Introduction

High-net-worth and ultra-high-net-worth individuals today expect a different caliber of service: one that combines timeless relationship management with modern digital sophistication. Across industries, digital experiences are instant, intuitive, and personal — and private banking is being measured against that same benchmark.

This means clients are no longer comparing banks solely to one another. Their expectations are shaped by every premium service they use. They’re expecting entire journeys, from onboarding to lending and portfolio management, to feel effortless. Not because they need additional convenience, but because convenience is now part of what defines quality.

This shift is placing pressure on traditional service models. Private banks that once competed on exclusivity and reputation are finding that these alone no longer differentiate. A truly premium experience must combine deep personal relationships with digital access that feels just as tailored and responsive.

Cost-income ratios (CIRs) further underscore the challenge. With averages hovering between 75% and 85% — 10-15% higher than retail counterparts — many private banks are struggling to generate sustainable margins. Even in Luxembourg, where CIRs fell to 63.4% in 2023, profitability improvements remain fragile, especially as interest income growth (the main driver of this success) slows.

The economic reality: a model under pressure

The universal private banking model, characterized by enduring client relationships and a broad suite of services, is being tested by economic and structural constraints. Operating costs remain stubbornly high.

Meeting modern client needs through technology and personalization

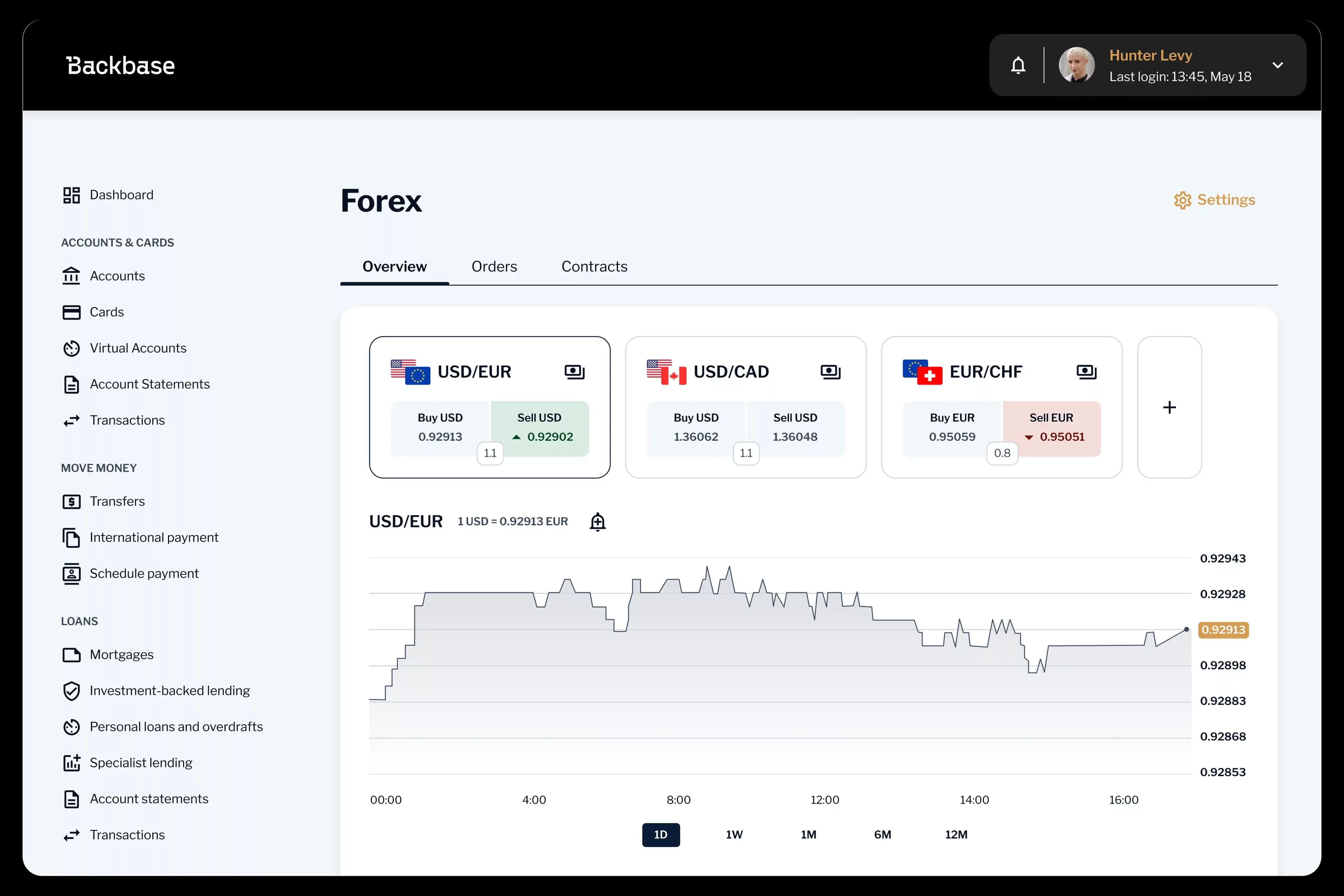

It’s important to highlight that clients are not just asking about digital functionality. Being used to a certain level of ease in the luxury services they use, they are also evaluating banks on how their digital experiences feel. Real-time dashboards, mobile transaction capabilities, contextual alerts, and intelligent engagement then become expectations across wealth holders, especially younger generations.

Technology is key to meeting these expectations at scale. Artificial intelligence is expected to play a central role in 2025 and beyond, not only to improve fraud detection and identity verification, but to enable personalized engagement. AI is increasingly being deployed to summarize client interactions, generate actionable insights, and support financial planning. These enhancements reduce workload for relationship managers while increasing the precision of advice.

Meanwhile, private banks continue to rely heavily on advisory and asset management fees, which account for approximately 65% of total net income. This dependency highlights the need to protect and grow these core services, making client loyalty, scale, and operational agility more critical than ever.

Clients who receive tailored financial advice are, on average, 10 basis points more profitable, exhibit 16% longer tenure, and increase their assets under management by up to 25%, as noted by EY. And when it matters most, 85% of clients say they want personal, advice-led guidance.

Premium banking services, delivered with speed and flexibility

The future lies in a model that brings together diverse services into one intelligent, unified experience. This means offering a full suite of premium products in one place — from daily banking to specialist lending — with journeys that are not only fast and compliant, but truly tailored to each client.

Streamlining credit and lending services

Premium banking begins with the fundamentals: credit that is not just accessible but easy to manage. That means digitizing the full lifecycle of credit products, from investment-backed loans and mortgages to overdrafts. With built-in automation and case management, banks can remove delays and manual processes, turning complex lending needs into smooth, guided journeys.

Serving complex, global client structures

For clients with international footprints or family office setups, banking should simplify — not compound — their complexity. This requires flexible account configurations that support multi-entity structures, cross-border transactions, and multi-currency operations. When this level of complexity is handled with clarity, clients experience their banking as cohesive and responsive to their needs.

Enabling intelligent, real-time client servicing

Clients expect to remain informed and in control at every stage. Whether they’re reviewing a term deposit, monitoring a credit line, or managing liquidity, the experience must offer full visibility. With smart notifications, real-time data, and intuitive digital access, private banks can foster a sense of proactive partnership, ensuring that even intricate portfolios feel easy to navigate.

Providing premium banking, without compromise

At every level, premium banking must meet high expectations with precision. Whether clients are reviewing a term deposit, managing liquidity across multiple accounts, or requesting a bespoke credit facility, the experience must be fast, secure, and tailored.

Banks that consolidate daily banking, credit origination, and international servicing into one intelligent experience can turn complexity into clarity. From smart notifications to self-service features, every capability should reinforce a sense of control, transparency, and trust.

Backbase makes this possible with a single platform purpose-built for private banking. Pre-integrated capabilities, from multi-currency account management to automated lending journeys, remove operational friction and unify client and advisor experiences. With configurable modules and AI-powered engagement tools, banks can quickly adapt to evolving client needs while staying true to their service promise.