Introduction

Digital transformation and banking modernization — in recent years, these have become two of the industry’s most popular buzzwords. Unfortunately, during this rise to prominence, many bankers have gotten the terms confused, leading to a few misunderstandings about these somewhat interchangeable concepts.

Before we dive into the two key differences between them, here’s the big-picture definitions, just to set the scene. Digital transformation, per IBM, is “the act of integrating digital technologies and strategies to optimize operations and enhance personalized experiences,” fundamentally altering how you operate and deliver value to your customers. And while that may be a big ask, it’s an imperative these days, as a successful digital transformation can help you slash your cost-to-income ratios, boost customer acquisition and retention rates, and improve your time to market.

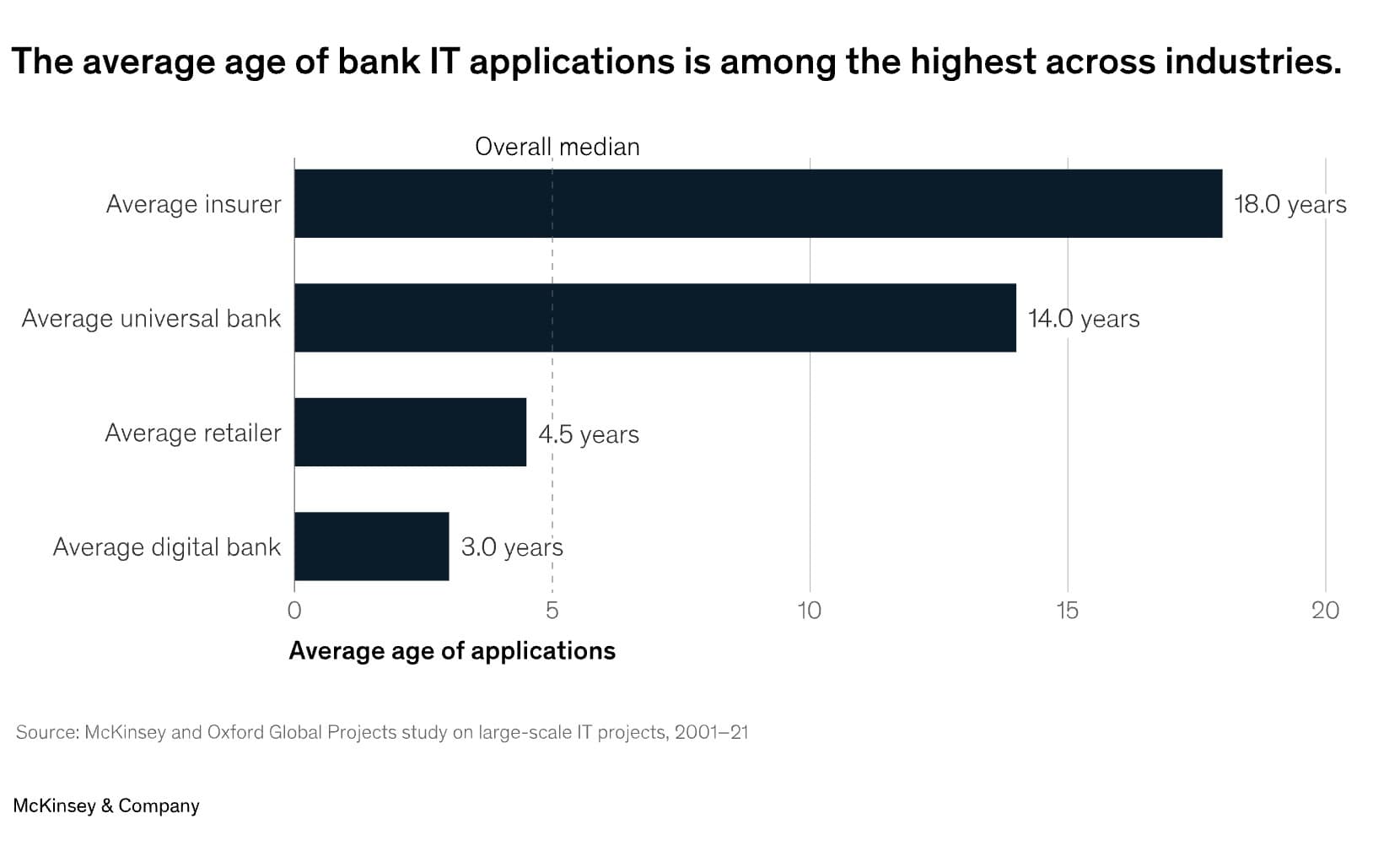

On the other hand, banking modernization refers to the ways through which your bank updates and improves its existing systems, infrastructure, and processes, allowing you to enhance operational efficiency, improve existing processes, and reduce costs. And while this does make it more tech-focused than a digital transformation, it’s no less important. After all, with legacy systems in place, it’s all but impossible to compete in a crowded market, let alone deliver real customer value. And to make matters worse, banks are lagging behind compared to other industries when it comes to modernization, as you can see in the McKinsey chart below.

But let’s dive in and further demonstrate the differences between the two concepts.

1. Digital transformation involves so much more than tech

To put it simply, digital transformation is an immense undertaking — a total re-evaluation of your bank’s operating model, culture, and more. It’s all about finding the best way to use tech in order to enable a new, improved way of working, business-wide. Rather than a project, digital transformation is a cross-functional endeavor that requires the involvement of every individual and team in your bank, from the CEO to front-office staff. And although this may make the process seem daunting, we assure you, it’s an essential part of remaining relevant in modern banking.

On the other hand, while banking modernization is also quite a long, intense process, it's strictly focused on overhauling your bank’s legacy systems, point solutions, and operational silos so you can better support your customers and empower your employees. It’s largely tech-specific and leverages incremental changes to update and improve your existing systems and ways of working, without fundamentally changing the way your bank operates. During this process, you’ll need to consider upgrading to a platform model, for instance, which will allow you to reduce costs, improve performance, and ensure regulatory compliance.

As you can see, these two concepts are absolutely related, but remain sufficiently distinct. And here’s another key difference: the duration of the journey.

2. Digital transformation is a never-ending process

At the risk of making digital transformation sound more intimidating still, it’s truly a process that does not end. It’s not a project you can knock out in a few years and then turn your back on. Rather, it’s an ongoing, constant analysis of the way your bank operates and creates value, then finding progressively better ways to improve by using digital tech. As you know, the banking sector is ever-evolving, meaning there’s no finish line for digital transformation. And we may be mixing metaphors here, but once you reach the proposed “end” of your digital transformation journey, you’ll realize the goalposts have been moved, meaning you have no choice but to keep improving and innovating. But don’t look at this as a burden, it’s actually an opportunity, a chance to find new ways to better serve your customers.

Conversely, modernization is absolutely something you can achieve in three to five years, if you have the right operating model and strategic partner. Of course, that doesn’t mean it’s a “one-and-done” affair, as you’ll certainly need to conduct multiple modernizations during the lifetime of your bank, but these can be projects with concrete starts, middles, and ends. That makes it more achievable, but don’t forget that it’s also a difficult process that involves a lot of hard work — not to mention a full reconstruction of your systems, from core banking to integrations and everything in between. But like digital transformation, it’s also a crucial part of future-proofing your bank for the years to come.

3 approaches to banking modernization

Now that we’ve cleared that up, it’s finally time for us to get into the “nitty-gritty” of things — helping your bank select an approach for modernization. In the following blog, we’ll give you a bit of background about the three most common approaches — namely big bang, greenfield, and progressive modernization — and then we can do a deep-dive on the best option for the average bank after that.

For more information, check out our Banking Reinvented podcast, where Backbase Founder/CEO Jouk Pleiter dissects similar topics alongside Tim Rutten, EVP/Chief of Staff, and other digital leaders. Stay tuned as they chat about everything from progressive modernization to decomposing your bank’s complexity.