Introduction

Corporate treasuries are under more pressure than ever. They need instant visibility into balances, transactions, and liquidity to make fast, confident decisions. Still, many banks are still delivering reports as delayed, fragmented batch files, leaving clients to manually reconcile data across formats, regions, and systems.

The stakes are high. Deloitte’s 2025 banking outlook warns of tightening margins and modernization imperatives, while AFP surveys show real-time visibility and automation remain top treasury priorities.

And with ISO 20022 deadlines looming, banks must transition away from legacy MT94x reporting to new CAMT standards or risk losing ground to competitors.

Information reporting has moved from being a back-office requirement to a front-line driver of trust, efficiency, and growth. The banks that get this right will not only meet compliance obligations but also strengthen client relationships in an increasingly competitive landscape.

The strategic power of data transparency in banking

Shifts in client expectations, regulatory frameworks, and data strategy are redefining what “good” looks like. The following three trends explain why banks must think of reporting as a cornerstone of competitiveness:

Managing complexity

The regulatory environment is in flux. ISO 20022 is becoming the global standard, with camt.052, .053, and .054 reports leading the way. At the same time, clients still require legacy formats like BAI2 or MT940. Serving multiple standards simultaneously requires flexible, future-ready reporting stacks.

Turning data into intelligence

Commercial banks hold a wealth of transaction data. But without structure and accessibility, it’s just noise. Reporting is evolving into a strategic function: integrating with ERP/TMS systems, standardizing data mapping, and enabling analytics that drive faster and smarter liquidity decisions.

Meeting client expectations

Treasury teams now operate in always-on, 24/7 environments. They expect to see balances update as payments move, spot anomalies as they occur, and act on accurate information without delay. When banks can’t deliver that immediacy, corporates look to competitors who can.

The 7 capabilities every bank needs now

To deliver against today’s demands, banks should benchmark their solutions against seven gold-standard capabilities:

1. Multi-format support

Banks must serve both machine-readable formats (camt, BAI2, MT) and human-readable formats (PDF, CSV, OFX). Flexibility across standards ensures commercial clients can integrate into their diverse environments without trouble.

2. Intra-day balance & activity

Clients should see balances and major transactions in near real-time, with alerts on anomalies or exceptions. This reduces reconciliation delays and supports proactive liquidity management.

3. Scheduling & templates

Treasury teams shouldn’t waste time recreating reports. They should be able to save templates, define delivery schedules (daily, weekly, monthly), and receive reports securely via their chosen channel.

4. Entitlements-aware delivery

Security is about encryption, but also precision. Role-based permissions, audit trails, and entitlements-aligned delivery ensure the right people see the right data, every time.

5. Cross-account search & filtering

For commercial clients managing multiple entities, the ability to search and filter across accounts, geographies, and transaction types is essential. This becomes even more powerful when combined with intra-day updates.

6. Standardized data mapping

Consistency is key for ERP/TMS integration. Banks must use uniform transaction codes and map legacy data into modern standards, reducing friction and custom work for clients.

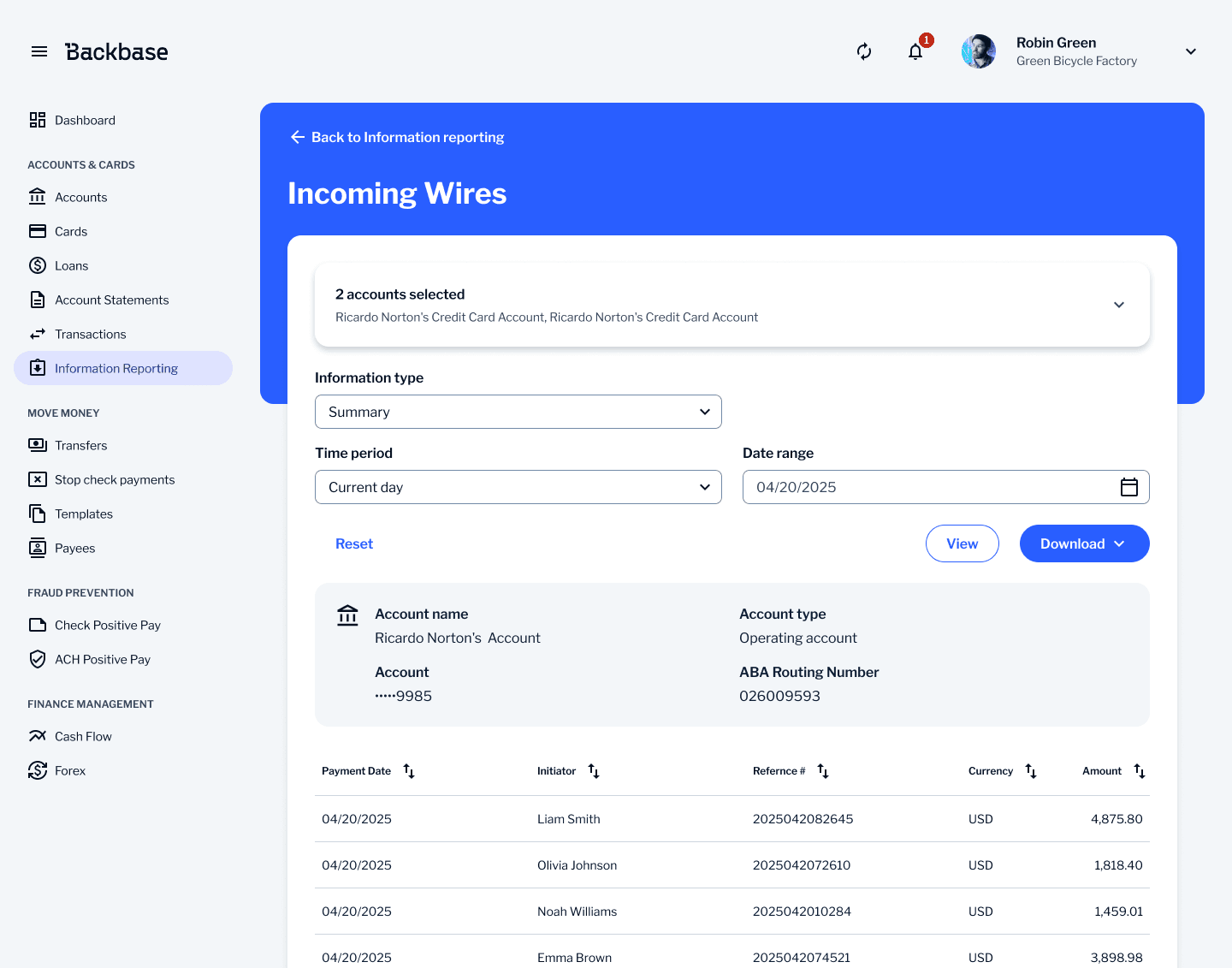

7. Embedded access in digital channels

Reporting should live inside the bank’s digital channels — not as an afterthought, but as an integrated, intuitive feature in web and mobile banking portals. Clients expect seamless, self-service access.

How banks can move forward

Modernization doesn’t have to be a massive overhaul from day one. Banks can make meaningful progress by tackling reporting in stages, focusing on practical wins that bring immediate value to clients while laying the groundwork for long-term transformation. That means:

1. Stabilize formats

Start by aligning with ISO 20022 timelines. Confirm adoption schedules with correspondent banks and develop a clear plan to exit MT coexistence. Standardizing on CAMT formats not only meets regulatory obligations but also positions banks to serve clients with richer, more consistent data.

2. Reduce latency

Move beyond end-of-day files by piloting intra-day balance and activity reports. Add event-driven notifications for exceptions such as ACH returns, notices of change, or incoming wires. Providing treasurers with timely updates helps them act on risks and opportunities as they emerge.

3. Automate workflows

Empower treasury teams with templates and scheduling tools that eliminate manual cycles. Instead of pulling and formatting reports repeatedly, users can define their preferred parameters once and receive updates automatically (daily, weekly, or monthly) delivered through secure, pre-agreed channels.

4. Tighten access

Reinforce trust by making delivery entitlements-aware. Role-based permissions, audit trails, and secure channels (in-app, SFTP, encrypted email) ensure that sensitive financial information only reaches authorized users. This not only strengthens compliance but also gives clients confidence in the bank’s security posture.

Together, these steps help banks reduce operational risk, simplify reconciliation, and create a better client experience — without waiting for a full-scale system transformation.

Future-proofing reporting

The reporting landscape will continue to evolve, and banks that treat modernization as a one-time compliance exercise will quickly fall behind. The next wave of innovation is already taking shape:

- AI-driven anomaly detection will flag unusual activity the moment it occurs, reducing fraud and operational risk.

- Predictive insights will move reporting from historical snapshots to forward-looking guidance, helping treasurers forecast liquidity and manage cash with greater accuracy.

- API-first delivery will let corporate clients pull reporting data directly into their ERP and TMS systems, cutting out manual reformatting and reducing errors.

- Natural language interactions powered by AI/LLM capabilities will allow users to ask questions directly of their data, making it easier to uncover insights, explore results, and drill down for deeper understanding without technical complexity.

These innovations won’t arrive all at once. But banks that invest today in strong data foundations, flexible architectures, and multi-format capabilities will be best positioned to adopt them seamlessly in the future.

Closing the data gap with Backbase

For years, fragmented data and slow, batch-driven reporting left treasuries operating in the dark. Backbase has reimagined this challenge by consolidating data from multiple sources into intelligent, structured outputs — delivered faster, more accurately, and embedded directly in banks’ digital channels.

Backbase enables banks to access real-time and historical reporting, generate multi-format exports such as CSV, BAI2, PDF, and OFX, and take advantage of user-defined templates, scheduling, and entitlements-aware delivery.Looking ahead, expanded export capabilities, composable multi-cloud reporting, predictive analytics, and agentic AI for treasury operations are on the horizon.

With the data challenge finally solved, reporting can move from a burden to a breakthrough, empowering banks to deliver the clarity clients expect now while opening the door to AI-powered insights and next-generation treasury intelligence.