Be The Preferred Next-gen Bank For Thailand’s Mass Affluent Investors

Backbase

From Gen Y to Baby Boomers, mass affluent in Thailand are actively investing to better prepare for life events and life moments. Banks who can be lightning fast to deliver on evolving digital investing needs have a significant opportunity to boost revenue, growth, and ROE.

What are the expectations of Thailand’s mass affluent investors

The Backbase Thailand ConsumerPulse Report 2024: Strategies to win the hearts of Thailand’s mass affluent surveyed 606 active Thai wealth investors.

While there is high market penetration for wealth investment in Thailand, majority of investors are dissatisfied with their current bank’s wealth management services. Not only are investors ready to switch to another bank to pursue their ongoing investments, more than two-thirds of active investors are prepared to grow their level of investments in the next 3 years.

Backbase ConsumerPulse Findings:

Thailand wealth management landscape

1. Low satisfaction with primary bank for wealth management

High majority of active Thai investors are dissatisfied with their current bank. There is huge opportunities for banks to gain preference with the mass affluent.

2. The triggers behind switching banks for mass affluent

Mass affluent investors prioritize lower fees, advanced digital investing platforms, and availability of customer service—key areas where banks can strengthen engagement and drive loyalty.

[Chart question: Top reasons to switch from primary bank for wealth management]

3. The big shift from traditional to digital self-serve needs

Thai investors are growing in independence and digital savviness, resulting in consumer needs shifting from traditional to digital self-service.

[Chart question: Which of the following would likely motivate you to increase your current investment level?]

Expectations for wealth management center on hygiene fundamentals—easy, secure transactions, and deeper insights within mainstream portfolios like mutual funds, annuities, and stocks. Thai mass affluent investors are clearly motivated to increase their investments, with a major shift toward self-serve digital investing.

4. Digital investing priorities

Top 5 functionality that is most important in self-serve digital investing platform?

Top 5 investments which respondents are most comfortable self-servicing through digital investing

Thai mass affluent investors are clearly motivated to increase their investments, with a major shift toward self-serve digital investing. Thai banks that can swiftly deliver these capabilities through robust end-to-end wealth management and hybrid digital investing platforms will capture the mindshare and preference of local mass affluent investors.

5. Phenomenal growth and ROE by getting digital investing right

71% of active Thai investors want to grow wealth investments in the next 3 years

[Chart question: In addition to your current investments, how much investment dollars are you willing to put in the next 3 years?]

Tap into the Potential of Trillions with Less Than 1% Investment

USD109,200

Average investment per person

Heading

USD4.058 Trillion

Forecasted investment in next 3 years, only active investors above 25 years old

Heading

USD5-10M

Digital wealth platform investment

Heading

∞

Return on Equity (ROE)

Heading

Investor-Centric Architecture for Next-Gen Digital Investing

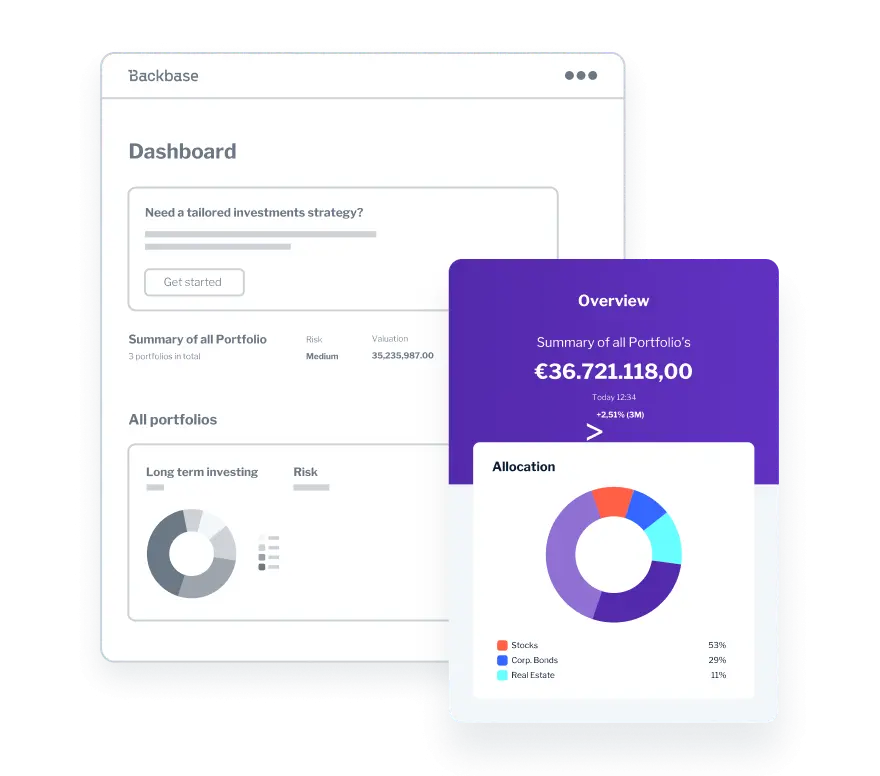

Digital investing at your fingertips

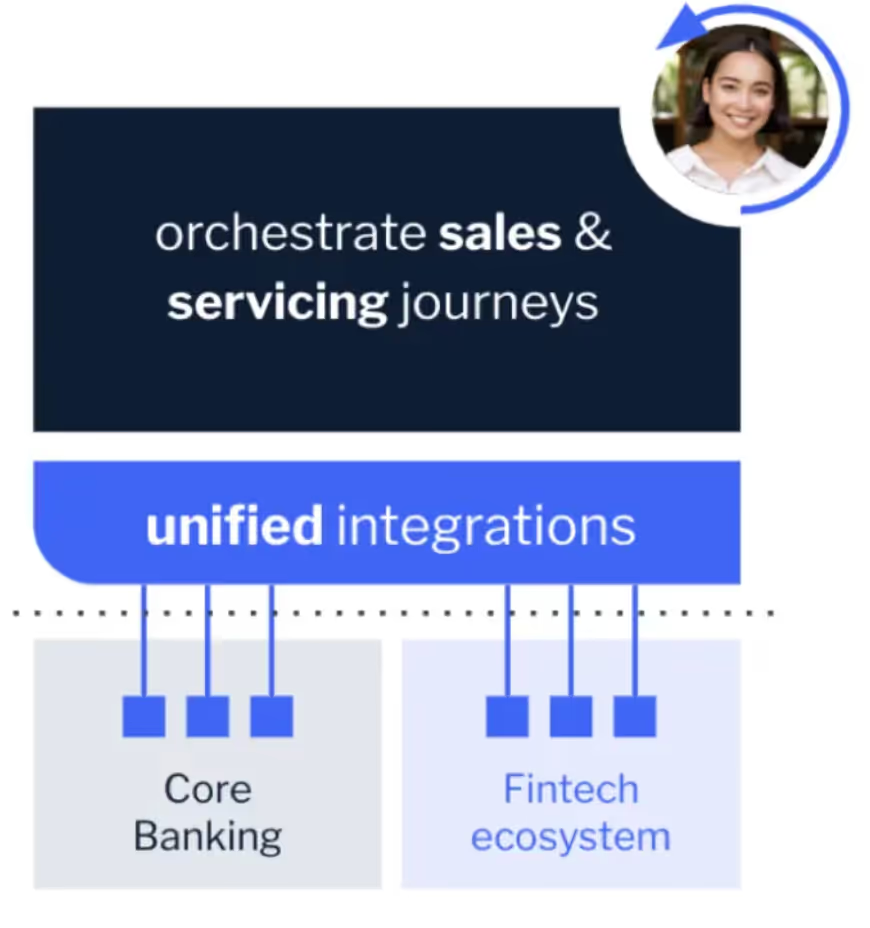

The key to winning the hearts of the next generation of mass affluent customers is to offer a digital investing and wealth management that achieves the right combination of digital and personal.

With the Backbase Engagement Banking Platform, you can combine digital convenience with a human touch and empower your investors with the right tools and easily connect them to a self-service digital investing platform, the bank’s customer service and hybrid advisory. All of it would be through one single platform with ready-to-go apps that you can build on top of.

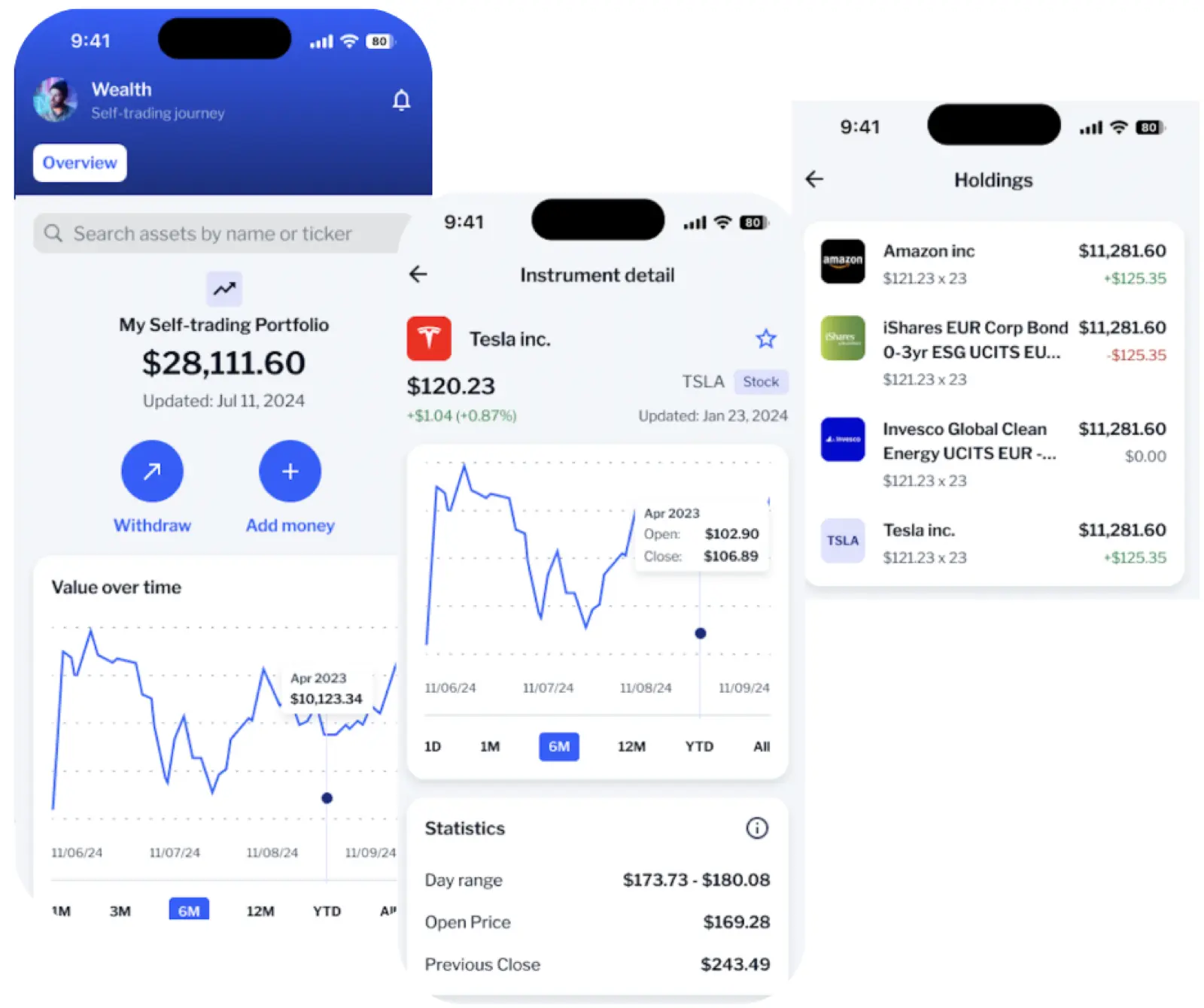

Self-serve investing

From market analytics to portfolio selection. On-demand investing

With the rising demand for self-serve digital investing, the Backbase Engagement Banking Platform enables banks to offer secure, easily accessible portfolios—such as stocks, mutual funds, and bonds—along with real-time market analysis. The platform delivers a seamless self-service investing experience, integrating retail banking and wealth management for a unified view of customer investments and banking

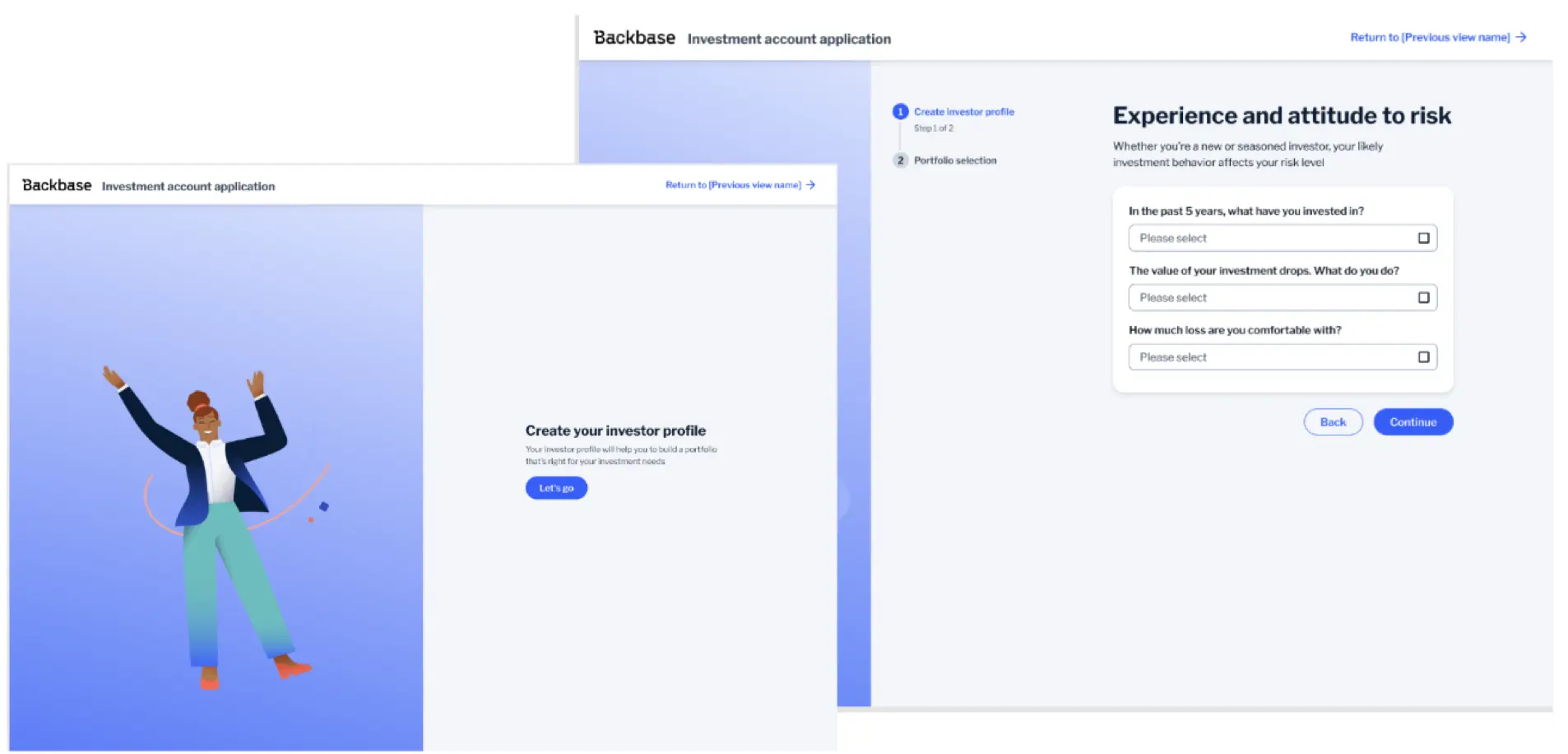

Risk assessment

Personalized risk profiling

To enable new investors to confidently begin investing, the Backbase Engagement Banking Platform provides users with repeatable self-assessments to determine their risk tolerance, ensuring that portfolio selections align with their individual risk appetites.

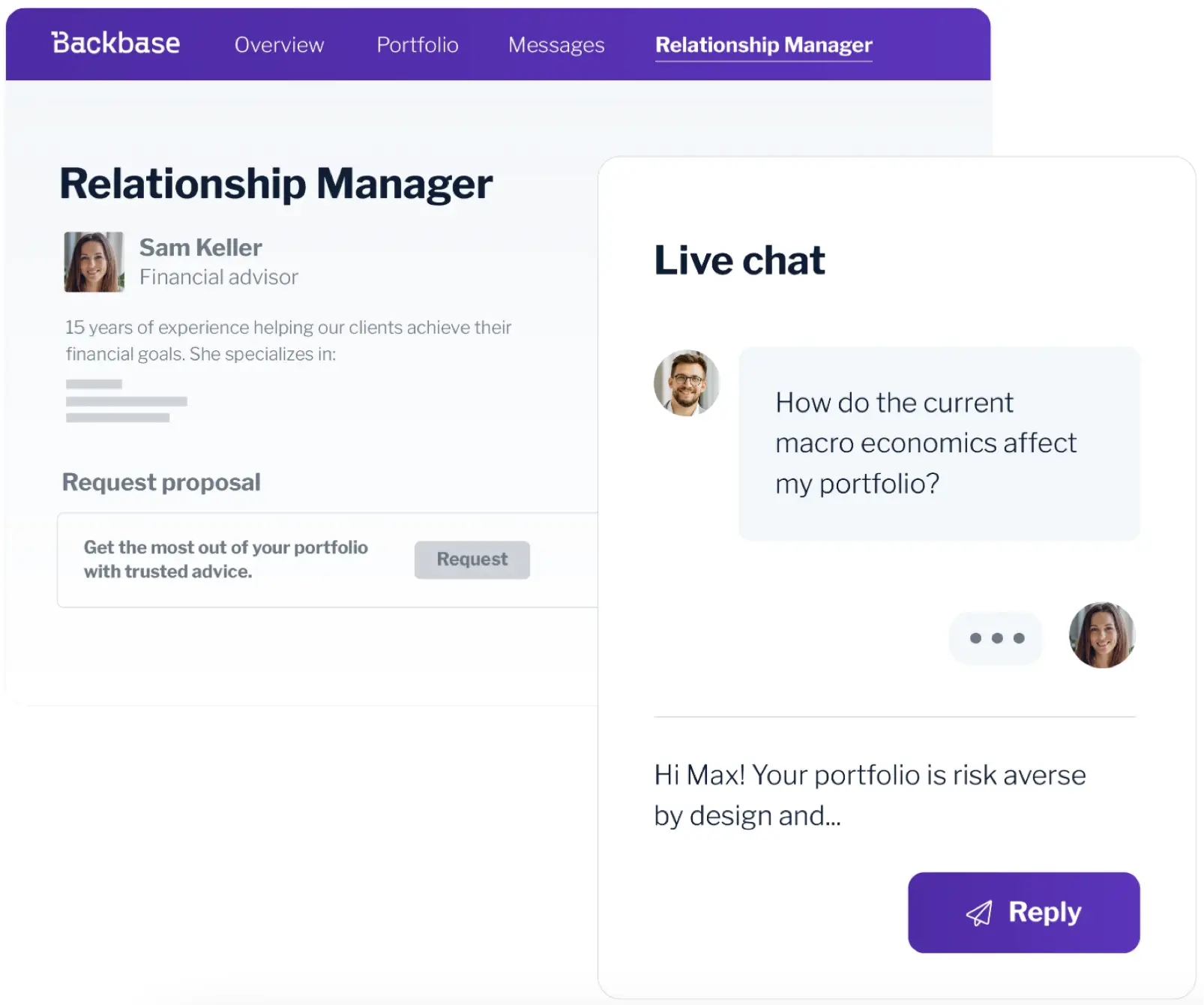

Hybrid advisory

Advisory and support services. At your fingertips

Mass affluent investors value self-service but also seek expert advice when needed. The Backbase Engagement Banking Platform combines self-serve investing with the power of a relationship-manager-led advisory experience, enabling seamless transitions between independent investing and personalized guidance to modernize wealth management

Tailored solutions

Offer tailored investing products to meet diversified needs

Build tailored products for a variety of customer sub-segments with solutions that help them achieve their financial goals, based on their personal needs and maturity levels.

Backbase offers fully automated and compliant investment product journeys for self-directed trading, as well as both robo advisory and hybrid advisory wealth management.

Quick Go-To-Market

Up your game with minimal disruption

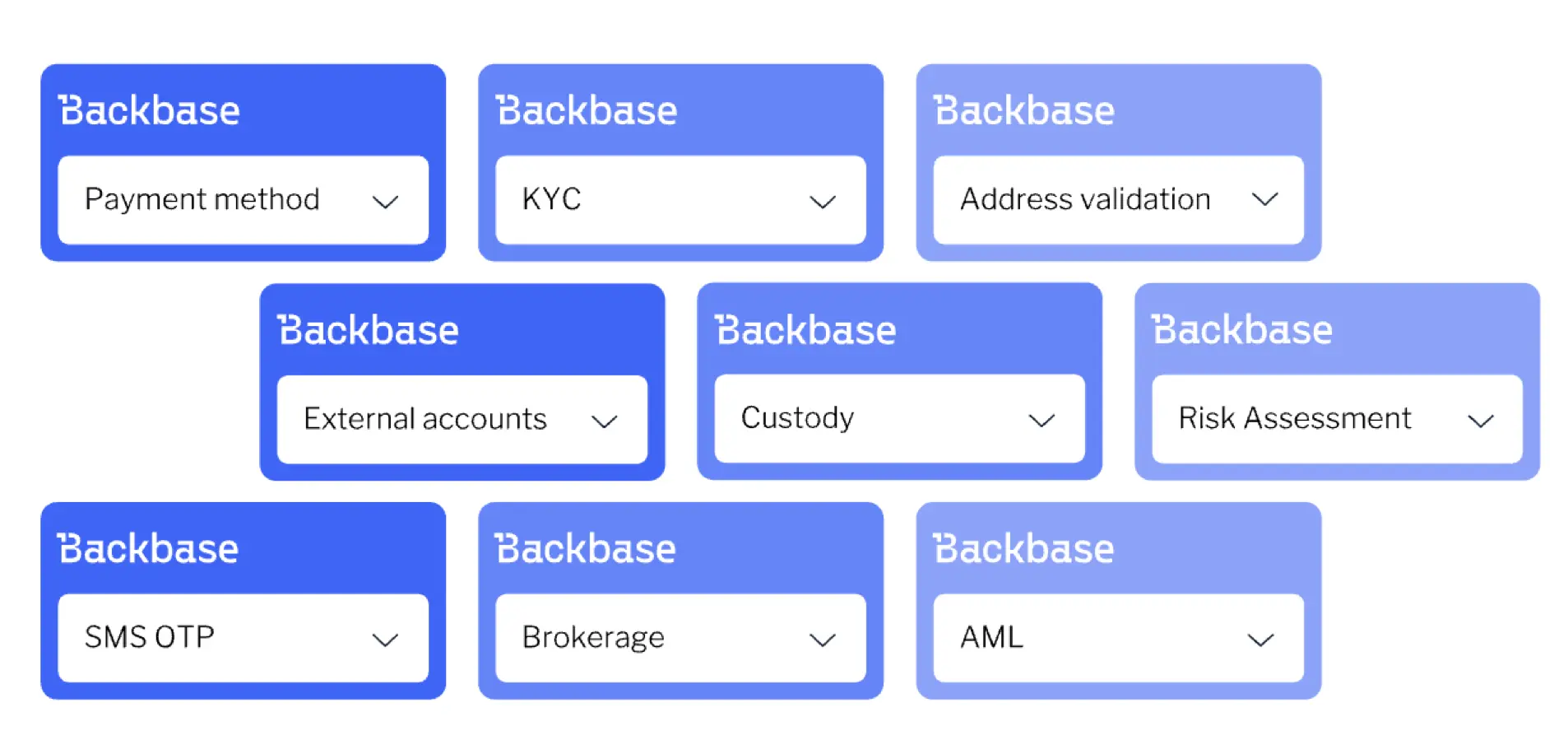

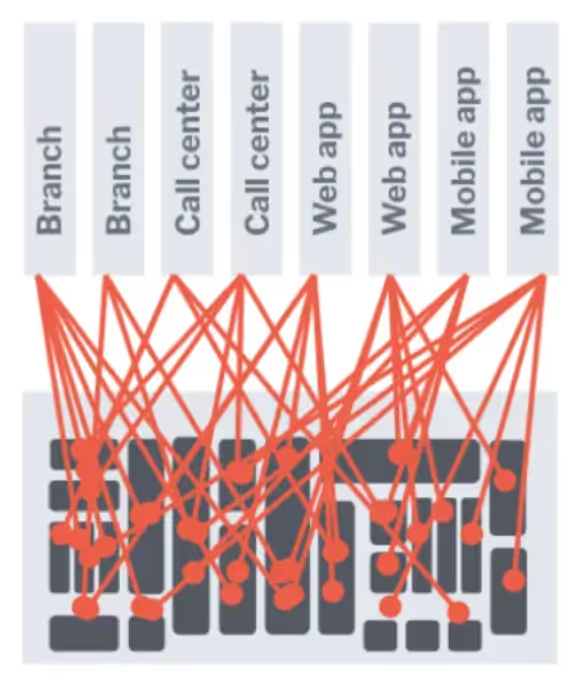

The Backbase modular and configurable platform can sit on top of your existing wealth infrastructure to leverage existing tech stacks, APIs, and partnerships.

From custody and brokerage providers to risk assessment solutions to identity and data verification offerings, you get access to a vibrant ecosystem of top-notch solutions within the safety of the Backbase Engagement Banking Platform.

Turn your wealth management architecture to be investor focussed

Create an experience that sets you apart. No vendor lock-in. No one size fits all. The Backbase Engagement Banking Platform gives you all the tools and components to design and build truly differentiated user experiences.

Adopt functionalities on the platform, apply the style that suits your brand, and build on top of our platform and apps. You can have it all.

Book a demo

Take the lead for wealth management and digital investing. Be the preferred next-gen bank for Thailand’s mass affluent investors.