Backbase

Hidden groundswell of activity – APAC retail banks turn to digital financial wellness apps to address changing consumer needs

Hidden groundswell of activity – APAC retail banks turn to digital financial wellness apps to address changing consumer needs

Today, Backbase announced today the results of a commissioned study conducted by Forrester Consulting, revealing a hidden movement by financial institutions across the APAC region to become more ingrained in the financial decisions of their customers by using digital financial wellness and money management apps. From Australia to Japan, India to Vietnam, retail banks are seeing the value that such apps can bring to their customer experience and revenue, as well as data and insight mining capabilities.

Commonly used by smaller digital-only banks, financial wellness apps delivered through mobile have most certainly ‘pricked the ears’ of the institutional giants in APAC, with spending in this niche set to increase by a regional average of 57%.

Talking about the findings of the study, Regional Vice President for Backbase APAC, Iman Ghodosi, said financial wellness apps have moved past the realm of online-only ‘digital banks’: “The data shows the whole retail finance sector is seeing the benefits of interacting with their customers in this way. Larger banks see the opportunity of competing in the space and capitalizing on the comparatively low trust APAC consumers have with digital-only banks at the moment.The study showed only 26% of consumers trust digital-only banks, compared with 60% of traditional banks.”

“Consumers use digital-only banks precisely for the financial wellness and digital money management tools they provide. Traditional banks see a massive opportunity to compete in digital, and still retain their heritage and trust. And they need to compete. Legacy intuitions are slowly losing market share to digital-only banks and getting beaten on data and insight collection through such apps.”

Of the 450 retail banking business decision-makers interviewed as part of the report, 89% said they were ‘planning to’ or ‘actively expanding’ their financial wellness initiatives, while 72% said it was of ‘high’ or ‘critical’ priority.

Assistance in your pocket, anywhere, anytime

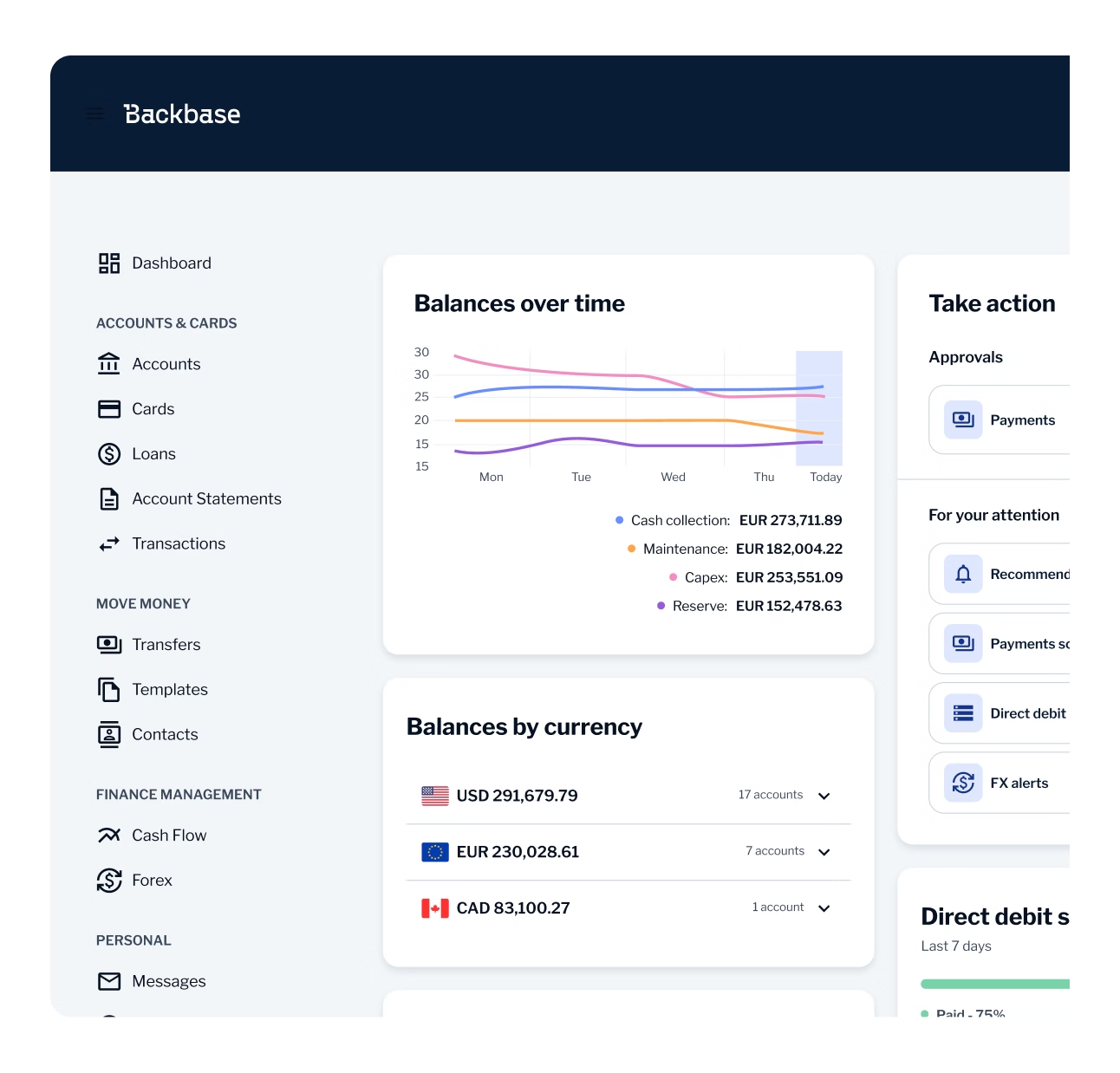

Providing customers with digital services such as spend analysis, subscription & recurring payment management, creation of savings goals, and transaction categorization, it’s no wonder consumers across the region are equally craving these tools. Many features are only recently available through advances in AI, mobile-first technology, and rapid evolution of user experience and smartphones.

The Forrester study, commissioned by Backbase, revealed APAC consumers do need assistance in certain areas of their financial lives such as building savings (69% find this difficult), planning for retirement (60% find this hard), and managing debt (49% struggle).

Mr Ghodosi continues: “In the platform era of Grab, Netflix and Spotify, people want the same high level of customer focus and flexibility for financial services they subscribe to.They want access to their personal finances anytime, anywhere, through any channel. Banks are realizing digital financial wellness tools can address these needs of their customers, whenever and wherever the consumers need it.”

“Now more than ever, it is important to own the relationship with your customer. We’ve now entered the Engagement Banking Era, an evolution that stresses a one unified platform approach for banking. The number one priority in this new era is to completely re-architect the bank around the customer, moving away from siloed technology investments. At Backbase, we help banks to adopt and build modern, cloud-native banking platforms to keep pace with changing consumer demands, gain a 360 degree view into banking behaviours, and grow market share across all lines of business. We focus on customers before products, and create digital money management tools that match individual needs.”

But it’s not without its challenges. Unlike nimble and dynamic digital banks, legacy financial institutions struggle with many aspects of implementing such mobile-first digital services. 67% of the interviewed APAC retail banking business decision-makers said outdated or legacy technology is a key challenge that their bank faces in trying to implement or further develop digital money management or financial wellness tools. 55% said internal ‘organizational silos’, 65% said a lack of understanding of customer needs, and 53% said competing priorities.

“We can see that for traditional banks, the path to success might be bumpy, however the cost for not meeting consumer needs will be far higher, as digital and neobanks flourish, Mr Ghodosi added. “We see the next six months as an inflection point in the space with some financial institutions being left behind.”

Banks can now offer more care and protection than ever before

One of the most interesting findings from the research is that the motivation behind this new direction by retail banks is not just about customer engagement and revenue. Through developments in A.I. and data analytics, banks can now offer far more safeguarding, and care more for their customers than they previously had the capacity to offer.

64% of respondents said their intuitions had plans to ‘prevent exploitation of vulnerable and older customers’, 57% said they had plans of ‘identifying risks of vulnerability and financial difficulty’ in their users. 69% are planning to encourage customers to ‘build better financial habits’, and 70% are going to offer further ‘financial literacy tools’. Something that may be seen as favourable when it comes to Environmental, Social, and Corporate Governance reporting.

“The data points to financial wellness apps being a primary interface between banks and their customers as we move into the future. As a market leader in engagement banking platforms enabling the disruptors of the banking industry and incumbents alike, Backbase is primed to address this real need. Our unified engagement approach is helping banks to launch modern, cloud-native banking services that keep pace with change, while offering superior customer experience for both consumers and employees across all touchpoints and all lines of business of the entire bank.”

Backbase is on a mission to put bankers back in the driver’s seat — fully equipped to lead the AI revolution and unlock remarkable growth and efficiency. At the heart of this mission is the world’s first AI-powered Banking Platform, unifying all servicing and sales journeys into an integrated suite. With Backbase, banks modernize their operations across every line of business — from Retail and SME to Commercial, Private Banking, and Wealth Management.

Recognized as a category leader by Forrester, Gartner, Celent, and IDC, Backbase powers the digital and AI transformations of over 150 financial institutions worldwide. See some of their stories here.

Founded in 2003 in Amsterdam, Backbase is a global private fintech company with regional headquarters in Atlanta and Singapore, and offices across London, Sydney, Toronto, Dubai, Kraków, Cardiff, Hyderabad, and Mexico City.