Backbase

Vietnam’s Übank the first digital bank in APAC to accelerate transformation with Backbase-as-a-Service

Delivering 50 new features in one month to enhance mobile banking app

Übank, Vietnam’s digital bank powered by VPBank, has successfully partnered with Backbase – global engagement banking platform leader – leveraging their Backbase-as-a-Service (BaaS) managed cloud service for its Engagement Banking Platform to enhance the bank’s mobile banking experiences and offerings, with the latest release of nearly 50 new features in just one month.

Übank is the first digital bank in Asia Pacific (APAC) to leverage Backbase-as-a-Service, using its Retail Banking functionalities for the bank’s digital banking app. Übank strives to be the first digital-only bank in Vietnam that provides a full range of retail banking products via its Übank mobile application. Together with Backbase, Übank’s ambition is to increase its customer base to more than 5 million by 2025.

To name a few key offerings available as a result through the mobile app upgrade:

- +3.6% interest rate on Üsuper spending account – no need to open a separate term deposit or savings account, money is instantly available for spending. +3.6% is automatically awarded for every VND which is on Üsuper account for more than 1 month

- Unlimited Cashback up to 1% for all spending on Übank MasterCard

- Loans up to 6 month salary instantly available 24/7 for Übank payroll account customers. No need for additional documents, applications, discussions with bank officers. Loan limit is awarded fully automatically, just 3 clicks under 1 minute and money is on Üsuper account

- With help of Übank instant card box, Übank can be opened anytime, anywhere in less than 5 minutes including activated and fully functional international MasterCard debit card

- Cash service available in all branches of VPBank as well as 24/7 in over 200 cash deposit machines of VPBank

As digitally savvy consumers grow increasingly comfortable with the contextualised and personalised experiences that big technology firms provide, consumers are turning to fintech companies, neobanks or mobile-only newcomers for their financial needs.

In a new study conducted by Forrester Consulting, commissioned by Backbase, 54% of Vietnamese banking consumers say it’s critical for their bank to provide them with digital money management tools. Yet 28% of banking decision-makers said their organisation had ‘no interest in’ or was ‘removing’ its digital banking offering. What’s concerning is that 74% of Vietnamese banks are unsure of how to partner with fintechs.

This presents a huge opportunity for disruptors and banks like Übank to gain a first-mover advantage.

With Backbase’s innovative Backbase-as-a-Service offering, Übank is well-poised to increase its market share in Vietnam’s burgeoning digital banking landscape, with mobile transactions expected to see a 300% increase by 2025. The collaboration will also allow Übank to get a 360-degree view of its customer banking behaviours to deliver services that matter, as well as hyperpersonalised, engaging and contextualised experiences that seamlessly connect across multiple touchpoints in their everyday lives. From the collaboration with Backbase, Übank can offer decisive advantages to Vietnamese mass and upper mass customers.

Backbase’s global expertise and innovative engagement banking platform will accelerate Übank’s mission to provide digital banking for a new generation, enabling it to stay ahead of the competition in Vietnam’s competitive digital banking environment.

Manoranjan Sahu

Chief Information Officer of Übank

We’re excited to transform Übank’s digital banking app, unleashing the potential of its engagement banking platform. By strengthening its digital banking offerings with Backbase’s market-leading solutions, Übank will deliver superior value to customers with fast turnaround time, conversational banking, and personalisation at scale, which are the top three factors driving customer loyalty in the region.

Abhijit Chavan

Regional Vice President, Customer Success for Asia Pacific at Backbase

Übank’s first-mover advantage as the first digital bank in Vietnam has positioned it for significant growth as a result of rapid changes in consumer behaviours and expectations. By leveraging our BaaS managed cloud platform service, Übank will continue to develop innovative solutions as well as a scalable banking infrastructure, driving deeper customer engagements through personalised banking experiences.

Jeroen Brusker

Senior Vice President, Global Customer Success at Backbase

About Übank by VPBank

Übank by VPBank is the digital bank application with the mission “Bank less. Get more.” – aiming at providing all banking products and services conveniently through one mobile application. Hence, customers can reduce lengthy procedures and enjoy more benefits at their fingertips: automatic high-yield saving account, unlimited cashback, zero-fee services, instant loan, etc. To know more about Übank, please visit: https://ubank.vn/

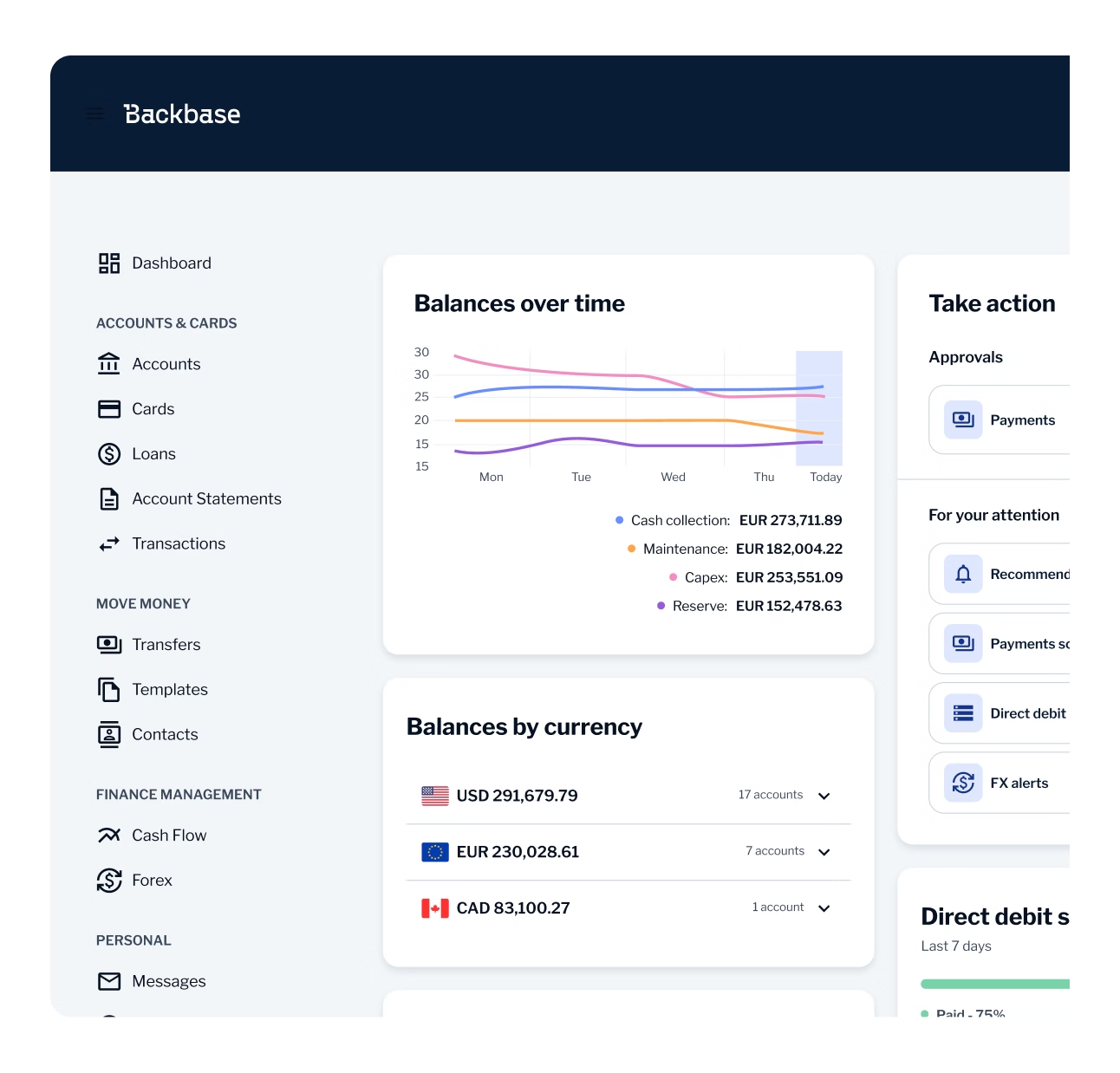

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.