Put the power of AI at the heart of your bank

Backbase

Break free from fragmented systems and point solutions that slow innovation and bottleneck your teams, data, and operations.

Build faster, launch smarter, scale without limits.

Grow Revenue

- Customer Segmentation

- Recommendations | NBA

- Increase Product Holdings

- Churn Prevention

Plain Text

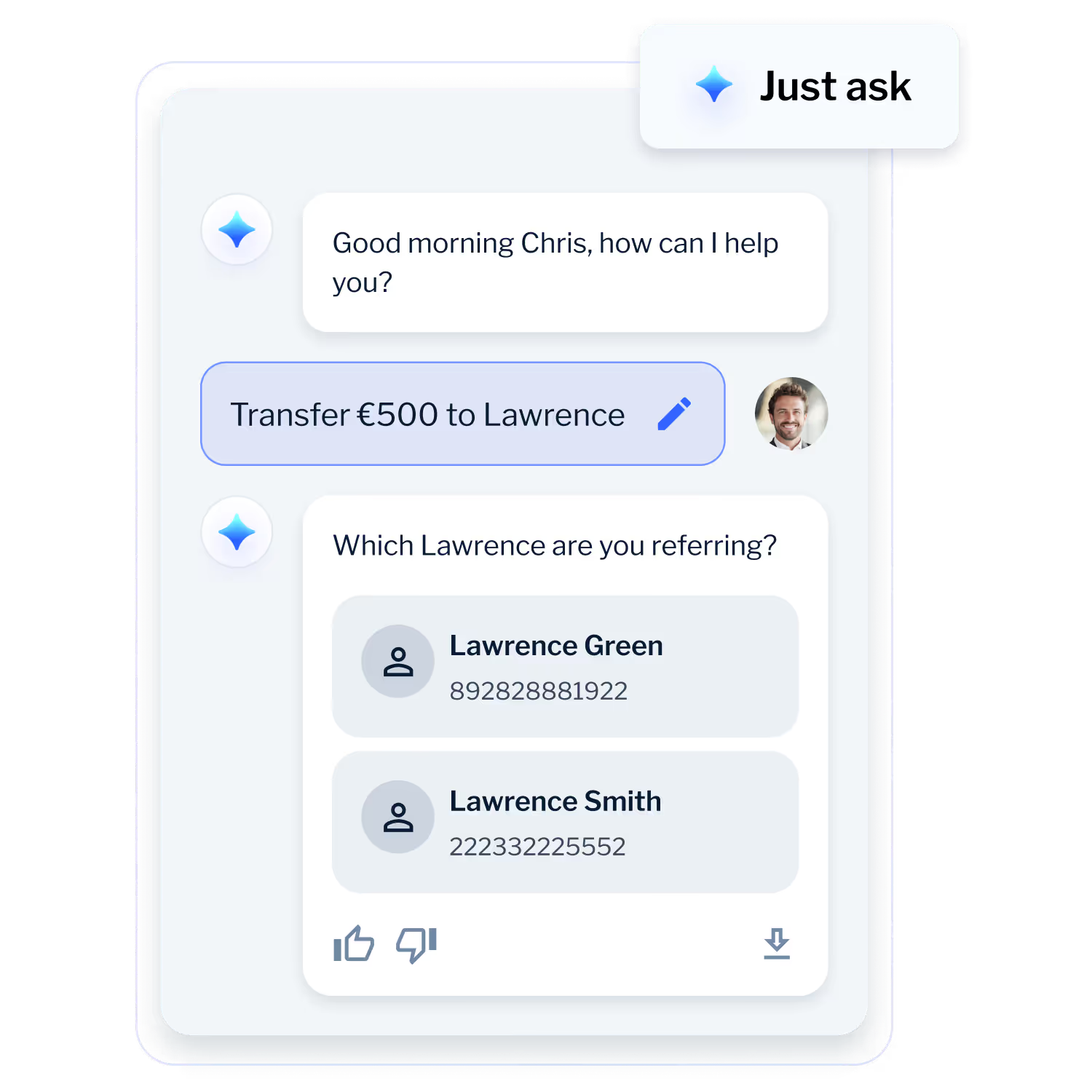

Improve Customer Experience

- Conversational banking

- Financial coaching & advice

- RM productivity

- CSR productivity

Description

Unlock Operational Efficiency

- Onboarding & Origination

- Customer Due Dilligence

- Dispute Management

- Mid & Back office productivity

Plain Text

Faster Software Development

- SDLC Agents

- Backbase Upgrade Agents

- Knowledge - Ask IO

- Legacy Modernization

Plain Text

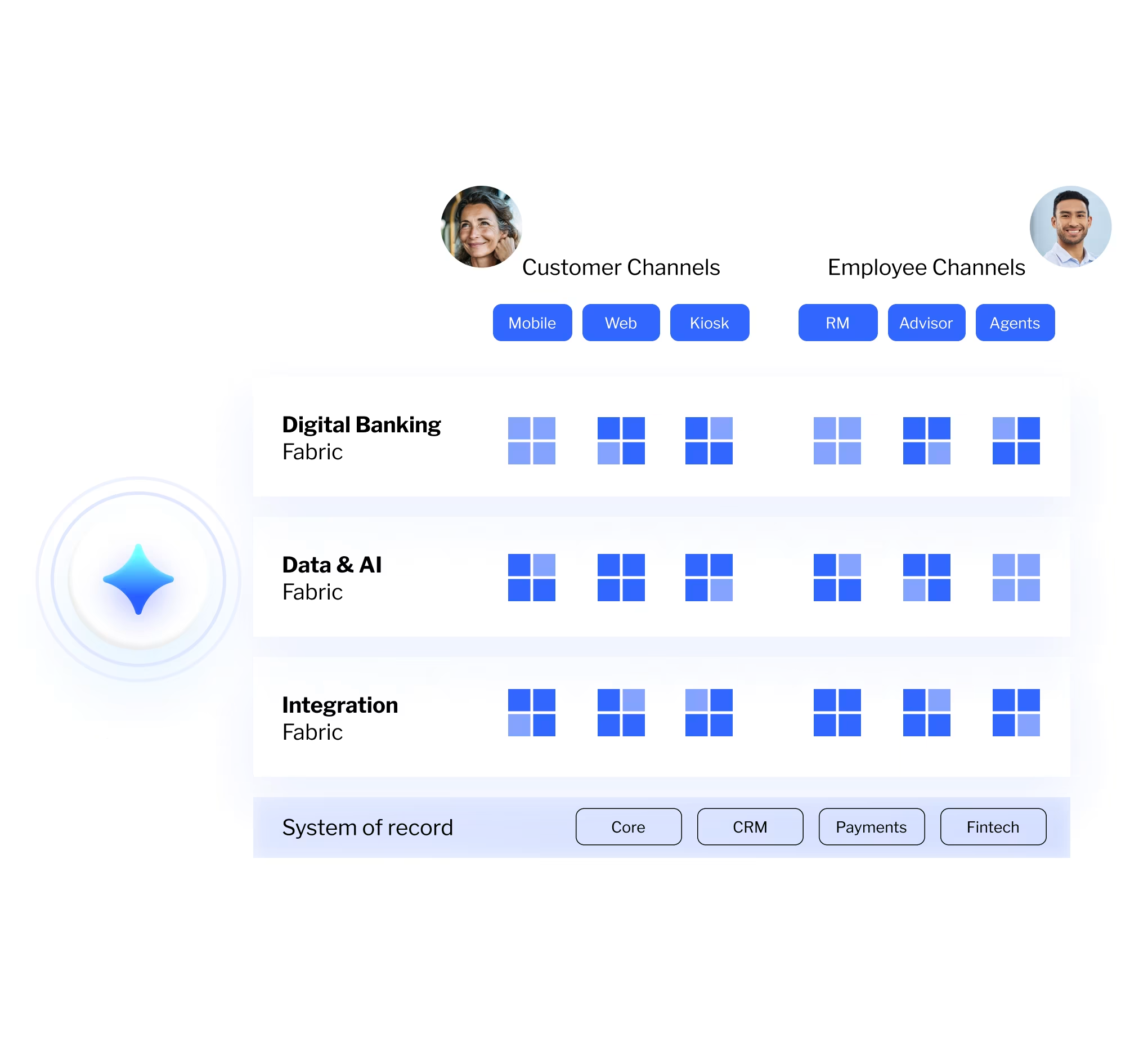

No more fragmentation, no more compromise

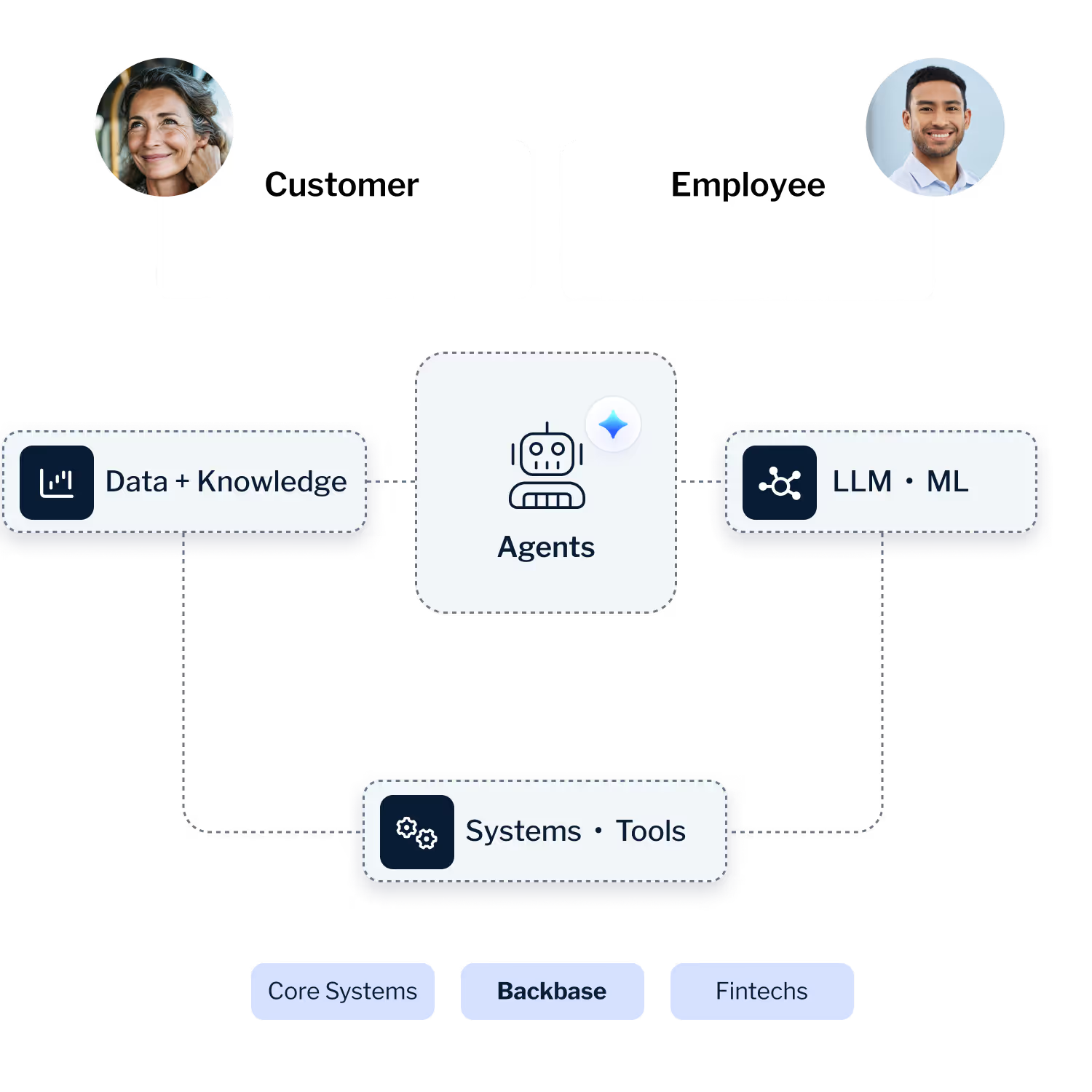

The AI-powered Banking Platform is designed to power every aspect of the banking experience - enabling banks to engage customers meaningfully, act on data-driven intelligence, and integrate with any system, faster and smarter.

Deliver a best-in-class digital experience

Heading

Modernize your bank without replacing your core. Unify experiences across every channel and deliver personalized customer journeys that exceed expectations.

Transform your data into growth

Heading

Consolidate fragmented data and power every journey with real-time intelligence. Turn insights into action, automate decisions, and deliver impact at every customer interaction.

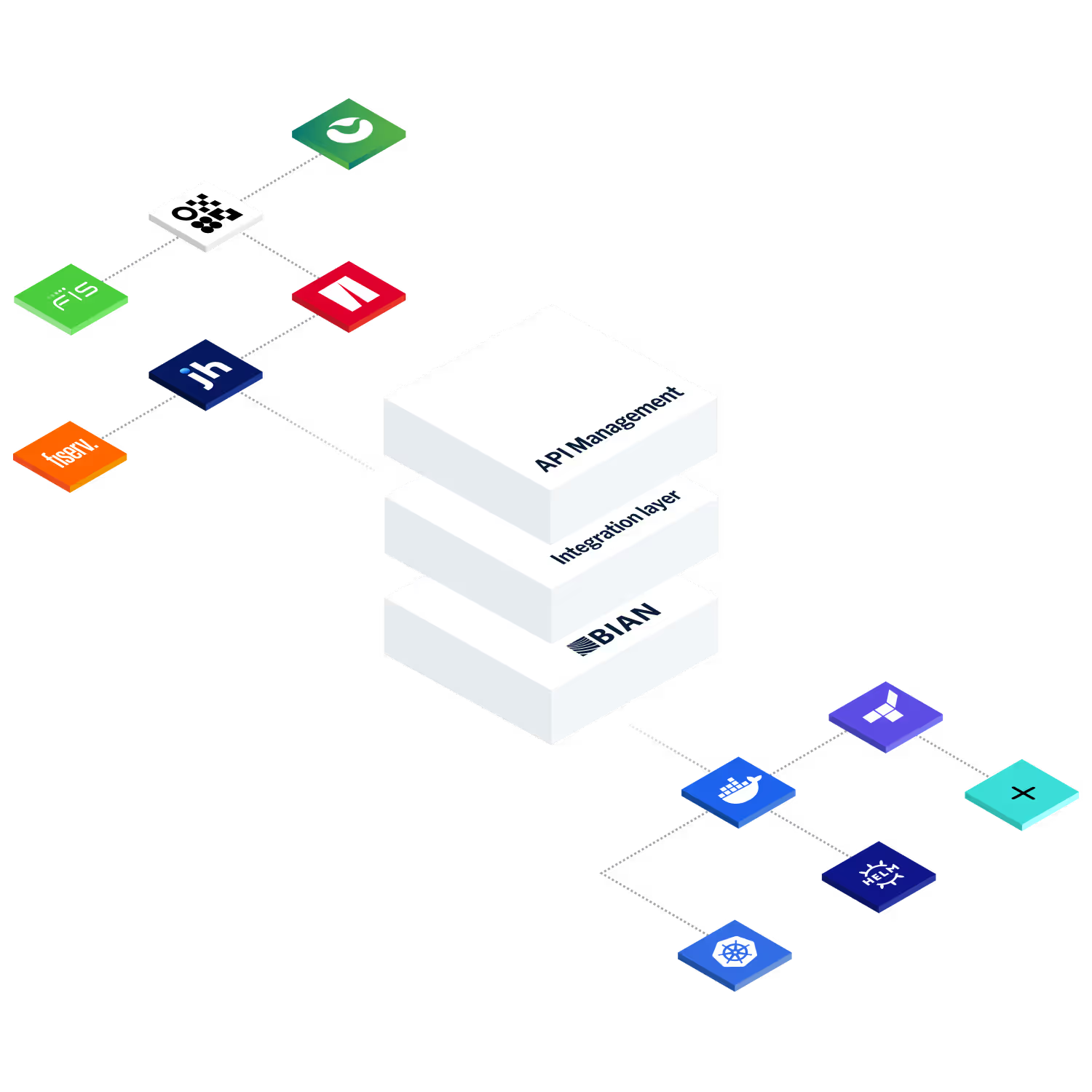

Eliminate complexity. Connect everything

Heading

Connect every system - core, CRM, fintech - through plug-and-play integrations. Reduce time-to-market with pre-built connectors and a standardized API layer.

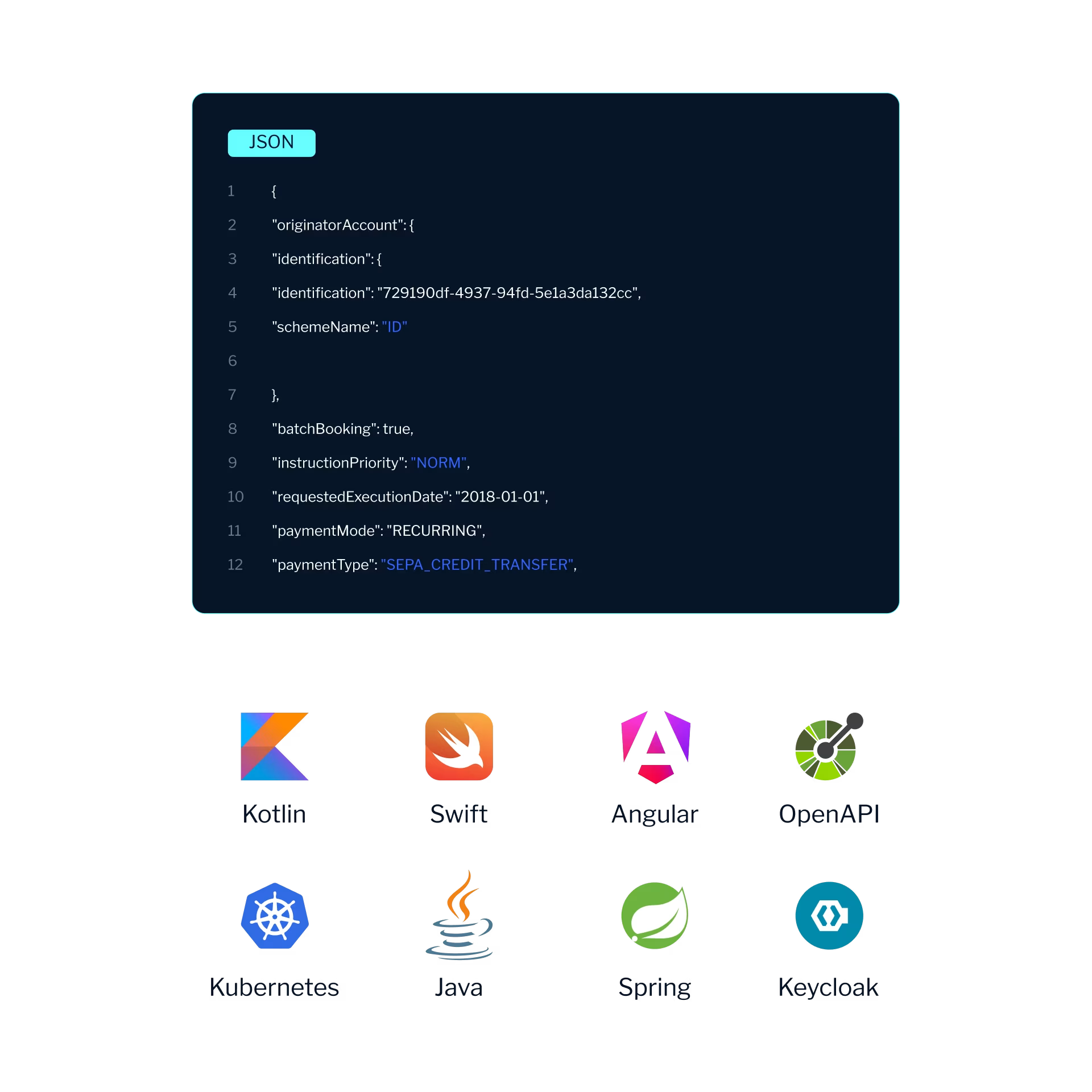

Give your developers a headstart

Built by developers, for developers. We offer detailed documentation, tools, training, and personalized support so your teams can explore, learn and outpace your competition.

Developer resources

Subline

Pre-built APIs, SDKs, and a complete design system - all documented on our DeveloperHub. Everything developers need to build fast.

AI waits for no bank. See it in action.

Let’s build something great — together.

See how the AI-powered Banking Platform helps banks move from pilots to real growth.

Schedule a call to discuss your specific needs and how we could support your ambitions.

See how the AI-powered Banking Platform helps banks move from pilots to real growth. Schedule a call to discuss your specific needs and how we could support your ambitions.