Backbase

Backbase partners with Microsoft to re-architect banking around the customer

Backbase Engagement Banking Platform on Microsoft Cloud for Financial Services enables true customer centricity

Backbase, the global Engagement Banking Platform provider, today announced its global collaboration with Microsoft to help financial institutions move into the Engagement Banking Era with the first fully integrated financial services cloud stack. The collaboration, which sees Backbase’s Engagement Banking Platform serving in the engagement layer within Microsoft Cloud for Financial Services, helps financial institutions re-architect banking around their customers and accelerate their digital transformation.

In order to re-architect banking around the customer, financial institutions must simultaneously modernize several layers of legacy technology and operations. The combined value proposition of Backbase’s Engagement Banking Platform on Microsoft Cloud for Financial Services offers a complete industrialized stack of pre-integrated capabilities that address banks’ critical requirements for effectively executing their digital transformation:

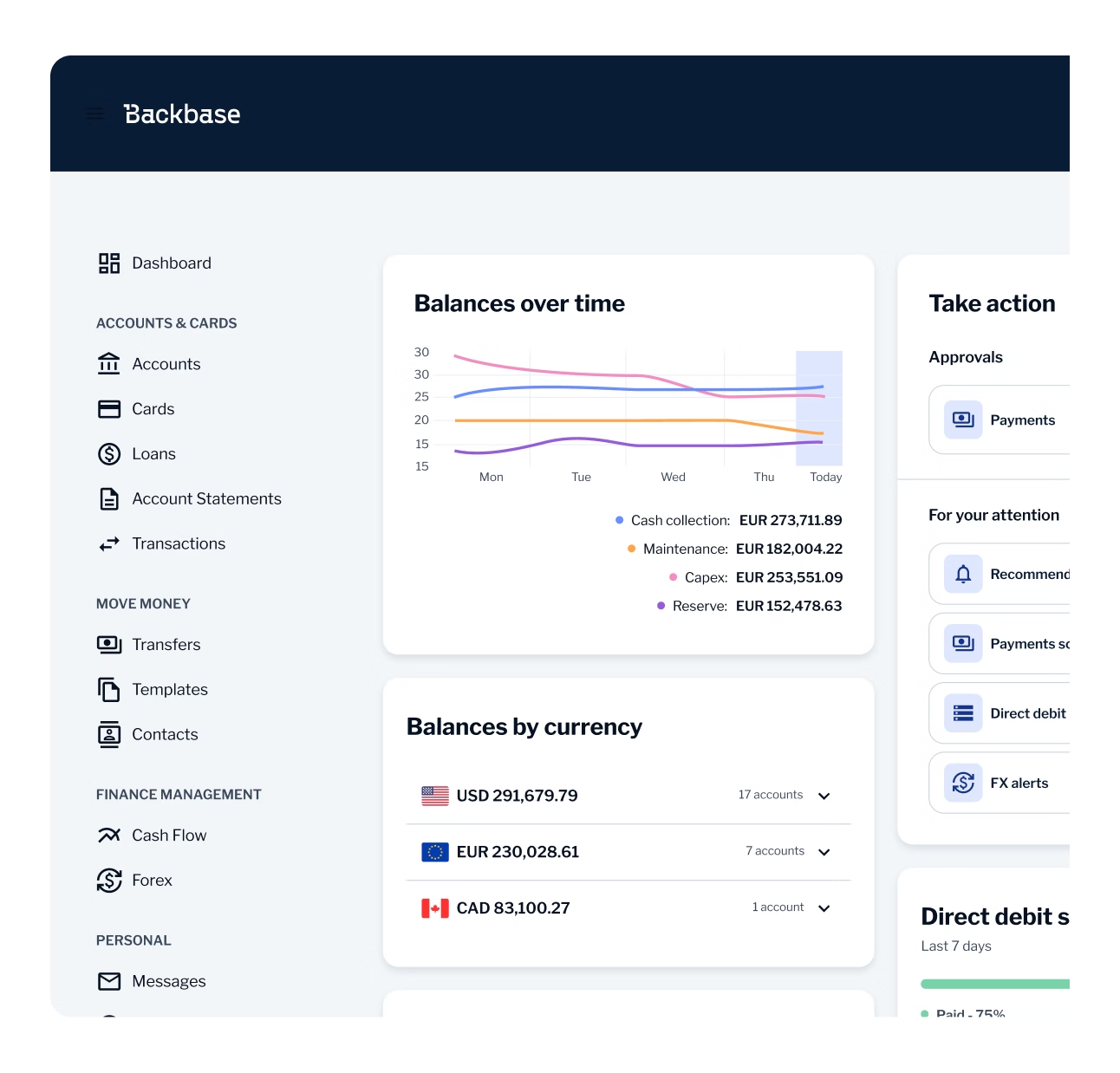

- Customer Engagement Layer — The system of engagement that powers seamless customer journeys, from customer onboarding to managing day to day finances. At this level, the Backbase Engagement Banking Platform brings the customer-facing element, breaking down channel silos, providing a single orchestration hub to streamline any customer journey across every digital touchpoint.

- Employee Productivity & Banking Processing Layer — On the employee productivity side, Microsoft brings its widely used business applications such as Microsoft Dynamics 365, Power Platform and Microsoft 365, including Teams, that offer seamless interoperability with the Backbase Engagement Banking Platform. On the banking processing side, the Backbase Marketplace offers out-of-the-box connectors to leading core banking providers and best-of-breed fintech fulfillment partners.

- Cloud Infrastructure Layer — The cloud infrastructure is responsible for providing all the advanced cloud computing capabilities running the full stack in a scalable, secure and compliant manner. Microsoft leads this element with its Microsoft Azure cloud computing platform, with Backbase’s Engagement Banking Platform fully using the underlying Azure capabilities.

This collaboration is a demonstration of Microsoft’s long-term commitment to industries and investment in powering digital transformation for customers and partners, on their terms and specific to their needs.

Most of our clients tell us they need to fast-track their digital transformation. Everybody’s competing for speed,” said Jouk Pleiter, CEO at Backbase. “But that is easier said than done. Digital transformation is challenging, requiring institutions to simultaneously modernize a multitude of complex business systems as well as their infrastructure. Together with Microsoft, we can deliver so much more value in less time, enabling organizations to quickly adopt solutions specifically built for their industry. You can now use modular solutions with built-in industry standards that augment your organization’s current investments and are extensible as business needs evolve and grow. Together we break down data silos, helping organizations take a data-first approach with a common data model that unifies information while adhering to industry compliance standards.

Jouk Pleiter

CEO and Founder at Backbase

With the combined power of Microsoft Cloud for Financial Services and Backbase’s Engagement Banking capabilities, banks and credit unions can now more rapidly modernize their technology stack and move to a cloud-based operating model that is truly customer centric,” added Bill Borden, corporate vice president of Worldwide Financial Services at Microsoft. “It’s all about empowering financial institutions to spend less on legacy and more on innovating and creating value for their customers.

Bill Borden

Corporate vice president of Worldwide Financial Services at Microsoft

The Backbase Engagement Banking Platform on Microsoft Cloud for Financial Services is now broadly available.

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.