notifications, mobile approvals, and real-time updates.

Why Backbase?

The bank selected Backbase for its ability to support rapid, scalable innovation. The platform’s modular architecture and reusable components enabled the bank to bring new features to market in just 1.3 weeks on average, while its flexibility allowed customization to meet the bank’s specific needs.

- Unified omnichannel experience: Backbase provided the foundation for seamless customer engagement across digital and physical channels.

- Rapid innovation: The bank deployed new features at a faster pace, thanks to reusable components and APIs.

- Collaboration between teams: The Digital Factory model facilitated smoother cooperation between business and IT teams, ensuring efficient delivery of customer-centric services.

Shaping the future of digital banking in Southeast Asia

The partnership with Backbase enabled the bank to significantly improve operational efficiency, enhance customer satisfaction, and boost customer conversion rates. By leveraging a unified platform and focusing on personalized, data-driven experiences, the bank positioned itself at the forefront of the region’s digital banking revolution.

As Southeast Asia continues its rise as a digital hub, the bank’s collaboration with Backbase has set the stage for sustainable growth and innovation. By humanizing banking and delivering tailored digital experiences, the bank is well-equipped to lead the charge in Southeast Asia’s evolving financial landscape—unlocking new business opportunities, improving customer engagement, and driving the future of digital banking.

Ready to learn how Backbase can help you better serve businesses?

Backbase

Our team of experts is ready to answer your questions.

Backbase