One platform to empower small businesses

Backbase

Small businesses hustle. Their banking should, too. But most SME experiences weren’t built for today’s digital-first economy.

Backbase helps banks across New Zealand and Australia break free from legacy limitations—offering seamless onboarding, tailored journeys, and deep fintech integrations that meet the needs of modern entrepreneurs, across every segment and every stage of growth.

Build with security, scale with confidence

Subline

A unified banking platform that evolves with your business—secure, compliant, and designed for long-term success, trusted by 100+ banks worldwide.

Connect with the best fintechs

Seamlessly integrate with top fintech providers, from accounting to payments, unlocking new value for small business clients.

Seamlessly integrate with top fintech providers, from accounting to payments, unlocking new value for small business clients.

Build a banking experience that small businesses can truly rely on

Backbase helps banks overcome SME banking’s toughest challenges with a platform that’s fast, secure, and ready to scale.

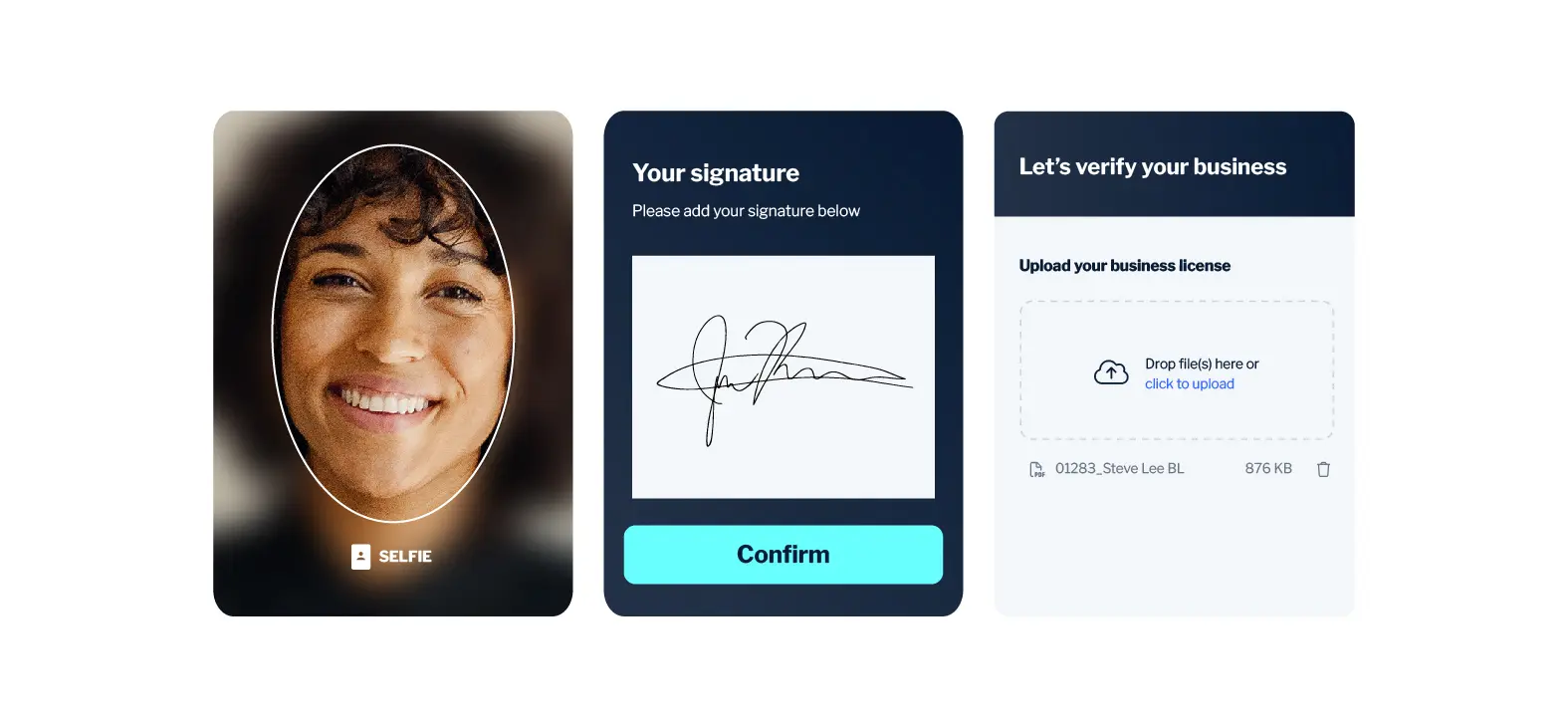

Friction-free onboarding

Get SMEs up and running in minutes, not weeks with a frictionless digital onboarding experience. Reduce manual processes, eliminate paperwork, and offer a fast, intuitive sign-up that keeps small business owners focused on growing their companies. With Backbase, banks can streamline KYB, automate approvals, and convert more SMEs into long-term customers from day one.

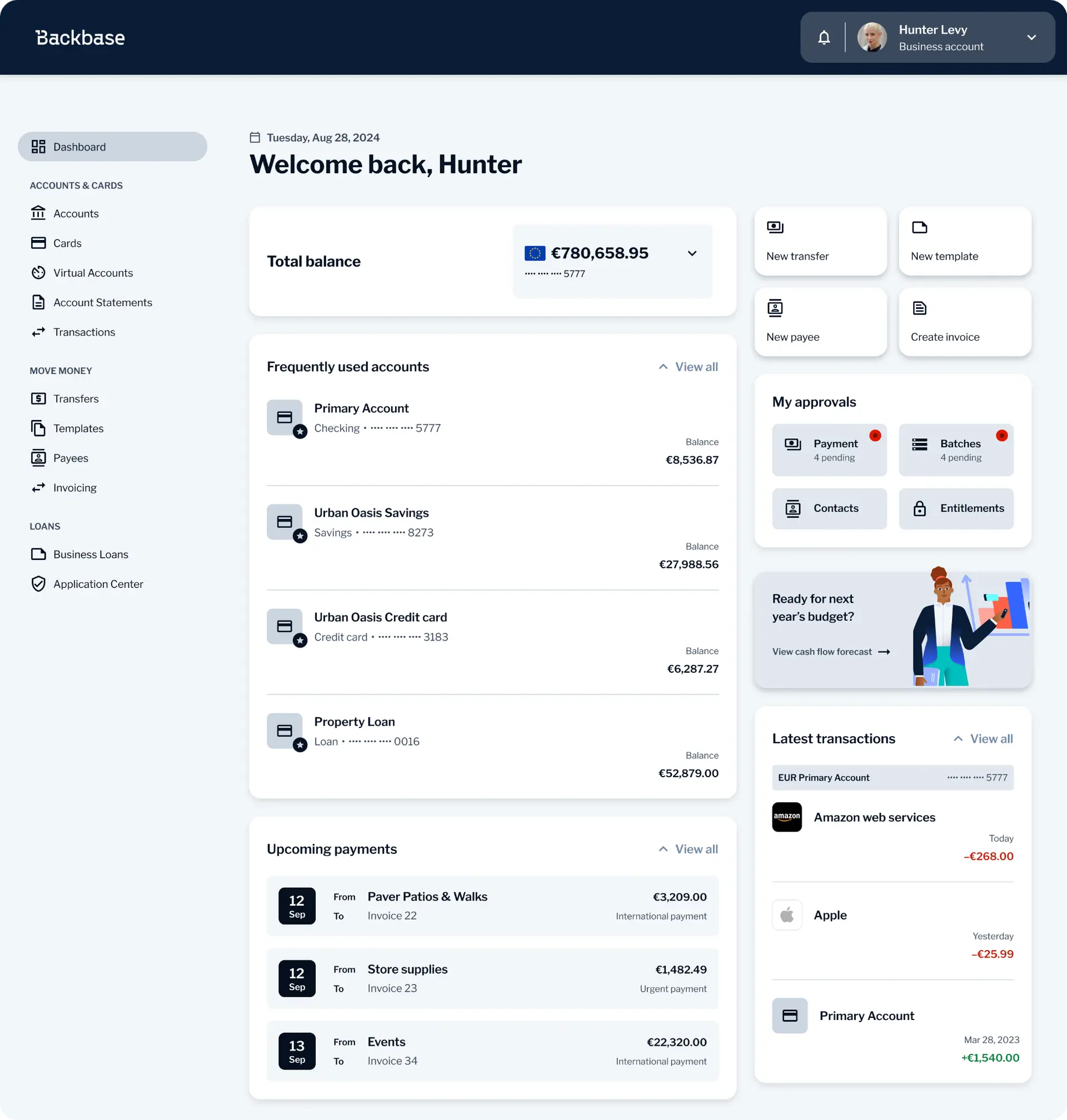

Smarter banking for business customers

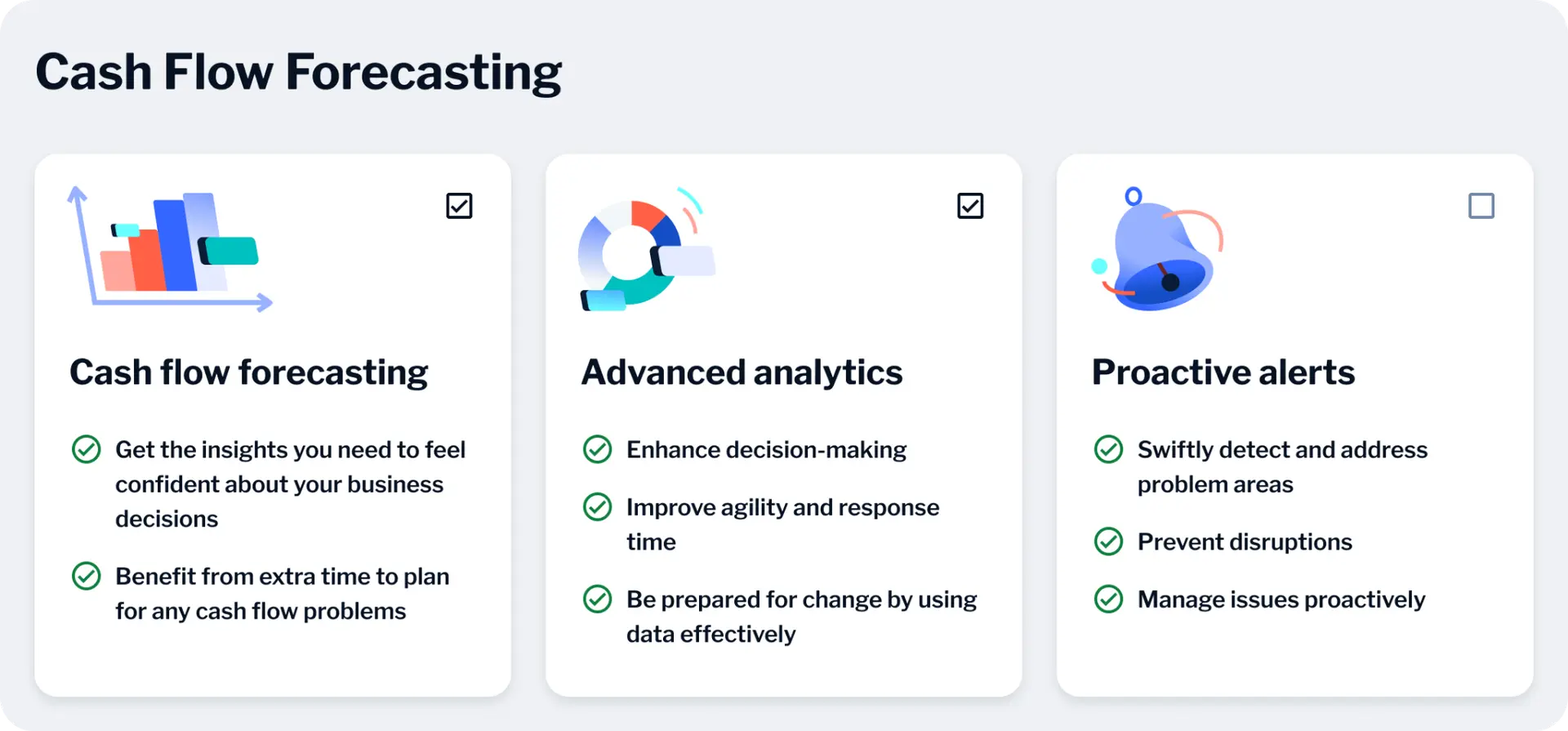

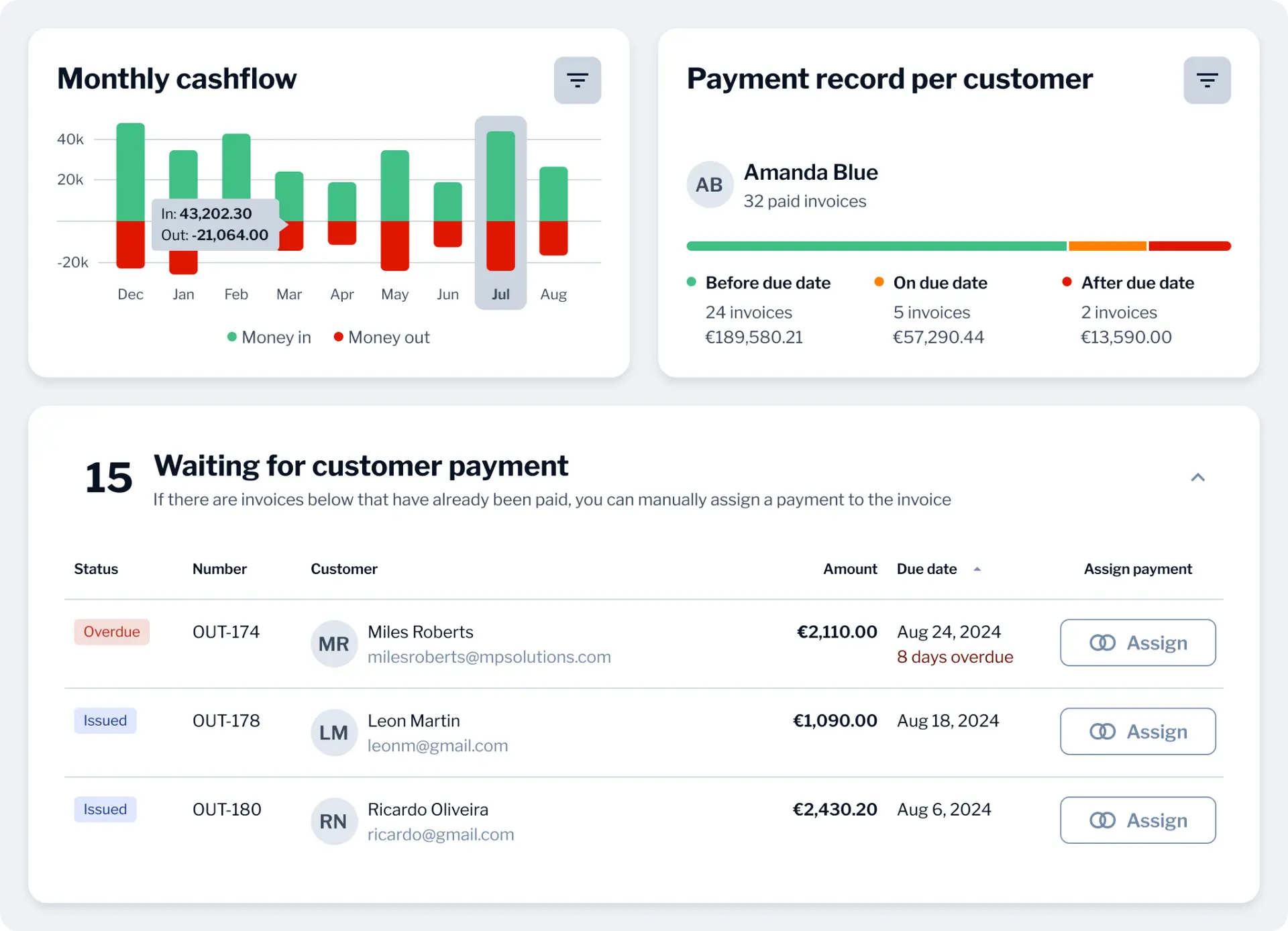

SMEs need more than just a place to store money. They need tools that help them manage cash flow, track invoices, and handle payments—seamlessly integrated into their banking experience.

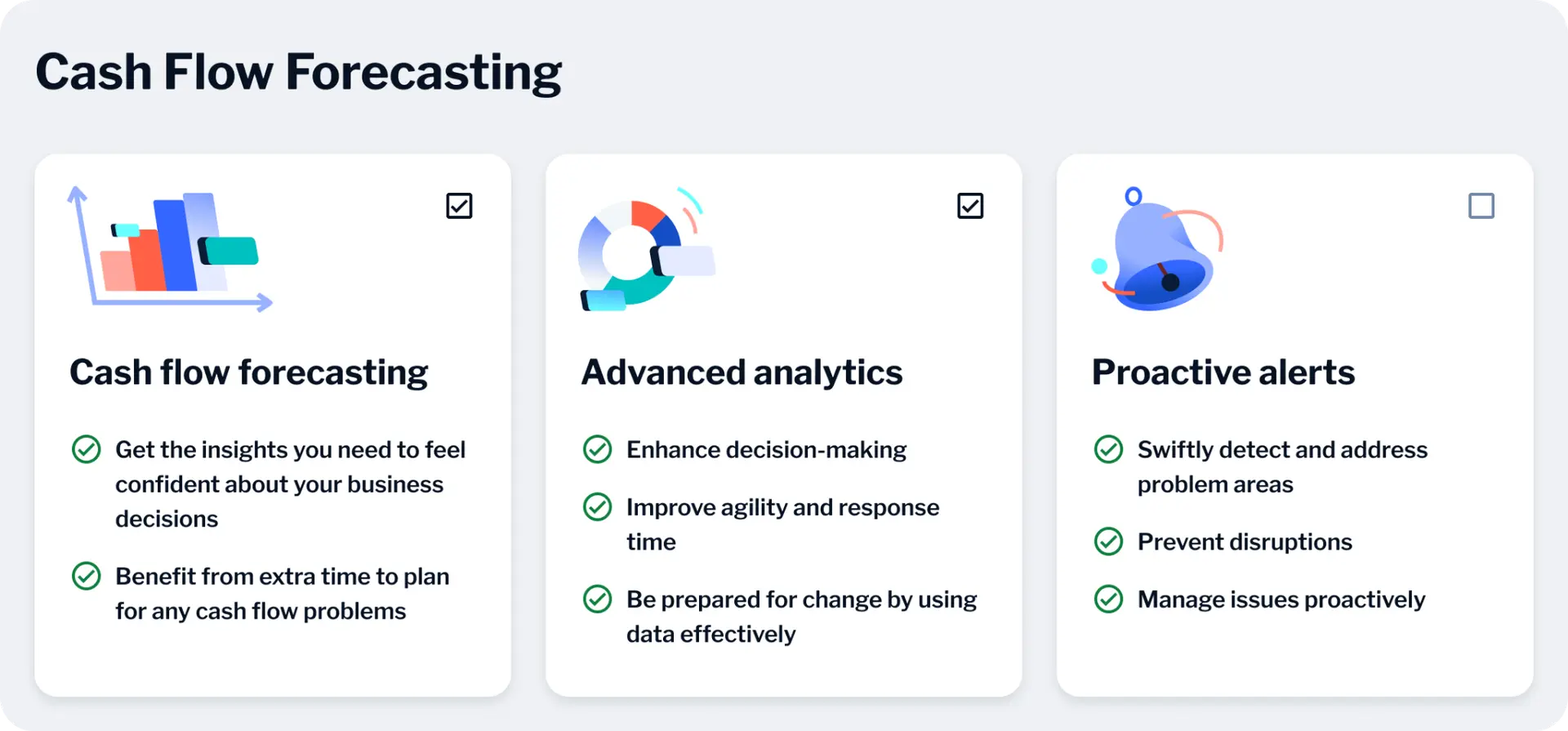

With Backbase, banks can provide value-added services like invoicing, cash flow forecasting, and treasury management, making their banking platform an essential part of an SME’s daily operations.

This means more engagement, stronger SME relationships, and new revenue opportunities, all while helping businesses thrive.

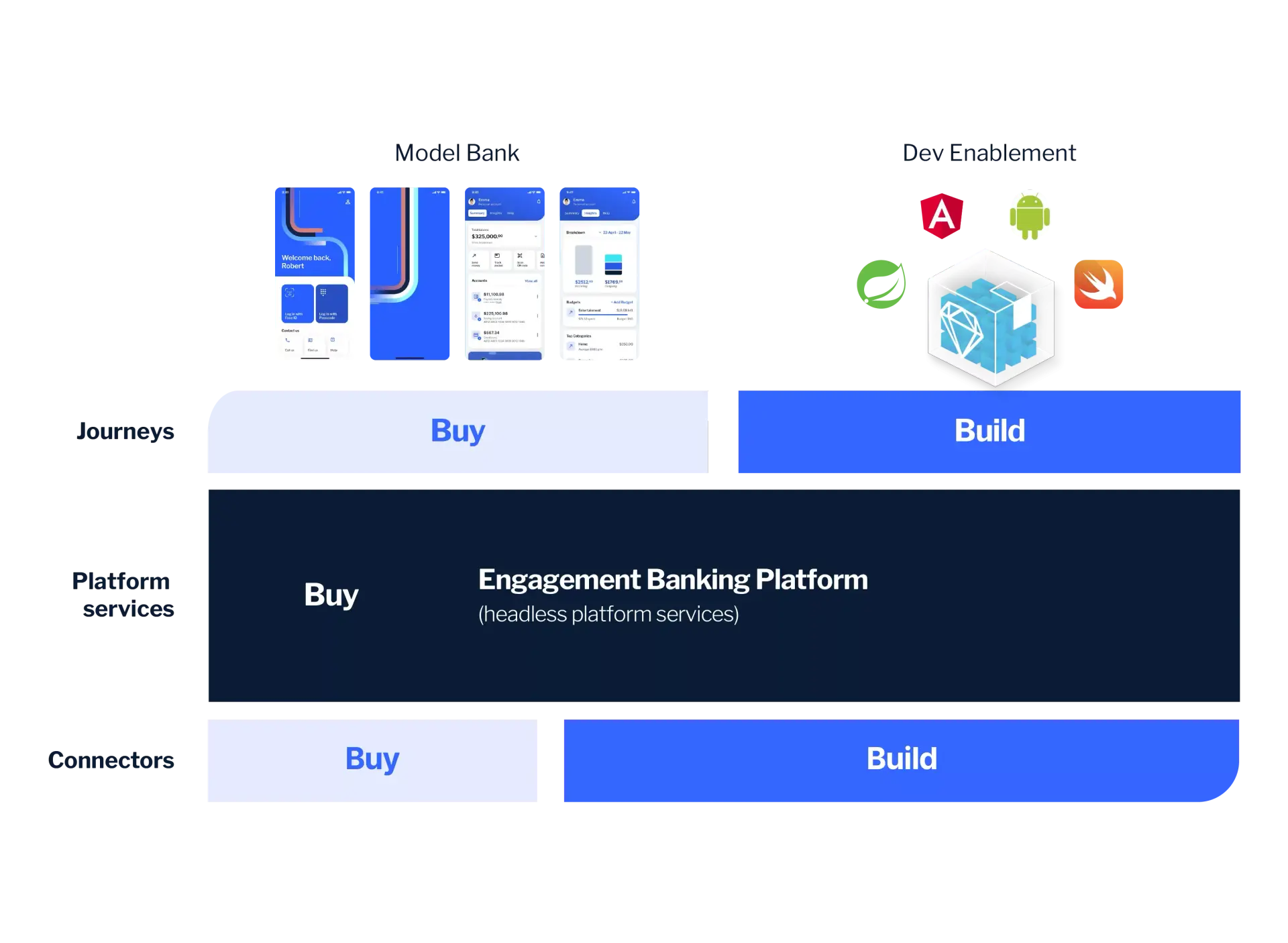

Modernisation without disruption

Transforming SME banking doesn’t have to mean starting from scratch. Backbase enables banks to modernise at their own pace with a composable platform that integrates with existing systems. No risky rip-and-replace. No unnecessary downtime. Just a progressive transformation approach that lets banks introduce new SME services while keeping their core banking infrastructure intact.

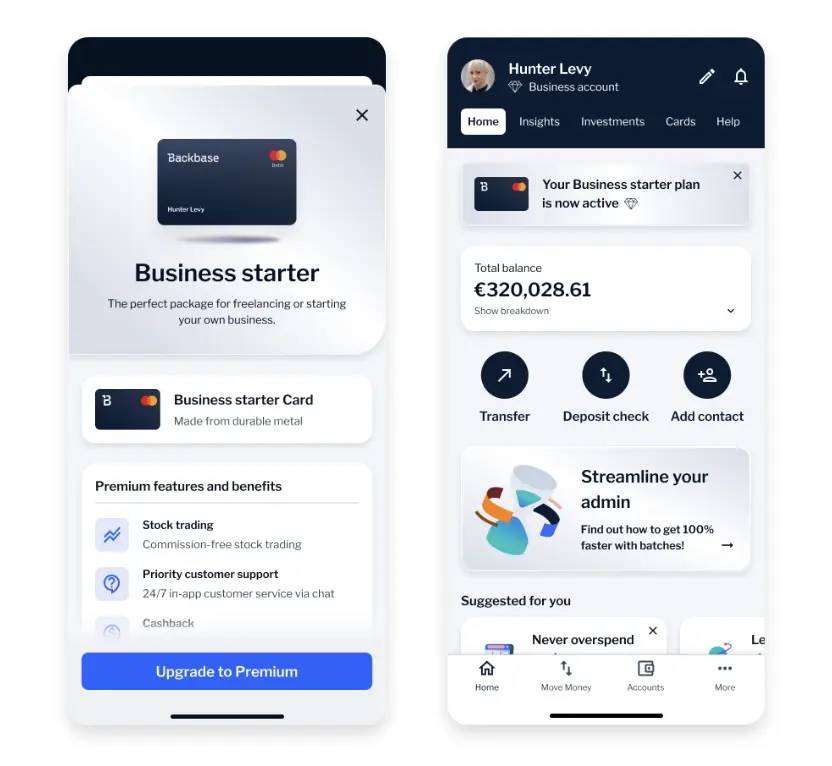

Become a one-stop shop for business banking

Small businesses need more than just a bank. They need a partner that helps them manage cash flow, access funding, and streamline daily operations—all while staying focused on what they do best. With Backbase, banks can anticipate SME needs, offer tailored financial solutions, and unlock new revenue streams, all within a seamless, digital-first experience.

Easy account setup

Heading

Turn existing retail clients into SME customers with AI-driven insights and frictionless onboarding—no redundant paperwork, no delays.

Business insights & smart dashboards

Heading

Help SMEs stay on top of cash flow, invoices, and key financials with real-time analytics and tailored business dashboards.

Proactive lending & cash flow support

Heading

Detect potential cash flow issues before they happen and offer instant financing options like Invoice Financing to keep businesses moving.

Embedded invoicing & payments

Heading

Enable SMEs to create, track, and send invoices while seamlessly integrating with their banking experience—making you their one-stop financial hub.

AI-powered personalisation

Heading

Deliver tailored recommendations and proactive nudges to drive engagement, cross-sell opportunities, and long-term loyalty.

Explore more resources

From in-depth guides to customer stories, find everything you need to plan your journey.

Let’s build something great — together.

Let’s build something great — together.

Discover how we can help you drive your bank's ambitions.

Discover how we can help you drive your bank's ambitions.