Introduction

Private banking is entering a new phase, one defined not by access or exclusivity alone, but by a client’s expectation for continuity, context, and control across every dimension of their financial lives.

Today’s HNW individuals and families want their financial institutions to understand their broader needs: planning, lending, liquidity, lifestyle, and legacy. And they want that understanding delivered consistently across digital and human channels.

Meeting these expectations requires rethinking how private banks design and deliver value. Increasingly, that means embracing holistic wealth as the foundation of the client experience.

A structural change in wealth management

Across private banking markets, client expectations may have shifted more significantly in the past five years than in the two decades before them.

A significant 55% of HNWIs now value robust digital channel capabilities when choosing a private bank or wealth manager. That presents serious challenges, including meeting the demand for digitized services and providing a wider range of sophisticated advice.

Clients require comprehensive guidance beyond investments, encompassing wealth planning, legal, tax, inheritance, and philanthropic expertise, necessitating private banks to adapt their offerings and operational models to deliver holistic, client-centric solutions at scale.

While digital channels are seen as essential for a modern customer experience, some banks still lack these capabilities, indicating the need for continued investment in technology and operational efficiency to meet these diverse client needs.

Where private banks struggle

Discretion remains critical. But clients now expect that discretion to extend across mobile dashboards, instant RM access, and the ability to manage complex portfolios and legal structures with ease.

This is a marked departure from the engagement model that many firms still rely on. And it’s putting pressure on banks to reconsider how they organize their propositions, enable their RMs, and integrate their technology. Current challenges include:

- Service fragmentation, with clients navigating disjointed tools and teams to manage different elements of their finances.

- Inadequate digital interfaces, which fail to reflect the sophistication clients experience in other parts of their lives.

- Manual RM workflows, which reduce both responsiveness and time spent on strategic engagement.

How to move forward? Defining a holistic wealth proposition

A holistic approach to wealth management does not mean offering every service in every channel. It means integrating core elements — banking, investing, lending, planning — into a coherent, unified experience that reflects a client’s financial reality. That includes:

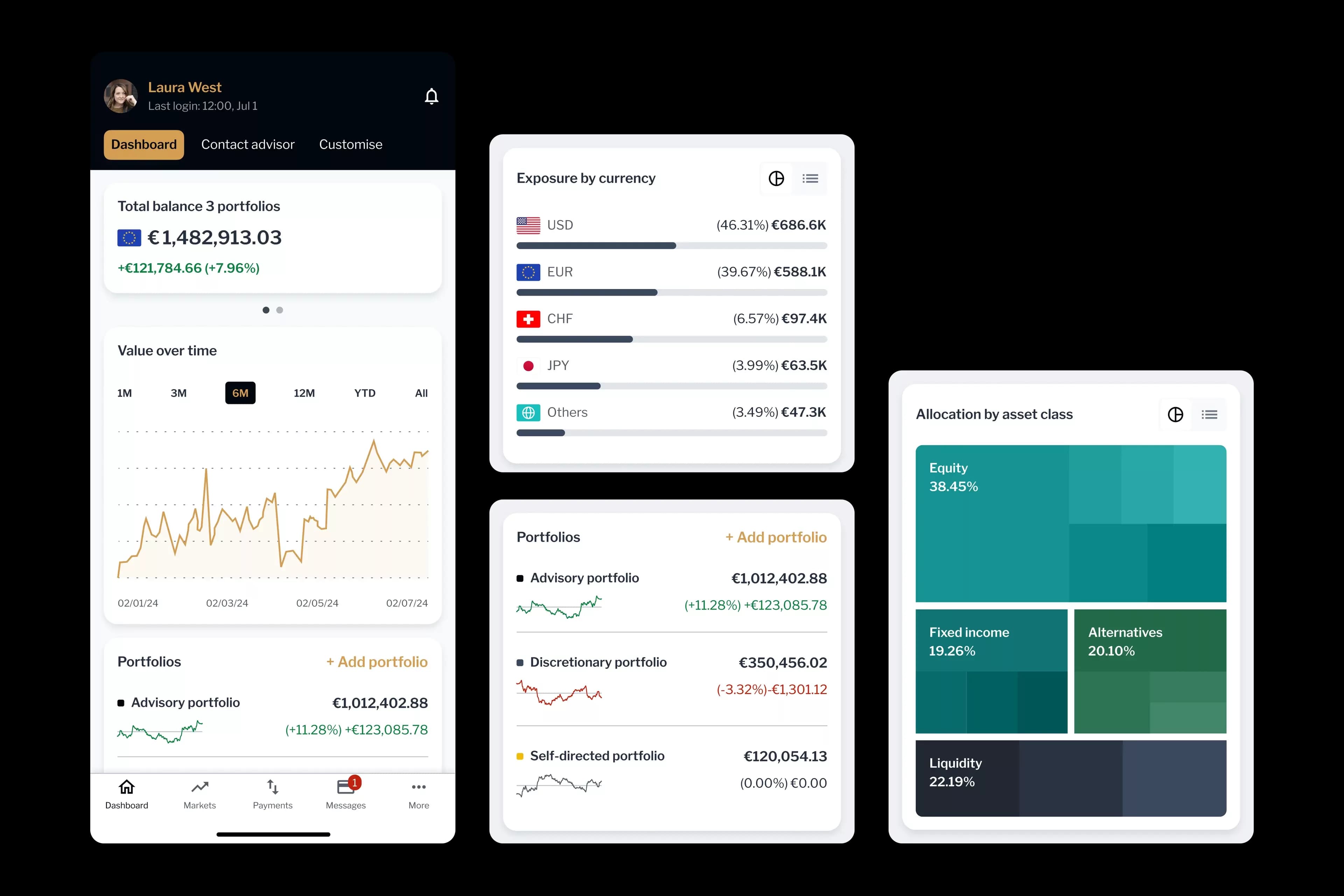

1. A unified financial view across the client’s full balance sheet

For many private clients, wealth is anything but centralized. Holdings are spread across multiple custodians, accounts, asset classes, and legal structures. Add to this the reality of international banking needs, complex family arrangements, and alternative assets, and the result is often a fractured picture that even the most experienced client struggles to navigate.

A holistic proposition requires that banks take responsibility for restoring clarity. That means building infrastructure that consolidates and contextualizes financial data across internal systems and third-party sources to offer a real-time, comprehensive view of a client’s total wealth.

Clients should be able to explore how changes in one area, such as a refinancing event or asset sale, affect their broader financial strategy. And relationship managers, in turn, should have access to the same information to provide relevant, well-timed guidance. This shared clarity forms the baseline for trust, and it lays the groundwork for more meaningful engagement over time.

2. Embedding digitally supported wealth planning into the core relationship

Private clients don’t segment their financial lives the way banks do. Wealth planning, lending, and investment decisions are deeply interconnected, yet many banks treat these areas as separate functions.

This is why planning should be embedded directly into the client experience — through digital tools for scenario modeling, multi-entity structuring, and goal tracking, as well as secure collaboration spaces where clients, relationship managers, and third-party advisors can work together on planning outcomes.

Importantly, these journeys must be designed to accommodate complexity without introducing friction. For UHNW clients, that may mean accommodating a foundation, a family business, and a multigenerational trust structure in a single planning environment.

a multigenerational trust structure in a single planning environment.

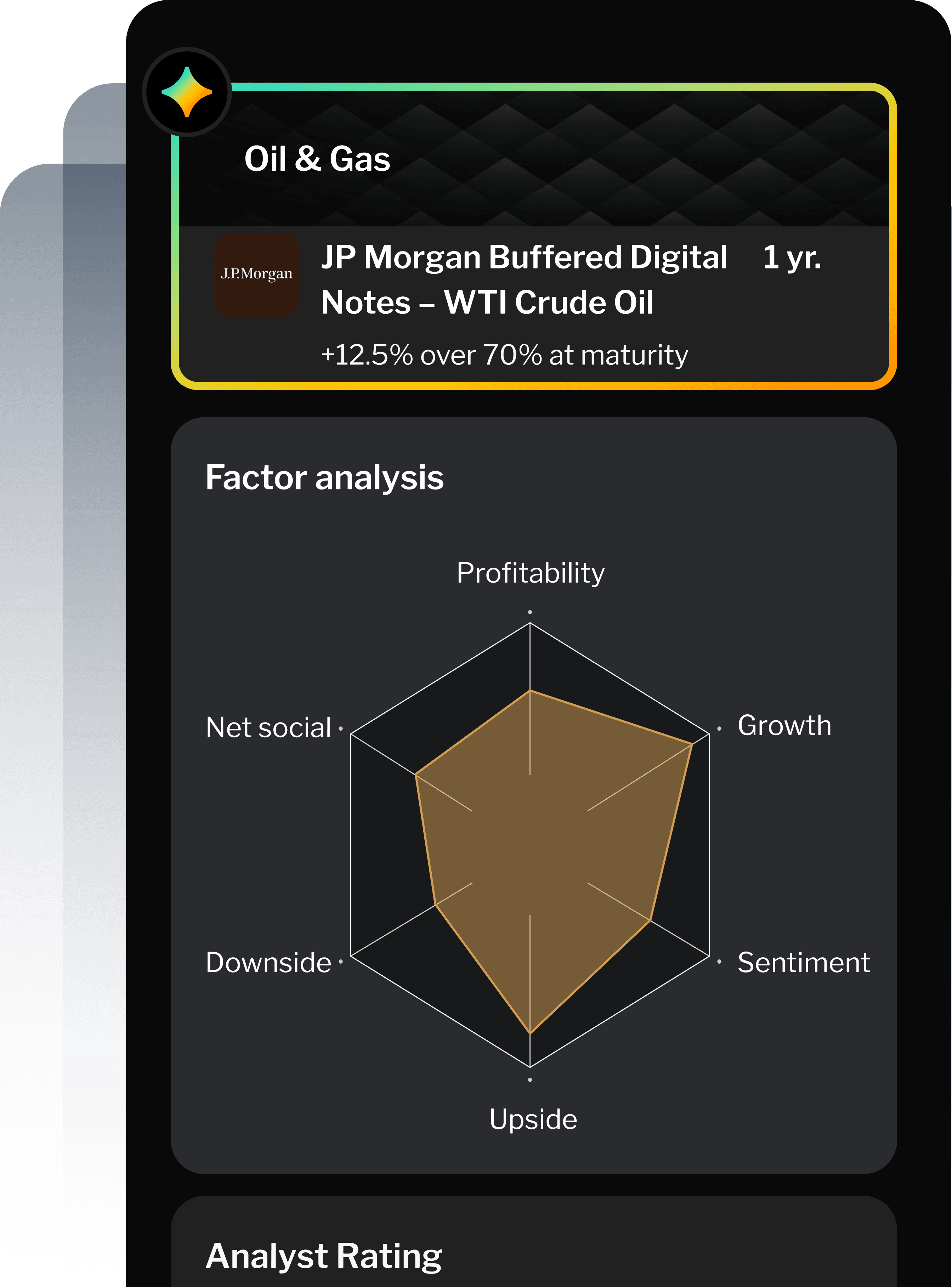

3. Turning insight into action: enabling proactive, AI-powered engagement

Even with clear visibility and structured planning, clients expect their bank to take initiative. They want their RMs to anticipate needs, highlight risks, and provide well-timed, relevant recommendations.

This is where digital enablement makes the difference. With AI-powered alerts and embedded nudges, RMs can be notified when a client’s liquidity falls below a threshold, when portfolios drift out of alignment, or when a regulatory milestone approaches.

The impact is twofold: clients receive timely, personalized support; and RMs spend more time building relationships, not managing processes. This shift from reactive service to proactive engagement strengthens loyalty, and positions the bank as a trusted, strategic partner in the client’s financial life.

Delivering holistic wealth management with purpose

Crucially, a holistic proposition is about ensuring that each service contributes meaningfully to the overall relationship, rather than simply expanding scope, and that it is delivered in a way that reinforces trust, control, and transparency.

For banks, that means moving beyond product-centric engagement and toward experiences that reflect the full complexity of each client’s financial life. It means designing journeys that blend digital convenience with expert guidance, and equipping relationship managers to operate not as intermediaries, but as strategic partners.

Backbase helps private banks realize this vision. As the AI-powered banking platform, we empower institutions to bring intelligence into every interaction — supporting relationship managers, simplifying complexity, and delivering the kind of modern private banking experience high-net-worth clients expect.