Introduction

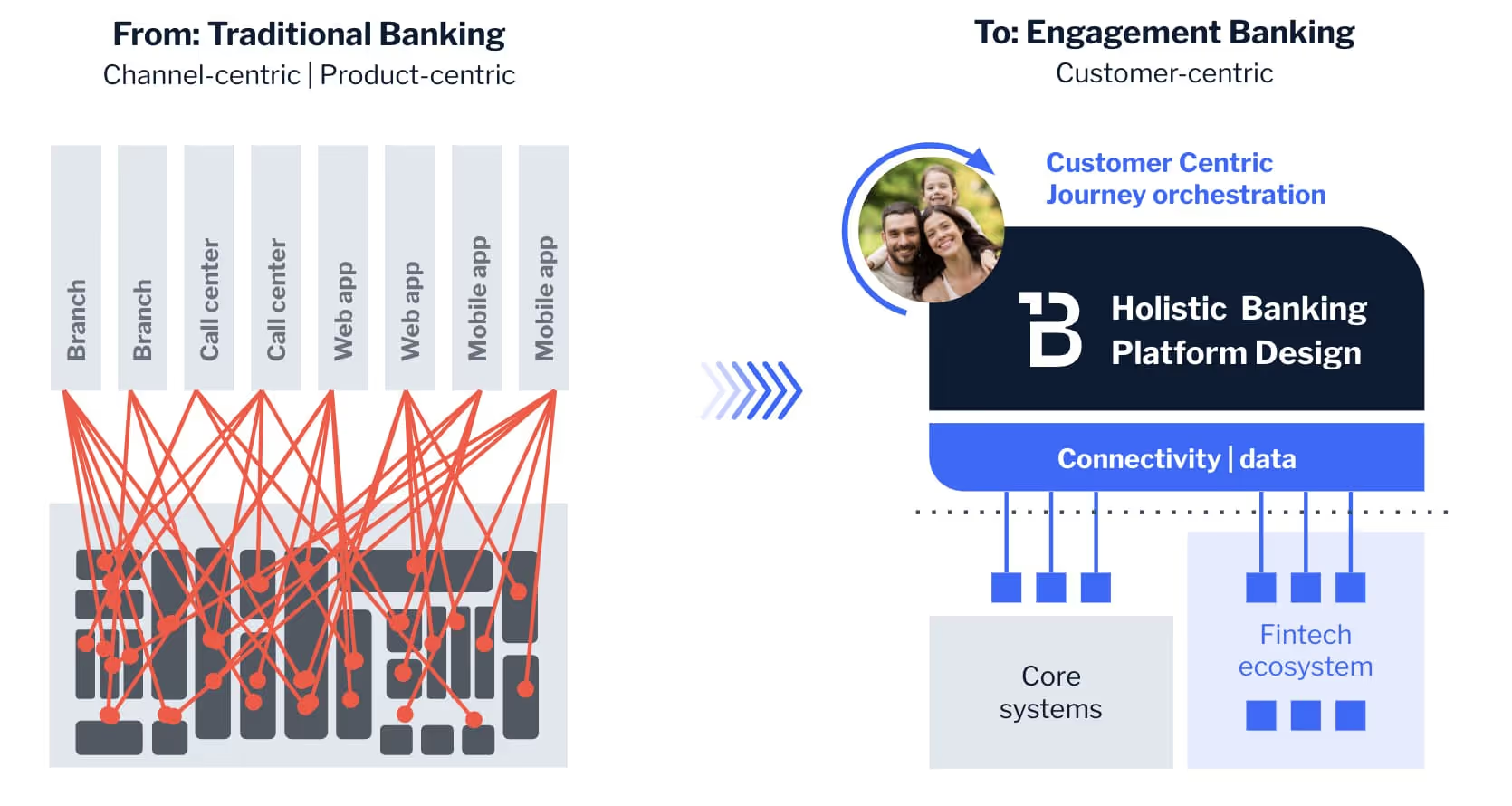

Over this blog series, we’ve explored how your bank can progressively modernize, which will allow you to eliminate silos and overhaul your monolithic legacy systems. But let us make something clear — modernization is not about fully eliminating your existing siloed architecture. In fact, these monoliths contain extremely valuable business logic that you’ll want to reuse and repurpose throughout your digital transformation journey. But of course, that’s simply not possible while it’s held captive within your legacy systems, as visualized in the chart below, which illustrates the benefits of Engagement Banking.

Your goal? To extract that business logic and make it into an autonomous, generic, modular capability or microservice. This process is called decomposing complexity, and it’s essential if you want to maximize your existing investments and also accelerate your bank’s tech modernization. And if you need a reminder of the stakes here, consider the fact that only 30% of digital transformations succeed, per McKinsey, a number that would be significantly higher if banks were able to decompose their complexity.

But maybe you’re wondering where you should begin — or even why you should care — so let’s take a closer look at this process.

Decomposing complexity in banking

To decompose complexity, you should start by taking a front-to-back look at your bank’s journeys and deciding which ones you really need to fix. Then, you’ll be able to determine what business logic capabilities you require, as well as where it’s being held captive within your tech monoliths. This logic is extremely valuable, it’s just mispositioned, not integrated in a scalable way, and potentially not API-exposed. That’s why you have to carve the logic out, freeing it up and translating it into a next-generation, cloud-based, modular business capability.

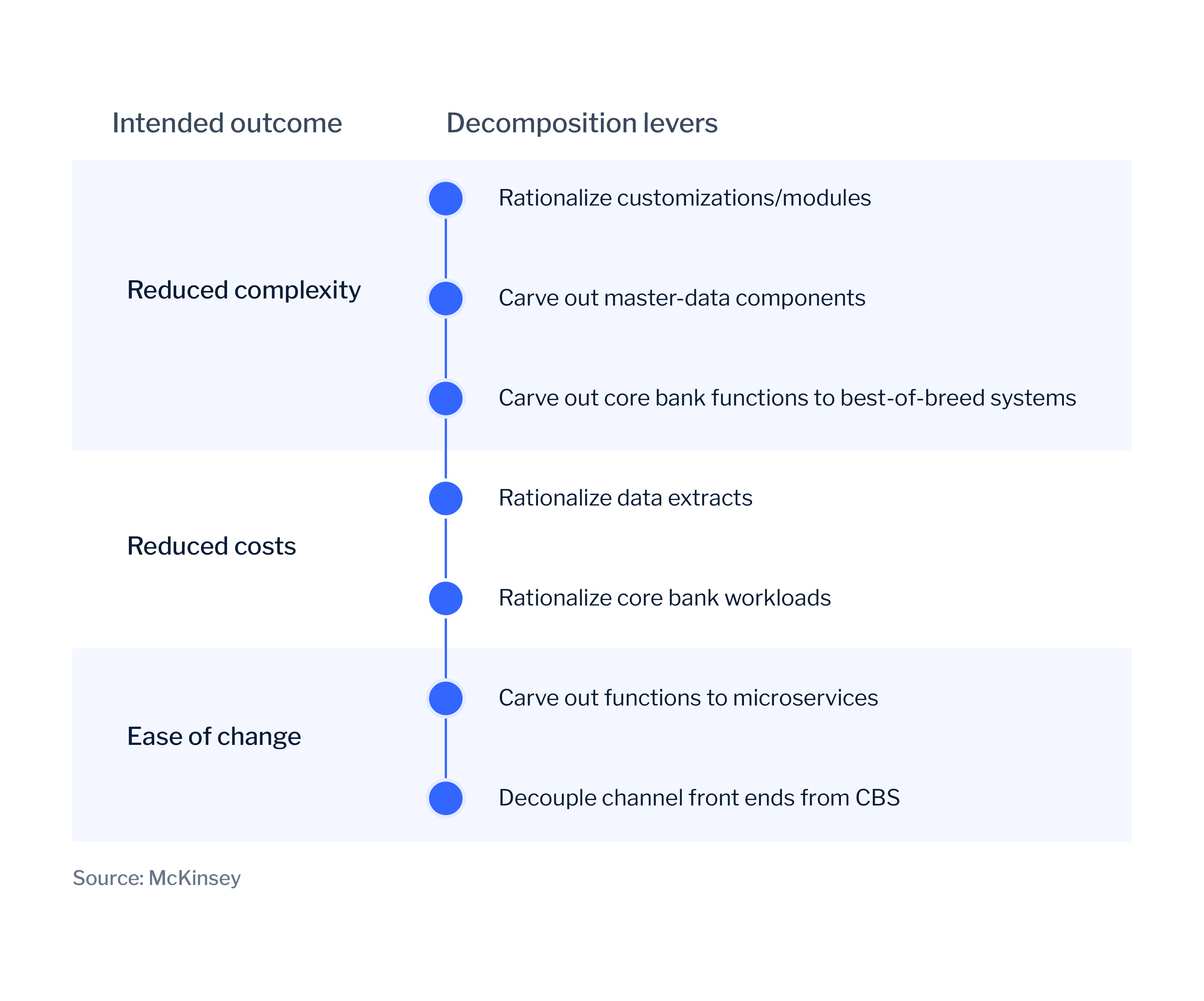

As you go, you’ll begin to build a library of generically composable capabilities and develop a more holistic, properly-layered banking architecture. Better yet, you’ll be able to reuse these capabilities as you work on other journeys, giving you the power to reduce complexity, cut costs, and contribute to ease of change, as McKinsey notes. To realize these benefits, they suggest a seven-lever approach, which you can see in this diagram.

In this blog, we focus primarily on the domain of reducing complexity, which involves carving out components and core banking functions, but you can see some overlap with McKinsey’s recommended next steps. These include rationalizing data extracts and core bank workloads, then carving out these functions to microservices and decoupling channel front-ends from your core banking systems.

But no matter what approach you take for decomposing your bank’s complexity, it’s important for you to see your legacy tech as more than just a burden — it’s also an opportunity. There’s a ton of value trapped within your monolithic systems, and by decomposing complexity, you’ll finally be able to benefit from it. With everything in its place, you’ll realize the full value of your existing investments, allowing you to thrive and divert resources from maintenance to innovation.

Hollowing out your bank’s core

Now that we’ve cleared that up, it’s time for us to take a look at a related process: hollowing out your bank’s core. In the next blog, we’ll explain what this actually means, as well as how your bank can benefit from this unique process. Keep in mind that hollowing out your bank’s core is very similar to decomposing complexity, so if you’d like, you can skip to the following blog about rethinking your operating model.

For more information, check out our Banking Reinvented podcast, where Backbase Founder/CEO Jouk Pleiter dissects similar topics alongside Tim Rutten, EVP/Chief of Staff, and other digital leaders. Stay tuned as they chat about everything from progressive modernization to decomposing your bank’s complexity.